Bar and Tavern Liquor Liability Insurance for CNY Businesses

August 28th, 2023

6 min read

If you own a bar or tavern in Central New York, you know how important it is to serve your customers well. You also know how risky it can be to serve alcohol. You could face lawsuits arising from drunk drivers, injured patrons, or damaged property. These lawsuits could cost you thousands in legal fees, settlements, and medical bills. They could even put you out of business.

That’s why you need bar and tavern liquor liability insurance.

This type of insurance protects you from the financial consequences of alcohol-related claims. It covers your legal defense costs, damages, and medical expenses if someone sues you for serving alcohol to an intoxicated person who then harms themselves or others.

But bar and tavern liquor liability insurance policies vary. Some offer more coverage than others. Some have exclusions and limitations that could leave you vulnerable. Some charge higher premiums than others. How do you find the best policy for your business?

That’s where Horan comes in. We’re a local insurance agency that specializes in bar and tavern insurance. We have years of experience in helping CNY business owners like you. We’ll find the right coverage for your needs and budget.

In this article, you will learn about the importance of liquor liability insurance for tavern owners in CNY. We will cover the different types of coverage available, and how to choose the right policy for your business. By the end of this article, you will have a clear understanding of how to protect your business from alcohol-related risks.

Liquor Liability Insurance for Bars and Taverns

As a tavern owner in CNY, you know that serving alcohol comes with certain risks. You want to protect your business from lawsuits and claims. Both could arise from your customers’ actions after they leave your establishment. Liquor liability insurance is the answer.

It covers the costs of legal defense, settlements, and judgments you may face as a result of a liquor-related incident.

Even if you serve food, the type of business you have may need a policy that is different from a restaurant. Here are some things to consider when choosing a liquor liability policy for your tavern:

- Standalone vs. Endorsement. Liquor liability for a tavern owner is more likely to be a standalone policy. Unlike a restaurant, you can’t add a liquor liability endorsement to a business policy. A standalone policy is a separate policy that covers only liquor liability. An endorsement is an addition to an existing policy that extends the coverage. In this case, liquor liability. A standalone policy may offer more comprehensive and specific coverage for your tavern. An endorsement may have limitations and exclusions. These could leave you vulnerable in some situations.

- Limits and Deductibles. The limit of your liquor liability policy is the highest amount the insurer will pay for a single claim. It is also the highest amount they will pay for all claims in a policy period. The deductible is the amount that you have to pay out of pocket before the insurance company pays the rest. You want to choose a limit and a deductible that suit your budget and risk exposure. A higher limit may cost more in premiums. But it could save you from paying large sums in case of a major lawsuit. A lower deductible may reduce your upfront costs. But it could increase your premiums over time.

- Exclusions and Conditions. Every liquor liability policy has some exclusions and conditions. They define what the policy covers and what it does not. Some common exclusions are assault and battery, intentional acts, employee injuries, and liquor sold to minors. Some common conditions are compliance with state and local laws, employee training, and incident reporting. You want to read your policy with care. You should understand what it excludes and what your insurer requires. You also want to ask your agent about optional coverages or endorsements that could enhance your protection.

Policies offer coverage that starts at $1,000,000. You can always increase coverage limits to suit your business.

We discuss costs in greater detail in our companion liquor liability article for restaurants. Be sure to read it for that and other essential aspects of this coverage, including a liquor bond, alcohol training, and more.

Liquor liability insurance is an essential part of running a tavern in CNY. It can protect you from the financial consequences of serving alcohol to customers. But not all policies are the same. You need to find the one that fits your business needs and budget.

That’s why you should work with an experienced and trusted insurance agency. One that specializes in liquor liability insurance for bars and taverns.

Why Bars and Taverns Have Difficulty Finding Adequate Liquor Liability Insurance

If you own or operate a bar that serves alcohol as its main service, you need liquor liability insurance. It will protect your business from liquor-related claims. Bars face higher risks than other types of businesses that serve or sell alcohol. This is because bars often:

If you own or operate a bar that serves alcohol as its main service, you need liquor liability insurance. It will protect your business from liquor-related claims. Bars face higher risks than other types of businesses that serve or sell alcohol. This is because bars often:

- Have higher alcohol sales and consumption

- Stay open late at night or early in the morning

- Host events or activities that attract large crowds or increase intoxication levels

- Have more exposure to assault and battery incidents

These factors create several issues. Bars may have challenges finding affordable and adequate liquor liability coverage. More so than other businesses. Some insurers may not offer liquor liability insurance for bars at all. Or, they may charge higher premiums, impose lower limits, or exclude certain coverages.

Standalone liquor liability coverage will increase your expenses. It is a pricier option than your business policy. Your location, your receipts, the hours you’re open, and other aspects will influence the cost.

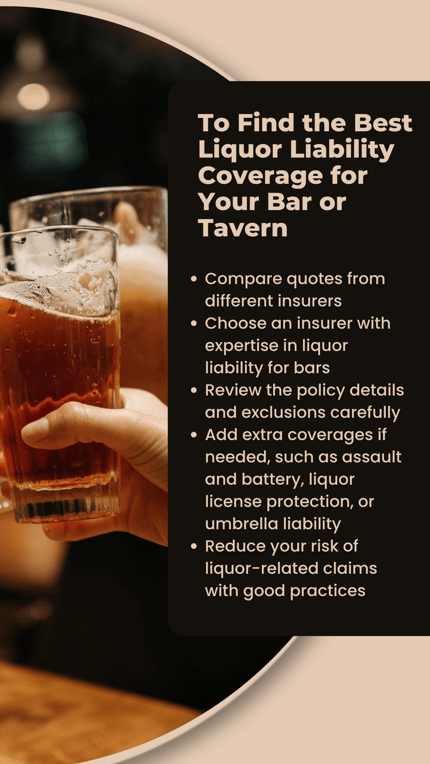

To find the best liquor liability insurance for your bar, you should:

- Shop around and compare quotes from different insurers

- Look for an insurer that specializes in liquor liability insurance for bars. Or find one that has experience in the industry

- Check the policy details and exclusions and make sure you understand what it covers and what it does not

- Consider adding endorsements or extra coverages that may suit your needs. These include assault and battery coverage, liquor license protection, or umbrella liability insurance

- Appy risk management practices to reduce your exposure to liquor-related claims. This could also lower your premium

Does Your Liquor Liability Policy Cover Assault and Battery?

As a business owner, you know that liquor liability insurance is essential to protect yourself from financial losses if a customer is injured after drinking alcohol at your establishment. But, as we stated above, not all liquor liability policies cover assault and battery.

Assault and battery is the intentional use of force against another person. It can include physical or verbal violence on your premises. In the context of liquor liability, assault and battery can occur when a customer becomes intoxicated and then assaults another customer, employee, or bystander.

While most liquor liability policies do cover property damage and medical expenses, they may not cover the cost of legal fees if you are sued for assault and battery. That’s why it’s important to read your policy carefully to see if assault and battery is included.

If assault and battery is not included in your policy, you may want to add an endorsement. Take time to understand your liquor liability insurance policy. Doing so can help you protect yourself from financial losses in the event of an incident.

Why Assault and Battery Is Not Always Offered as Coverage

Assault and battery is a serious crime, and insurers are understandably reluctant to offer coverage for it. There are a few reasons for this:

- It is difficult to prove the customer’s intoxication caused the assault or battery

- The damages courts award in an assault and battery lawsuit can be very high.

- Insurers worry that businesses will over-serve customers if they don’t have to pay for assault and battery claims.

When rating and underwriting your bar or tavern, carriers want to know a few things. Does your establishment cater to a night crowd? Is it open until 2:00 a.m.? What does your bar offer customers? Do you have a live band? Can patrons play a game of pool? Do you do karaoke night? Is there an alluring dart board on the wall?

This all matters. You need to supply as much information as possible. It leads to an accurate rating and adequate coverage.

Is Assault and Battery Coverage Right For Your Business?

You may feel an assault and battery endorsement isn’t necessary. Say you run a tavern in Pulaski, New York. You’re a stone’s throw from the Salmon River. You serve food. In your view, your establishment is closer to being a restaurant. You sell a lot of appetizers and sandwiches.

Your customers are locals and anglers from across the country. But most patrons order India Pale Ale (IPA), which you sell for $8 apiece. That pushes up your liquor receipts, leaving you at 45 percent. Food makes up the rest. As far as insurance goes, you’re a bar, but the IPAs customers consume don’t lead to midnight brawls.

You feel you can get by without assault and battery coverage. You will have to make a calculated decision based on your establishment.

If you’re ready to buy liquor liability insurance, talk to your insurance agent. Discuss whether assault and battery coverage is right for your business.

Get the Liquor Liability Coverage Your Bar or Tavern Needs

We know running a bar or tavern in Central New York can be a lot of work. You have to worry about serving your customers well, keeping your establishment safe, and complying with all the regulations. But one of the most important things you can do is to protect yourself from the financial risks of serving alcohol.

Liquor liability insurance can help you do that.

It’s also important to work with an experienced insurance agent who can help you find the right policy for your business.

The Horan agency can help you. We work with top-rated insurance companies. They offer competitive rates and comprehensive coverage for bars and taverns.

Liquor liability insurance can be expensive, but it’s worth the peace of mind it can give you. If you’re ever sued as a result of your customer’s intoxication, you’ll be glad you had the coverage.

For a free liquor liability quote and consultation, click the Get a Quote below. One of our insurance specialists will contact you to discuss your options.

And learn about critical employee benefits coverages by reading the following articles:

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: