Avoiding Coverage Gaps: Tips for Properly Insuring Your Personal Vehicle Use for Work

June 27th, 2025

5 min read

Using your personal vehicle for work-related activities seems straightforward until an accident occurs. You're rushing to a client meeting in Cicero, running late for a property inspection in Fayetteville, or heading to your third job site in one day when suddenly—impact. Now you're dealing with damage, injuries, and the devastating realization that your personal auto policy might not cover business activities.

Many Central New York workers face coverage gaps without realizing it. Whether you're a real estate agent, freelance consultant, or home healthcare provider, misclassifying your vehicle usage can leave you financially exposed during the worst-case scenario.

At the Horan insurance agency, our licensed agents can discuss vehicle classification requirements with Central New York drivers. We work with several carriers to help explore coverage options that may match your actual driving patterns.

In this article, we'll examine the three vehicle use classifications that determine your coverage level, show why proper classification matters through real-world scenarios, and provide steps for updating your current policy to avoid costly surprises.

The Three Classes of Use for Your Vehicle

There are three classes insurers employ to categorize your vehicle use:

- Pleasure

- Commute

- Business

Pleasure

This class drives their vehicle spontaneously. You won’t drive to and from work or school five days a week. What you do with the vehicle one day may differ from the next. And mileage may be inconsistent from year to year.

For most carriers, annual mileage under 7,500 results in a set rate for pleasure-use drivers. That rate won’t change whether you drive 2,000 miles or 7,500 miles.

Pleasure-use drivers make occasional coffee runs and pit stops at the local UPS Store to return a shoddy product. They head out for infrequent errands here and there, and nothing is routine.

You’re probably a retiree, a stay-at-home dad or mom, or you solely work from home and don’t make business appointments that will require you to drive.

Commute

This class, on the other hand, tends to be less spontaneous. You drive to the same place roughly five days a week, this being either work or school. The insurance carrier will rate you based on how far that routine trip is—or how many miles one way.

This class, on the other hand, tends to be less spontaneous. You drive to the same place roughly five days a week, this being either work or school. The insurance carrier will rate you based on how far that routine trip is—or how many miles one way.

It doesn’t matter if you drive five miles to work or thirty-five. The carrier wants to know so a rate can be determined. If your commute to work or school is quite far, expect to see a higher auto rate.

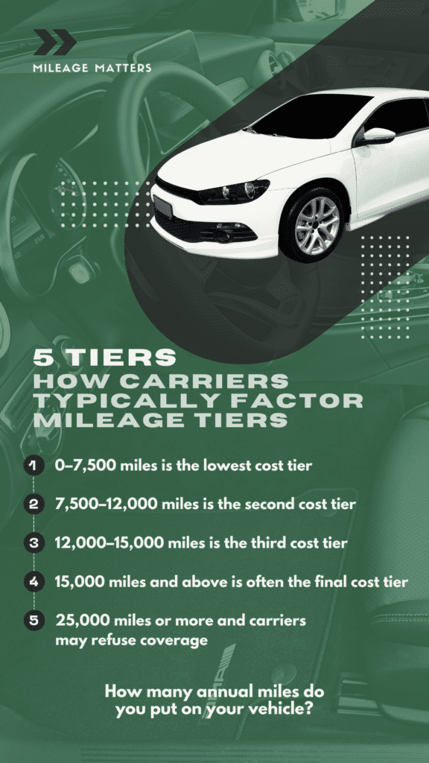

Above 7,500 annual miles takes you into a new price tier for most carriers. The next tier usually starts at 12,000 miles, and 15,000-plus miles is often the highest tier, with a cap of 25,000 annual miles.

That said, the first two vehicle uses are common, and most people are familiar with pleasure and commuter classes. But when should you let your carrier know you’ll be using your vehicle for business?

Business

Drivers in this class use their vehicles for work-related purposes. Unlike a commuter, a business-use driver goes to a job site routinely, but that site changes.

Construction inspectors are a good example since they drive from a building site on one side of town to a completely different construction area on the other while making stops at various offices for meetings along the way.

And the next month will look completely different.

A REALTOR® must also classify her vehicle for business use. If Amanda is going to drive her car from Liverpool to Fayetteville and then Auburn to show a few exclusive properties for two weeks, she should classify her car for business use.

This also applies to:

- Traveling nurses

- Home health aides

- Insurance agents

- Home inspectors

- District managers

- Outside sales reps

Or anybody who will consistently visit different places for work, which will change location from day to day.

Pleasure-use drivers are behind the wheel so infrequently that they are a low accident risk. They may leave their car parked for two days without the need to travel anywhere.

Commuters, meanwhile, travel familiar roads since they drive to the same location—with stops in between—day in and day out. And the vehicle is parked for most of the day.

But business-use drivers are unique in that they often travel to new places weekly, if not daily, at different times. The roads and traffic patterns will not be familiar, and we all know that the distraction level is higher when driving in an unfamiliar place, especially when you’re heading to an appointment and traffic is heavy.

The vehicle is an extension of the business-use driver. It’s part of the job. And they travel to new places so frequently that they pose a greater accident risk.

What Does it Matter Where I Drive?

Okay, you now understand the three classes of use for vehicles according to insurance carriers.

But what does it matter? Why should you call your agent and let them know that you started a new job as a REALTOR®? Or you just opened a cleaning business and now drive your personal van to different homes and businesses weekly.

Here are three things to consider:

- The carrier wants to know what you’re doing with the vehicle, ensuring you receive an appropriate rate.

- You want to tell them what you’re doing with the vehicle in case there’s a loss, and you have to file a claim.

- You want to ensure you’re covered for that loss by addressing the first two items on this list.

Telling your carrier that your vehicle is for pleasure use when you really drive it for business use to show houses may leave you with nothing if you encounter an accident and attempt to file a claim, even if you did it absentmindedly.

This is one of the reasons people are frustrated with their insurance policy, the licensed agent who sold it to them, and the carrier that underwrote it. They are not covered because they didn’t take the necessary steps to obtain the proper coverage.

That is what we're here to help you do: obtain appropriate coverage so you can have composure and security and be made whole if you ever suffer a loss.

We understand that life can become busy, often leading to things falling through the cracks. For most people, insurance coverage is one of those bottom-of-mind issues in order of importance.

If you’ve made it this far down in the article, insurance is rising to top-of-mind, and that’s a good thing. That means you want to have the appropriate coverage.

What Should I Do About Classifying My Vehicle?

Don't let a coverage gap derail your livelihood. Understanding and properly classifying your vehicle usage can help safeguard more than just your car—it may help protect your financial stability. Misclassifying your vehicle might save a few dollars monthly, but when an accident happens during business use with a pleasure-rated policy, you're facing potentially significant uncovered costs.

We've covered the three vehicle use classifications and why each matters in determining your coverage level. Whether you drive for pleasure, commute, or business purposes, accurate classification helps ensure your policy matches your actual risk exposure.

The Horan insurance agency works with multiple carriers to help Central New York drivers explore coverage that may match their driving patterns. Our licensed agents can review your current policy and discuss classification updates that could reflect your actual vehicle usage.

If you know how to classify your vehicle and find that you need to make a change, then reach out to your independent agent or carrier directly. Update your vehicle use and verify that you now have appropriate coverage based on your driving habit.

If you're still not sure how to classify your vehicle, call us at 315-635-2095 to discuss your policy with a Horan licensed agent.

For those using their vehicle exclusively for business—say you have a van with decals displaying company information and transport tools and materials for jobs—you may want to explore upgrading to a commercial auto insurance policy.

Click the Get a Quote button below to start a conversation about properly classifying your vehicle for potentially more accurate coverage.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: