Scheduled Personal Property Coverage: Insuring Your Most Valuable Things

June 9th, 2023

6 min read

You may have some valuable items in your home that you cherish and want to protect. But did you know that your standard insurance policy may not cover them fully if they’re lost or damaged?

A homeowners policy limits how much it will pay for certain items, such as jewelry, art, collectibles, etc. You may end up getting much less than what they’re worth or what it would cost to replace them.

This can be devastating and frustrating, especially if you have sentimental or irreplaceable items. We understand the financial hardship and emotional distress this can cause. That’s why you need to know how to insure your valuable items properly and get the coverage you deserve.

The Horan agency has years of experience writing policies for valuable items. We’ve helped many clients find the best coverage and value for their situation. We can advise you on the appraisal process and schedule your valuable items on your policy and get you the most benefits and protection, and thus become the conqueror of your family’s insurance needs!

In this article, we’ll explain what items are considered “valuable” by insurers, how to get them appraised by a qualified source, and how to schedule them on your policy. We’ll also show you how scheduling your valuable items can give you more benefits and protection than your standard home policy.

Read on to find out how to insure your valuable items properly.

What Are Considered “Valuable Things” to Insurers?

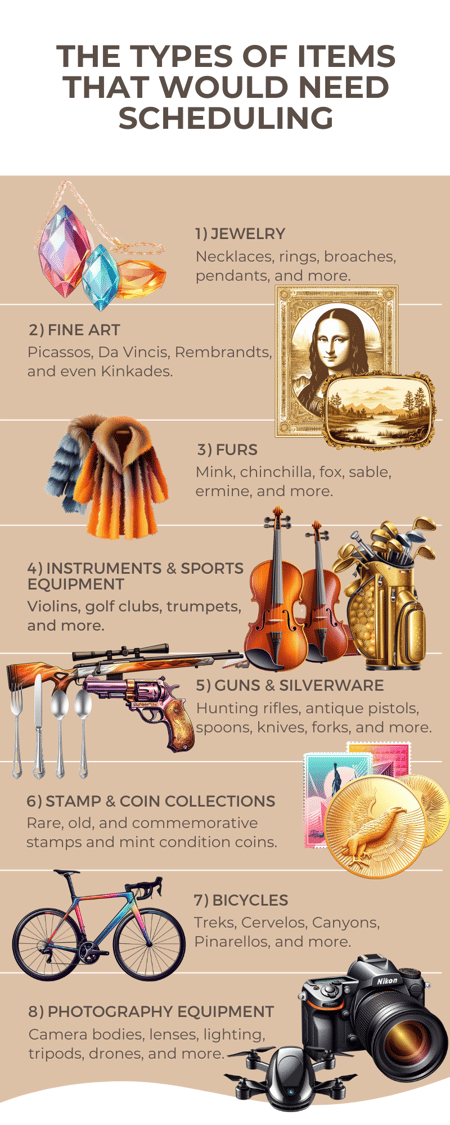

Insurance companies have different definitions of what counts as “valuable things” that may need extra coverage. However, some common examples of valuable items are:

- Art of any kind (i.e., painting or sculpture)

- Expensive jewelry

- Collectibles, such as coins or stamps

- Fur coats

- Musical instruments

- Cameras and other electronic devices

This is not a complete list, but it gives you an idea of the types of items that may have limited coverage under your standard homeowners policy.

The general rule of thumb is that if the cost of replacing an item exceeds the single-item limit shown in your policy, then you should consider it valuable. You can usually ask the insurer to cover the item separately for an additional cost.

What Your Homeowners Policy Covers (and Doesn’t Cover) with Replacement Cost Coverage

Many people wonder if their valuable items are covered by their homeowner policy with replacement cost coverage. This type of coverage means that your personal property will be replaced at the current market price if it’s damaged or destroyed by a covered event, such as a kitchen fire.

However, not all personal property is easy to value or replace. Some items may be rare, antique, or sentimental, and their worth may not be clear.

The standard home policy covers typical personal property that you use in your daily life, such as kitchen appliances, utensils, dishes, silverware, etc. These items have a known value that can be determined by online research or shopping around.

For example, if you bought your silverware $50 years ago and it costs $200 to replace it today, that’s what the policy will pay.

But some items may not have a known value or may not be replaceable at all. These items may include things like a 150-year-old Steinway piano, a solid gold wedding band with a 6-carat diamond ring, or a painting by a famous artist.

Such items may be rare, antique, or sentimental, and their value may depend on factors like age, condition, demand, and appraisal. The standard home policy may not cover these items fully or at all, depending on the limits and exclusions of your policy.

Does Your Home Policy Fully Cover Your High-Value Items?

So, what about high-value items? How are they treated by your standard home policy with replacement cost coverage for personal property?

The answer is that they’re covered, but only up to a certain limit per item. This limit is usually $2,500 for items the carrier considers highly valuable, such as jewelry, art, antiques, musical instruments, etc.

This means that if your high-value items are damaged or destroyed by a covered event, you’ll only receive $2,500 for each item, regardless of their actual value. For example, if your 150-year-old Steinway piano and Grandma’s ring are both ruined in a fire, you’ll get $2,500 for each of them.

If your total personal property coverage is $50,000, you will have $40,000 left to replace the rest of your belongings.

You don’t have to settle for this limit if you want to protect your high-value items more. You have options to increase your coverage for these items and ensure that you get their full value in case of a loss. Alternatively, you may decide that some of your high-value items are not worth insuring for more and take measures to safeguard them from damage or theft.

The choice is yours, but you should be aware of your options and the risks involved. So how can you increase your coverage for your high-value items?

How to Increase Your Coverage for High-Value Items

If you want to insure your high-value items for more than the limit in your standard home policy, you need to follow these steps:

If you want to insure your high-value items for more than the limit in your standard home policy, you need to follow these steps:

- Get a professional appraisal of your item from a qualified source. You can’t use online estimates or personal opinions to determine the value of your item. You need a written appraisal from an expert in the field, such as a jeweler, an art dealer, or an antique appraiser. For example, if you want to insure Grandma’s ring for more than $2,500, you need a jeweler to appraise it and give you a document that states its value.

- Decide if the appraised value is worth insuring for more. You may find your item worth more or less than you expected. You need to weigh the cost and benefit of increasing your coverage for your item. For example, if Grandma’s ring is appraised at $4,000, you may decide it’s not worth paying extra to insure it for more than $2,500. But if it is appraised at $15,000, it may be worth paying extra to insure it for its full value.

- Submit the appraisal to your carrier and request to schedule your item on your policy. This means that your item will be listed separately on your policy with its specific value and description. It will no longer be covered by the personal property portion of your policy. It will have its own coverage and premium. For example, if you want to schedule Grandma’s ring on your policy, you need to send the jeweler’s appraisal to your insurer and ask them to add it to your policy with its value and details. The details should include any serial numbers or unique markings that identify the item.

The Cost to Schedule Your High-Value Items

The cost of scheduling personal property on your policy depends on the value of the item and the insurance company’s evaluation. To find out the cost, you need to submit the appraisal of your item to the insurer. They may ask you some questions or request photos of the item.

Then they’ll give you a quote for adding the item to your policy as scheduled personal property.

You can then decide if the cost is worth it. Say you have a ring worth $15,000, and the insurer charges you $1 to schedule it on your policy, that would be an easy decision. But if they charge you $10,000, that annual amount for one item might give you pause.

The cost of scheduling personal property varies from one carrier to another and from one item to another. However, a general rule of thumb is that it may cost about 1 or 2 percent of the item’s value. This is not an exact figure, but it can give you some idea of what to expect.

The Benefit of Scheduling High-Value Items

Scheduling a high-value item on your policy gives you more coverage than your standard home policy. Your standard policy may only pay up to $2,500 for your ring if it is damaged at home, and up to $500 if it is damaged on vacation. But if you schedule your ring on your policy, you’ll get its full value regardless of where or how it’s damaged.

You also may not have to pay a deductible if you make a claim for an item that you scheduled on your policy. A deductible is the amount of money you have to pay out of pocket before the insurance company pays the rest.

For instance, if you have a $500 deductible and your ring is worth $15,000, you’ll have to pay $500, and the insurer will pay $14,500. But if you schedule your ring on your policy, you may not have to pay anything, and the insurer will pay the full $15,000.

Scheduling an item on your policy means you’re covered for more situations and more money than your standard policy offers.

Insure Your Valuable Items Properly

If you have valuable items in your home and don’t insure them properly, you could be financially devastated if they’re lost or damaged. Your standard home policy may not cover them fully, and you could end up having to pay out of pocket for their replacement.

This could be a significant financial burden, especially if you have expensive items.

In addition, if you don’t insure your valuable items properly, you may be unable to file a claim with your insurer if they’re lost or damaged. This could leave you without any financial assistance to replace your belongings.

We don’t want to see you face such a devastating blow. Avoid these negative consequences by insuring your valuable items properly.

By following our advice, you’ll be able to enjoy your valuable items without worrying about losing them or getting underpaid by your insurance company. You’ll also save money and time by finding the best option for insuring your valuable items. Don’t let this opportunity pass you by.

Choose the proper coverage and protect your valuable items and your family’s legacy from unexpected losses and damages. You can also ensure that your high-value items can be enjoyed and passed on to future generations.

We know how to compare quotes and choose the best option for your needs and budget. We can save you money and time by finding the best deal for your valuable items. We care about your satisfaction and safety, and we’re here to support you every step of the way.

The right insurance helps protect your belongings and your financial future. Let us help you secure the coverage that can do that. Get started by clicking the Get a Quote button below, and one of our insurance specialists will reach out to you to begin tailoring coverage for your valuable items.

But if you’re not ready for tailored coverage, you can continue on the learning journey by reading about the best riders for a home insurance policy.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: