With over 1,000 glistening lakes in the upstate New York region, along with local rivers like the Seneca, the Oswego, and the Cayuga, CNY is a boater’s paradise (at least in the summer). But with all that water comes many boats and many different insurance policies.

While it’s easy to tell the difference between a pontoon and a runabout, it’s not so simple to spot the distinctions in boat coverage. Many carriers offer some version of boat insurance, but for those unfamiliar with the world of insurance, it’s like sifting through an informational haystack to find a needle.

The purpose of this article is to shrink that world and make it accessible by reviewing the top 3 boat insurance carriers in New York State. After you’ve read to the end, you can use the pertinent carrier and policy details we’ve compiled to choose the best boat insurance carrier for your needs.

We’re an agency in a boating town with a river running through the middle, so we know boat insurance. We’ve written many boat insurance policies over the years through various insurance companies. In that time, we’ve effectively narrowed down the carriers that have risen like cream among their competitors.

We’ll guide you to the top 3 New York carriers that have crafted policies for the unique needs of today’s boater. We’ll explain their unique coverage, benefits, potential discounts, and any specific restrictions to be mindful of. Finally, we’ll guide you on how to easily purchase a policy from them.

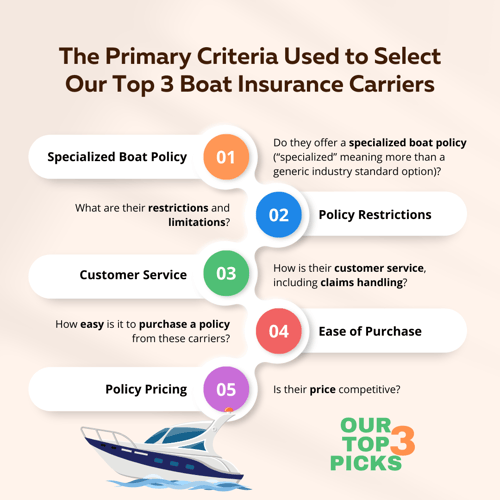

How We Chose Our Top 3 Boat Insurance Carriers

Our review of carriers is based on our combination of direct experience, research, and industry knowledge. Below are the primary criteria we used:

- Do they offer a specialized boat policy (“specialized” meaning more than a generic industry standard option)?

- What are their restrictions and limitations?

- How is their customer service, including claims handling?

- How easy is it to purchase a policy from them?

- Is their price competitive?

Based on these strict criteria, the three carriers that came out on top are

- Progressive Insurance

- BoatUS, and

- Markel Insurance

All three offer a boat policy designed specifically for the unique risks boaters might face. Keep reading to learn what separates these carriers from others in the business and how they differ from one another.

1. Progressive Insurance

While you know Progressive for their snappy commercials featuring Flo and Jamie, what you might not know is that this familiar insurance company has been offering robust boat insurance for decades.

Progressive offers coverage for different types of watercraft, such as bass boats, pontoon boats, powerboats, and personal watercraft. It gives you the freedom to boat wherever you’d like on any lake or river in the U.S., plus ocean waters within 75 miles of the coast.

What to Like About Progressive Boat Insurance

The Boat

Progressive offers unique boat coverage perks that go beyond basic policy offerings, such as:

- A wide range of boat values. With most carriers, the older your boat, the more restrictive your coverage is. But not with Progressive. A boat less than 10 years old can have a value as high as $500,000. For boats 11–20 years old, the top range is $350,000, and for those over 20 years old, $75,000. Many carriers will not offer damage insurance for boats beyond 15 years of age.

- Agreed Value replacement coverage. With agreed value, you and the insurer agree to a set value of your boat at the time you purchase your policy. The insurer will pay the stated amount if there is a total loss, even if the boat’s actual value was lower at the time of the loss.

- No Marine Survey requirement. While other companies offer agreed value, most require you to obtain a costly marine survey to prove that value. Progressive does not have this restriction.

- Coverage for bigger boats. Length is a primary factor when it comes to insurance acceptability. Many carriers walk away from those that are over 26 feet long. Progressive almost doubles that with their allowance for boats stretching up to 50 feet!

- Coverage for boats with higher speeds and horsepower. Do you own a powerful cruiser or sport boat? Progressive allows up to 75 mph (90 mph for bass boats), 700 horsepower (HP) for single engines, and 1,400 HP for twins.

Specialized Coverage

Progressive also offers expanded optional coverage for more complete protection on the water. Some of those options include:

- Sign & Glide on-water towing. No one wants to be stranded 30 miles from the nearest shore. That’s why Progressive provides optional coverage for disablement. While other carriers offer similar protection, Progressive makes it simple. All you have to do is sign a form for the work, and Progressive pays the tow operator directly.

- Propulsion Plus mechanical breakdown coverage. It works almost like a warranty on your motor. This optional coverage pays to repair or replace motors that suffer mechanical breakdowns, including from wear and tear. But there is one limitation to note—the boat must be under 10 years old when adding this coverage. However, it can remain on the policy until it reaches 20 years of age.

- Personal items coverage. You can purchase up to $10,000 in replacement cost protection for personal items damaged while boating. This is an excellent benefit because this coverage can be used instead of your home insurance. Pegging this option to a boat policy saves you from an additional deductible and a claim on homeowners insurance history.

Customer Service and Claims

Unlike other carriers who have claims specialists with limited boating knowledge, representatives at Progressive receive intensive watercraft training.

And that staff is available 24 hours per day.

You also work with one specialist from start to finish, eliminating the need to retell the whole situation to whoever answers the 800 number.

Ease of Purchase

Purchasing boat insurance from Progressive is as easy as it gets. You can buy a policy through an agency (like us) or direct through Progressive. It’s the same price either way.

Call and have a quote you can buy within a matter of minutes.

And enjoy flexible payment plans.

Discounts

Among a bountiful assortment, standouts include:

- Advance Quote (get a quote at least one day before the policy would begin)

- Original Owner

- Paid in Full

- Safety Course

- Responsible Driver

- Homeowner

- Multi-policy

To learn more about Progressive’s history and policy offerings, read our comprehensive review of the carrier.

2. BoatUS

Unlike Progressive, our remaining two carriers are hardly household names. But just because you can’t match them with a comedic mascot doesn’t mean they don’t come up strong in the world of boating insurance.

BoatUS, as evidenced by its name, is a carrier that is all boat, all the time. But if familiarity is a preference for you, the company is owned by GEICO Insurance, which you might have heard of.

What to Like About BoatUS

The Boat

BoatUS’s non-standard boat policies are designed to meet the needs of boaters who own boats that are not typically covered by traditional insurance policies. Among those offerings are:

- High-value boat coverage. The carrier is open to pricier boats with values of up to $2.5 million.

- Agreed Hull Value replacement coverage. This policy option pays you the agreed value of your boat when you buy the policy for total losses and replaces parts “new for old” for partial losses. However, there are some limitations here, and some primary components—such as outboard motors and propulsion machinery—are subject to depreciation.

- Coverage for bigger boats. BoatUS extends coverage to most vessels topping out at 50 feet in length.

Specialized Coverage

BoatUS also offers a variety of specialized coverages, including

- Ice and Freezing. This coverage is meant for boaters who live in cold climates or who plan to winterize their boats in cold weather. Typically excluded by other carriers, this option covers damage caused by ice and freezing temps if winterized by a marine professional.

- Lifetime Repair Guarantee. Enjoy claims-related repairs made at an approved facility for as long as you own the boat and insure with BoatUS.

- Unlimited Towing. The basic freshwater option can be had for as little as $3 per month through TowBoatUS. Unlimited saltwater options cost more.

- Mechanical Breakdown. Available with Agreed Hull Value only and covers the lower unit of the outboard engine and outdrive due to mechanical failure.

Customer Service and Claims

BoatUS claim specialists are available 24 hours per day, 7 days a week.

Claims can be filed online within your account, on the BoatUS App, or by direct call.

The BoatUS “Cat” Team is flown into areas that have experienced major floods or hurricane damage to help speed up the claims processing.

Ease of Purchase

Oh, it’s easy, but you must buy directly from the carrier. There is no agent option, so don’t expect the white-glove service here.

Call directly for a quote or visit them online. And note that quotes are considered accurate and not “ballpark.”

There’s a minimum 30% down payment, but billing plans are limited.

Discounts

- The primary discount offered is the approved boater safety course completion.

3. Markel Insurance

Rounding out the top 3 is a carrier that has been around since 1930. Markel has a strong appetite for vessels ranging from smaller boats to large yachts. They favor the more experienced boaters and offer benefits to policyholders over the age of 30.

What to Like About Markel

The Boat

Markel Insurance is also a specialty insurance provider that offers a variety of non-standard boat options, including coverage for

- boats up to 26 feet in length

- boats over 26 feet in length in the marine category

- boats with speeds up to 65 mph (but that limit can rise to 120 mph when eligible for the

marine category) - Agreed Value, which is available with some exclusions on mechanical components over six years old

Specialized Coverage

Markel understands that every boat is different and every boater has different needs. That’s why the carrier offers a variety of specialized coverage options, including

- Optional $6,000 for damage to your boat lift if caused by collision, fire, lightning, or explosion.

- Up to $5,000 for personal items damaged while on the boat.

- Pollution liability of $997,100, which is standard on all policies.

- Ultimate Drive Coverage, which covers you for wear and tear breakdown of the outboard

lower gear casing or sterndrive upper or lower unit. - $500 on-water-towing limit, which is automatically included with an option to increase to

$2,000. This option includes towing, gas, and battery assistance. - No marine survey requirement for boat values below $30,000.

Customer Service and Claims

Markel sports a well-trained claims staff with deep expertise in boat and marine losses.

They complete policy changes quickly upon request. You will also have convenient access to an agent or carrier specialist to obtain policy information or proof of coverage if purchasing a new boat.

Ease of Purchase

A Markel policy must be purchased through an insurance agency (like ours). Quotes can be delivered on the same day and are valid for 90 days.

Policies can be purchased without a down payment for qualified buyers, and multiple payment plan options are available.

Discounts

- Experienced Boater (for those with 2 or more years of boating experience)

- Mature boater (over 30 years old)

- Married

- Homeowner

- Early shopper (get your quote at least 8 days before the policy starts)

Are You Ready to Find the Best Carrier for You and Your Vessel?

The choice you make today could be crucial for your future adventures on the water. Ensure that you’re selecting the right coverage for your unique needs so you won’t be left stranded in case of accidents or breakdowns.

Insuring with a carrier that doesn’t specialize in the unique needs of a boater will leave you short on coverage and long on frustration. You don’t want to waste precious time hunting for the right boat insurance and risk missing a season on the water.

We know you’re seeking the best possible coverage for your boat. We’re here to help you find the right policy so you can sail with peace of mind, knowing you’re protected.

Allow our Horan insurance specialists to guide you in the right direction. Simply click the Get a Quote button below for tailored assistance.

And if you’re new to boating, be sure to avoid common errors by reviewing our article, “5 Boat Insurance Mistakes First-Time Boat Buyers Make.” Equip yourself with the essential knowledge to make informed decisions and enjoy your time on the water with confidence.

Topics: