Insuring Older Homes: Coverage Considerations for Central New York Properties

August 15th, 2025

8 min read

Owning an older home in Central New York brings unique insurance challenges that can create uncertainty when it's time to rebuild after a catastrophic loss. You might wonder whether your policy will cover the vintage details you love or if you'll face unexpected gaps in coverage. The biggest concern isn't just finding any policy—it's securing coverage that matches your vision for restoration.

At the Horan insurance agency, we assist Central New York homeowners with information about insuring vintage, classic, and historic properties. We work with multiple carriers to help you explore coverage options that address your specific restoration requirements.

In this article, we'll explore how insurers classify home ages, the different coverage approaches available for older properties, and important considerations like building codes that can affect your rebuild costs.

Understanding How Insurance Companies Classify Home Ages in Central New York

Insurers consider three time periods when classing homes as old or new. To simplify, any home built in the last 30-plus years is “newer.” Think the year 1990 onward.

The next period for classifying the age of homes is between 1940 and 1990. Homes built during this 50-year period are considered “old.”

Where does that place homes that were built pre-1940s, you might ask? The pre-1940s is the era of “older” homes, many historic, classic, or vintage.

These homes may include elegant touches, such as ornately hand-carved crown molding, deeply sculpted tin ceiling tiles, or exquisite wood millwork details that reveal a rich history.

Why Does the Age of Your Home Matter?

Understanding these age classifications becomes important when you consider the unique challenges of rebuilding older properties. Let’s start with “older” homes. Say you have a house that was built before 1930. The construction style is from a bygone era. Many building materials that were in common use back then are not readily available today.

For one, the lumber (or timber) used in the 1930s and prior was largely culled from old-growth forests that have since been reforested. President Roosevelt spearheaded the planting of 50 million trees in the state of Pennsylvania alone because loggers had systematically cut them all down.

Vintage homes also showcased ornate banisters and railings, decorative cornices, and walls and ceilings finished in lath and plaster, which dates from the 1700s to the mid-1900s. Homes built in the Greek Revival and Federal styles, for instance, often featured front porches and entry porticos with fluted or smooth columns.

All of these details required highly skilled craft workers and expensive building materials.

You, the insured, will have to consider how many of these classic components are necessary to rebuild your home in the event of a catastrophic loss, such as a fire.

With regard to rebuilding after a covered peril, you will fall into one of two camps on this issue.

- You will care greatly about the original materials and details and want to restore the home to its former glory, or

- You liked some of the home’s vintage details but weren’t married to the style and are open to something more modern

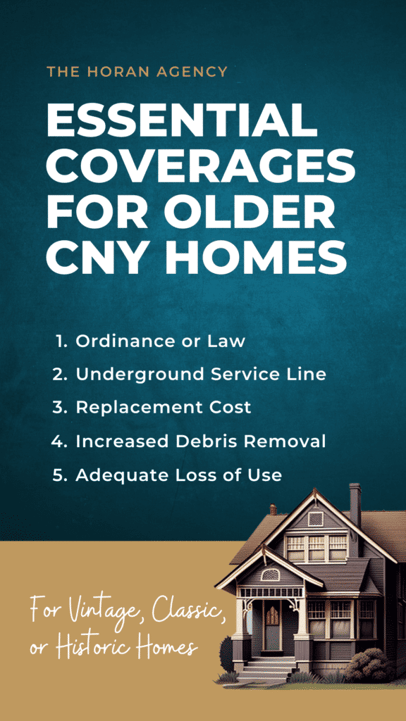

The Replacement Cost Coverage Option

Given these two distinct approaches to older home ownership, let's explore the coverage options available for each perspective.

If you fall into the first camp, you likely went on a specific house search that isolated vintage or historic homes. That called for a big budget and more expensive homeowners coverage.

Since you want to see vintage details of your home restored to its original state in the event of a covered loss, replacement cost coverage is worth considering.

Choosing that coverage may help ensure that your carrier will hire skilled laborers and source the materials needed to reconstruct your home as close to the original as possible.

It will be close, but it cannot be exact simply because some materials no longer exist in their commercial form—such as lumber from the old-growth forests we mentioned earlier.

More than that, homes are built differently these days. Outdated wiring, plumbing, and other components that fail to meet modern building codes must be updated to today’s standards. Similar wood will likely be used throughout the home, but they will be culled from younger trees.

Replacement cost coverage can help you pay for the rebuild, but it will cost you. Restoring or rebuilding a Greek Revival-style home with all its fancy period trimmings requires a level of craftsmanship that exists in a shrinking pool of artisans.

Design and construction will take longer to complete for that reason. Sourcing the right materials will also prolong the building process, which will further drive up costs.

If you can secure guaranteed replacement cost coverage, consider purchasing it immediately.

While it is a pricey option, guaranteed replacement cost insurance accounts for budget overruns and is there to pick up the expense of material, labor, and other factors that exceed the Coverage A limit on your home policy’s declaration page.

Accurate Rating Is Important for Your Coverage

For those who want to see each vintage detail restored following the loss of a home built before 1940, make certain that your insurer rates you accurately.

That means conveying to them every detail you can, including door sizes, ceiling heights, the types of crown molding used as well as their linear feet, and all the finer points of construction.

You want to have enough replacement cost coverage (or guaranteed replacement cost) to replace your home if a covered peril destroyed the entire structure.

But most Central New Yorkers who own these types of older homes are of a different breed, not being married to the idea of a house built in a bygone era. If that’s you, another type of homeowners policy exists.

The Functional Replacement Cost Option

For homeowners who fall into the second category and prefer modern conveniences over vintage authenticity, functional replacement cost offers a different approach.

Let’s put that into perspective.

If your 3,000-square-foot house was built in 1920 using all the fancy materials and craftwork we discussed, it will cost considerably more to rebuild than a 3,000-square-foot home constructed in 1975.

The materials for the 1920 home are expensive to source and replicate, and finding skilled artisans to fashion the intricate designs and build according to classic themes will come at a higher price for your insurer.

Knowing these details allows you to make an informed decision as to how you want to insure your property. If you choose the functional replacement cost option, your insurer will rebuild your 3,000-square-foot house following a covered peril, but it will not be in the vintage style.

The home will be modern and customary to 21st-Century standards. Lath and plaster walls and ceilings will give way to drywall. You might be the kind of homebuyer who opted for a Colonial Revival when you were in the market for a home because it was available at the time and met your budget and size requirements.

Original vintage details may not matter much to you in that case, and drywall, shingles or a metal roof, polymer or woodgrain vinyl siding, and other modern features aren’t a problem.

You may also be willing to downsize your restoration or rebuild if 3,000 square feet proved too big to manage. Following a covered loss, using functional replacement cost to insure for a little less than the replacement value of the home sometimes makes sense, depending on your situation or needs.

As long as you stay above 80 percent of what the overall cost to replace the home would be, you’re fine.

For these reasons, the functional replacement cost option may suit you well.

Considering the Building Code Equation

While coverage type addresses how your home gets rebuilt, building codes determine what standards must be met during that process.

While coverage type addresses how your home gets rebuilt, building codes determine what standards must be met during that process.

Rebuilding any home after a fire is straightforward if that home was completely destroyed. A total loss is one thing, but if the home only suffered, say, 51 percent damage, that is another matter altogether. The reason: building codes.

While every municipality is different, code enforcement officials all view old homes—those built in that 50-year period between 1940 and 1990—the same way.

As codes are updated over the years, those homes with old wiring and construction materials are grandfathered in, meaning they can reside under the old codes until improvements need to be made to the home.

So, if you wanted to update the kitchen in your one-story Liverpool ranch built in 1963, you’ll have to upgrade that portion of the home to the current building code for Liverpool, New York.

Code enforcement is taken even further concerning rebuilds after a loss. Let’s take our fire scenario, where the home is partially destroyed—in this case, up to 51 percent.

We reached out to Bill Reagan, the code enforcement officer for the village of Liverpool. He said that if you’re rebuilding less than 50 percent of the house then it’s business as usual. Undamaged elements that aren’t exactly up to code can remain as is.

But when damage to your home does exceed 50 percent, the current codes demand more. Of this, Bill Reagan says,

“What the building codes state is that if the damage to the building, or the cost of the project, exceeds 50 percent of the value of the building, then the entire building has to be brought up to current codes.”

That means gutting the entire home, which can cost you tens, if not hundreds, of thousands of dollars. Why? Because your home policy excludes this requirement. Homeowners must add a specific rider to cover the cost of construction in such cases.

The Ordinance or Law Coverage Option

When building code requirements exceed your standard policy coverage, ordinance or law coverage can help bridge the gap.

Once you add the ordinance or law coverage rider to your homeowners policy, it offers a set amount of money to rebuild the undamaged portions of your home after a covered loss so that those portions meet current building codes.

If two bedrooms and a half bath survived a fire unscathed while the kitchen, dining room, and living room were completely destroyed, as a policyholder with the ordinance or law coverage endorsement, the insurer will offer a set amount of money to help you rebuild the undamaged areas.

That set amount is all you’re getting. For many carriers, ordinance or law coverage totals $10,000. Others will offer up to 5 percent of your Coverage A limit. If that limit is $300,000, the ordinance or law coverage comes to $15,000 in total, which may not be much when you consider the work needed.

Central New York homeowners with homes built in the last 20 years may not find the ordinance or law coverage endorsement as relevant since their homes aren't far removed from meeting current code requirements. Upgrading undamaged portions of the house won’t be as expensive as older homes.

If you own a home that was built before 1990, however, you may encounter future rebuilding costs that the ordinance or law coverage endorsement can help offset.

Things to Consider if You Have an Older House

Beyond the main coverage decisions, several additional factors deserve attention when insuring an older home.

Loss of Use Coverage

Your insurance will also need to cover the extended loss of use rebuilding a home of this magnitude will require.

You will be displaced for a longer period than someone replacing a conventional home built in 1965, so your loss of use coverage needs to reflect that.

Underground Service Line Coverage

If you live in a home built before 1990, chances are the underground sewer line leading from the street to the house has been decaying for decades. It’s probably a matter of time before it ruptures, spewing wastewater and excrement into your yard and rendering your sewer or water line useless.

Adding an underground service line coverage endorsement is strongly advised.

Call Your Local Code Enforcement Office

If you’re considering purchasing an older home and are actively researching properties, consider calling your local code enforcement office. Local code enforcement officers are happy to speak with residents and dole out useful information about zoning laws and current building regulations.

Ask the code enforcer about the threshold to gut or tear down your house and rebuild after a covered loss. Does the home have to be damaged up to, below, or more than 50%?

Also, ask what past construction materials are red-flagged today. Does a home with lead-based paint have to be brought up to code?

Finding Suitable Insurance for Your Old Home

If you own an older home, you’re in a unique position and face equally unique risks. You stand apart from Central New Yorkers who own modern homes or houses that were built in recent years.

This requires you to gather information that will prepare you for a full and satisfactory restoration should a covered catastrophe or peril affect your home.

Understanding your coverage options for older homes can help you make informed decisions about your insurance requirements.

The Horan insurance agency assists homeowners in Baldwinsville and throughout Central New York with information about insuring vintage, classic, and historic properties. Our location has given us experience with these unique property types in our region.

If you're looking to explore coverage options for a home built during the periods discussed in this article, we'd like to help. Click the Get a Quote button below to start gathering information about your coverage options.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: