Avoid Home Insurance Denial by Fixing These 7 Property Issues

July 26th, 2023 | 14 min read

Being denied a home policy can be a major financial setback, as homeowners insurance can protect you from financial ruin in the event of a fire, flood, or other disaster.

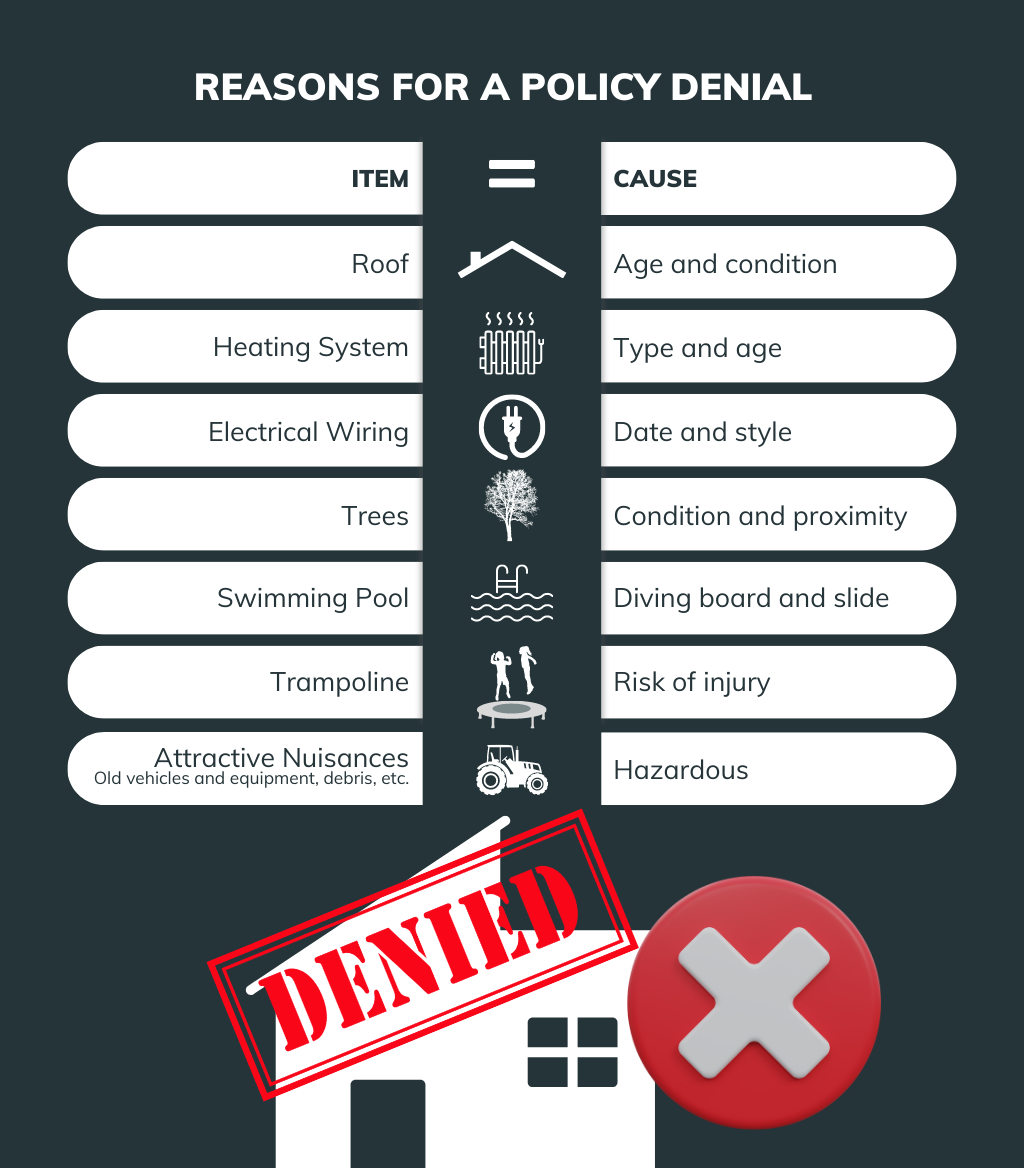

A number of negative factors can lead to a home insurance denial, such as an old roof, an outdated electrical system, a swimming pool, a treehouse, a trampoline, and other attractive nuisances neighborhood kids find hard to resist.

We understand that having these or several other issues can be a source of stress and frustration when it comes to finding and keeping home insurance. You may feel penalized for something you enjoy, or that adds value to your property.

You may also worry about the potential legal and financial risks that negative factors can bring.

We’re here to help you navigate this complex and challenging issue and find the best insurance solution for your needs.

As an independent insurance agency, we have years of experience writing home insurance policies for homeowners who have addressed challenging factors on their property through our guidance.

In this article, we will identify the most common hurdles and advise you on how to reduce your liability and improve your insurance eligibility by taking certain steps to secure or eliminate them.

After reading to the end, you’ll know how to increase your chances of getting home insurance, and you’ll be able to pass that info along to others who will appreciate you for it.

Property Conditions That Can Ruin Your Home Insurance Application and How to Fix Them

When you buy home insurance, you expect it to cover you in case of a disaster. But did you know that some property conditions can make it harder or even impossible to get a policy?

If your home has features that pose a risk to others or yourself, insurance carriers may deny your application or charge you higher premiums. Below, we’ll explore some of the most common property conditions that can cause a home insurance policy denial and how you can avoid or fix them.

By following our tips, you can increase your chances of getting approved for a policy that suits your needs and budget.

1. Your Roof’s Age and Condition Can Affect Your Home Insurance Eligibility

One of the most important factors that can affect your home insurance eligibility is your roof. Your roof protects your home from water damage caused by snow, ice, wind, and hail. These are all common weather hazards in Central New York that your home insurance covers.

However, if your roof is too old or damaged, it may not be able to withstand these perils. That’s why insurance agents ask these two important questions:

- What is the age and

- What is the condition of your roof?

The Issue with Roof Age

The age of your roof determines how resistant it is to the elements. Most shingled roofs last about 20 to 25 years before they start to deteriorate. If your roof is older than that, most carriers will not insure your home.

Even if you have a 40-year warranty on your shingles, you may still face limited insurance options after 20 years. Metal roofs are more durable and can last up to 50 or more years. They may have more flexibility with insurance carriers, but they’re also more expensive to install and repair.

The Issue with Roof Condition

The condition of your roof reflects how well you maintain it. Insurance carriers will look for signs of wear and tear, such as curling or missing shingles, cracked or broken tiles, or sagging or buckling areas.

They will also check for moss build-up, which can indicate moisture problems and rotting wood underneath. If your roof has any of these issues, insurance carriers may deny your application or charge you higher premiums.

Making Your Roof Eligible for Home Insurance in CNY

If you want to avoid getting rejected or paying more for home insurance because of your roof, you should take some steps to fix the issue. Here are six suggestions:

- Get regular roof inspections from a licensed roofer. They can spot any potential problems and advise you on how to fix them.

- Keep your roof clean and clear of debris, such as branches, leaves, or snow. This can prevent water accumulation and damage.

- Replace any damaged or missing shingles or tiles as soon as possible. This can prevent further deterioration and leaks.

- Remove any moss or algae growth from your roof with a soft brush or a moss remover product. This can prevent moisture and rotting issues.

- Consider replacing your roof if it’s older than 20 years or has extensive wear. This can increase your home value and your insurance eligibility.

- Shop around for different roofers and get quotes for a replacement. Some roofing companies may offer financing options or discounts for referrals.

- If you believe your roof may be a rejection factor for home insurance and need assistance, don’t hesitate to contact us for help.

2. How Your Heating System Affects Your Home Insurance Eligibility

Another factor that can affect your home insurance options is your heating system. Your heating system keeps your home warm and comfortable during the cold months, but it can also pose a fire or freezing hazard if it isn’t working properly.

Insurance carriers will check your heating system before insuring your home. They’ll look for two main aspects:

- the type and

- the age of your heating system.

The Issue with the Heating System’s Type

The type of heating system determines how well it heats your home and how much energy it consumes. Insurance carriers require you to have a central heating system, which distributes heat throughout your home using ducts, pipes, or radiators.

A central heating system should be controlled by a thermostat, which allows you to adjust the temperature and save energy. If you don’t have a central heating system, you may not qualify for a standard home insurance policy. You may have to seek an alternative policy that offers less coverage and costs more.

The Issue with the Heating System’s Age

The age of your heating system determines how reliable and efficient it is. Insurance carriers prefer newer heating systems that are less likely to break down and cause damage. Furnaces over 25 years old are considered too old by many carriers, who may refuse to insure your home or charge you higher premiums.

Old furnaces can malfunction and cause a fire or lead to frozen pipes. If you have an older furnace, some carriers may ask for proof of annual professional maintenance, which can help extend its lifespan and improve its performance.

Making Your Heating System Eligible for Home Insurance in CNY

If you want to avoid getting rejected or paying more for home insurance because of your heating system, you should take some steps to fix the issue. Here are seven suggestions:

- Get regular inspections and tune-ups from a licensed heating contractor. They can spot any potential problems and advise you on how to fix them.

- Clean or replace filters for your furnace at least once a month to maintain optimal airflow and comfort.

- Keep warm-air registers, baseboard heaters, and radiators from being blocked by furniture, carpeting, drapes, or dust by keeping them clean and clear.

- Install a smart thermostat to learn your preferences and habits and adjust the temperature accordingly. This can help you save energy and money.

- Consider replacing your heating system if it’s older than 25 years or has extensive damage. This can increase your home value and your insurance eligibility.

- Shop around for different heating contractors and get quotes for a replacement. Some contractors may offer financing options or discounts for referrals.

- If you have a problematic heating system in your home that may cause a policy denial and need assistance, don’t hesitate to contact us for help.

3. The Impact of Your Electrical Wiring on Home Insurance Eligibility

Your electrical wiring is another significant factor that can affect your home insurance eligibility. Your electrical wiring carries electricity throughout your home and powers your appliances and devices. But if your wiring is outdated or dangerous, it can cause electrical fires, shocks, or power surges.

Insurance carriers will check your electrical wiring before insuring your home. They will look for two main aspects:

- the date and

- the style of your electrical wiring.

The Issue with the Date of Your Electric Wiring

The date of your electrical wiring determines how modern and safe it is. Insurance carriers consider modern wiring to be anything installed after 1980. Many older houses have wiring that dates back to before 1980, which may not meet the current safety standards or energy demands.

If you live in an older house, you may have to update your electrical wiring to qualify for a standard home insurance policy.

The Issue with the Style of Your Electric Wiring

The style of your electrical wiring determines how it’s installed and connected. Insurance carriers prefer copper wiring, which is durable and resistant to corrosion. However, some older houses have other styles of wiring that can pose a fire risk. These include:

1. Aluminum wiring: This was popular between 1965 and 1972 when copper prices were high. However, aluminum wiring can overheat and cause sparks or fires. The US Consumer Product Safety Commission has stated that homes with aluminum have a fire risk 55 times that of those with copper wiring.

When confronted with such statistics, insurance providers are likely to take evasive action. To gain a better understanding of why aluminum wiring is such a serious fire hazard, we encourage you to explore the topic further.

2. Fuses: These are older devices that protect circuits from overloading by melting when the current is too high.

Some people confuse fuses with circuit breakers. A circuit breaker is a panel with switches that you can flip on and off. As long as your circuits have copper wiring, you’re good. Fuses are different.

Fuses can’t handle the power needs of modern appliances and devices. Fuses also have a high risk of being tampered with, so they can work with large appliances. This is more likely in older houses, and insurance carriers see this as too risky.

Some carriers may still accept your application if you have fuses in your electrical system. But most will ask to inspect your house before they agree.

3. Knob & tube: This was common in houses built before 1950. It consists of ceramic knobs and tubes that support and insulate wires running through walls and floors. However, knob & tube wiring is ungrounded, which means it doesn’t have a third wire that protects against shocks or surges.

Knob and tube wiring systems can deteriorate over time, making them brittle, frayed, and sagging. Age can take a toll on these systems, and finding qualified electricians to fix them and the necessary parts can be a challenge.

This issue has led to poor upkeep and an increased risk of electrical fires.

If you have a house with an active knob and tube service, finding insurance carriers willing to cover you can pose a challenge. However, there are still options available.

Making Your Electric Wiring Eligible for Home Insurance in CNY

If you want to avoid getting rejected or paying more for home insurance because of your electrical wiring, you should take some steps to fix the issue. Here are seven suggestions:

- Get regular inspections from a licensed electrician. They can assess the condition and safety of your electrical wiring and advise you on how to fix any problems.

- Upgrade your electrical panel to at least 100 amps. This will increase the capacity and efficiency of your electrical system and allow you to add more circuits and outlets.

- Replace any outdated or dangerous wiring styles with copper wiring. This will reduce the fire risk and improve the performance of your electrical system.

- Install three-prong outlets with ground-fault circuit interrupters (GFCIs) in wet areas like kitchens and bathrooms. These outlets will prevent shocks and surges by shutting off the power if they detect a fault.

- Consider replacing your entire electrical system if it’s older than 40 years or has extensive damage. This will increase your home value and your insurance eligibility.

- Shop around for different electricians and get quotes for an upgrade. Some electricians may offer financing options or discounts for referrals.

- If you have outdated fuses, aluminum or knob and tube wiring in your home and need assistance, don’t hesitate to contact us for help.

4. How Trees Can Affect Your Home Insurance Eligibility

Trees can add beauty and value to your property, but they can also pose a risk to your home insurance. Insurance carriers are concerned about the health and location of trees on your property because they can cause damage to your buildings and other structures.

For example, a tree can fall on your roof, break your windows, or damage your fence. Insurance agents will ask about these two main aspects:

- the condition and

- the proximity of your trees.

The Issue with the Condition of Your Trees

The condition of your trees determines how healthy and stable they are. Insurance carriers prefer trees that are alive and well-maintained. Dead or decaying trees are more likely to fall or break during a storm or strong wind. If you have any dead or decaying trees near your house or other insured items, insurance carriers may ask you to remove them or deny your application.

The Issue with the Proximity of Your Trees

The proximity of your trees determines how close they are to your house or other insured items. Insurance carriers prefer trees that are at a safe distance from your structures. Trees with branches overhanging your roof can cause damage by scraping, dropping debris, or falling.

If you have any trees with overhanging branches near your house, insurance carriers may ask you to trim them back or charge you higher premiums.

Making Your Trees Eligible for Home Insurance in CNY

If you want to avoid getting rejected or paying more for home insurance because of your trees, you should take some steps to fix the issue. Here are five suggestions:

- Get regular inspections and pruning from a certified arborist. They can assess the health and safety of your trees and advise you on how to care for them.

- Remove any dead or decaying trees from your property as soon as possible. This can prevent accidents and injuries.

- Trim any branches that are overhanging or touching your roof, windows, or fence. This can prevent damage and debris.

- Consider planting new trees away from your house or other insured items. This can create a buffer zone and reduce the risk of falling objects.

- If trees are preventing you from obtaining a home policy and you need assistance, don’t hesitate to contact us for help.

5. How Your Swimming Pool Affects Your Home Insurance Eligibility

Swimming pools can be a source of fun and relaxation, but they can also cause problems for your home insurance. Insurance carriers are concerned about the features and safety of your pool because they can increase your liability risk.

For example, a pool can attract unwanted visitors, cause injuries, or damage your property. Insurance agents will ask about these two main aspects:

- the type

- and the security of your pool.

The Issue with Your Pool’s Type

The type of your pool determines how it is built and installed. Above-ground pools are cheaper and easier to install than inground pools, but they may not have fence requirements.

Inground pools are more expensive and durable, but they may have features that pose a risk. For example, if you have an inground pool with a diving board or a slide, many carriers may not offer you a policy or may charge you higher premiums. These features can increase the chance of accidents or injuries.

The Issue with Your Pool’s Security

The security of your pool determines how it is protected and restricted. Insurance carriers prefer pools with safety measures to prevent unauthorized access or use. For example, if you have an above-ground pool, you should have stairs that can be raised and locked.

If you have an inground pool, you should have a fence that surrounds it with a self-latching gate. You should also have signs that warn of potential hazards or rules for using the pool.

Making Your Pool Eligible for Home Insurance in CNY

If you want to avoid getting rejected or paying more for home insurance because of your pool, you should take some steps to fix the issue. Here are five suggestions:

- Get regular inspections and maintenance from a licensed pool contractor. They can assess the condition and safety of your pool and advise you on how to fix any problems.

- Remove features that increase your liability risk, such as diving boards or slides. These features may not be worth the extra cost or hassle.

- Install safety devices and equipment for your pool, such as covers, alarms, locks, fences, signs, and flotation devices. These devices can help prevent accidents and injuries.

- Consider draining and filling in your pool if it is too old or damaged. This can reduce your liability risk and save you money on maintenance.

- If a pool prevents you from obtaining a home policy and you need assistance, don’t hesitate to contact us for help.

6. How a Trampoline Affects Your Home Insurance Eligibility

Trampolines can be a source of fun and exercise, but they can also bounce you out of consideration for home insurance. Insurance carriers are concerned about the safety and liability of your trampoline because they can cause injuries to yourself or others.

For example, a trampoline can result in falls, fractures, sprains, or even neck or spinal cord injuries. According to the American Academy of Orthopedic Surgeons, in 2018, 313,850 trampoline-related injuries resulted in medical treatment.

If someone visiting your house gets hurt on your trampoline, they may sue you for damages. If that happens, the insurance company has to pay to defend you.

Many insurance carriers will not offer you a policy if you have a trampoline on your property, regardless of its features or safety measures. Others will offer you a policy but exclude any liability arising from a trampoline injury. This means you’ll have to pay out of pocket for any legal fees or settlements if someone sues you because of your trampoline.

Dealing with Home Insurance Eligibility in CNY When You Have a Trampoline

If you want to avoid getting rejected or paying more for home insurance because of your trampoline, you should take some steps to fix the issue. Here are five suggestions:

- Get rid of your trampoline. This will remove your liability risk and make you eligible for home insurance from many carriers.

- If you’d rather cover the liability yourself and opt for carriers that will forego that coverage, install safety features and equipment for your trampoline. These can include nets, pads, springs, anchors, and ladders, features that can help prevent accidents and injuries.

- Restrict access to your trampoline by locking it up when not in use or placing it in a fenced area with a self-latching gate. This can deter unwanted visitors or trespassers from using your trampoline.

- Supervise anyone who uses your trampoline and enforce rules for safe use, such as one person at a time, no flips or stunts, and no jumping off. This can reduce the chance of accidents or injuries.

- If you have further questions about how a trampoline affects your home policy eligibility and need assistance, don’t hesitate to contact us for help.

7. Understanding Attractive Nuisances and Their Impact on Home Insurance Eligibility

Some items on your property may attract children or other visitors who want to play with them, but they can also be dangerous and cause injuries. These items are called attractive nuisances, and they can increase your liability risk.

For example, someone may get hurt or injured by climbing on an old vehicle, boat, or appliance, or by falling from a treehouse or a pile of gravel. If that happens, they may sue you for damages.

Insurance agents will review these items and ask about two main aspects:

- the type

- and the location of these items.

The Issue with the Type of Attractive Nuisance

The type of attractive nuisances determines how appealing and hazardous they are. Insurance carriers prefer items that aren’t attractive or dangerous to children or other visitors.

For example, tractors and farm equipment may not be as tempting as old vehicles or boats, but they may be more risky. Some items may have sentimental or practical value to you, but they may also pose a risk to others.

The Issue with the Location of Attractive Nuisances

The location of these items determines how accessible and visible they are. Insurance carriers prefer items that aren’t easily reached or seen by children or other visitors.

For example, discarded appliances may not be as accessible as gravel piles or treehouses, but they may be more visible. Some items may be part of your landscape or decoration, but they may also invite unwanted attention.

Dealing with Home Insurance Eligibility in CNY When You Have Attractive Nuisances

If you want to avoid getting rejected or paying more for home insurance because of these items, you should take some steps to fix the issue. Here are four suggestions:

- Remove any items that you do not need or use from your property as soon as possible. This can reduce your liability risk and save you space.

- Secure any items that you need or use with locks, fences, covers, or signs. This can prevent unauthorized access or use.

- Supervise anyone who visits your property and enforce rules for safe behavior. This can reduce the chance of accidents or injuries.

- If you have further questions about how attractive nuisances affect your home policy eligibility and need assistance, don’t hesitate to contact us for help.

Remember, your home insurance policy protects you from liability claims if someone gets hurt or injured on your property, including by these items. But it also requires you to maintain your property and prevent potential hazards. By addressing these property issues, you can protect yourself and save money on your insurance.

Don’t Let These Negative Factors Prevent You from Getting the Best Insurance For Your Needs and Budget.

You’ve now learned how to address some of the most common property conditions that can ruin your home insurance application and how to fix them.

By following our tips, you can improve the condition and safety of your property and reduce your liability risk. This can help you avoid getting denied or paying more for home insurance. You can also increase your home value and protect yourself from financial losses in case of a disaster.

If you overlook the advice in this article, you may face serious consequences for your home insurance. You may get rejected by many insurance carriers or pay higher premiums for less coverage. You may also expose yourself to liability risks and potential lawsuits if someone gets hurt or injured on your property.

We understand that finding and keeping home insurance can be stressful and frustrating. You may feel overwhelmed by the many factors that can affect your eligibility and cost. You may also feel anxious about the potential risks and damages that your property may face.

We know how important it is to protect your home and your family from financial ruin in case of a disaster. That’s why we’re here to guide you through this challenging issue to find the best insurance solution for your needs.

By taking action to improve the condition and safety of your property and reduce your liability risk, you’ve made a smart and responsible decision that will benefit you and your loved ones for years to come.

To receive the tailored coverage you need for your home property, click the Get a Quote button below, and one of our insurance specialists will be in touch.

If you’d like to discuss your options for dealing with the negative factors affecting your eligibility for homeowners insurance, call (315) 635-2095. We’re waiting to hear from you.

Not done with your learning journey as yet? Read about what it takes to obtain a homeowners policy.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

.png?width=207&height=55&name=Horan_Logo%20Transparent%20No%20Tagline%20(2).png)