When Your CNY Business Needs Directors and Officers Liability Insurance

January 3rd, 2024

8 min read

You are a non-profit leader in Central New York. You joined the board to make a difference. But you also took on a lot of risk. You make decisions that can lead to lawsuits. You face legal challenges from various sources.

That’s why you need directors and officers liability insurance (D&O). D&O protects you and the board from lawsuits that allege wrongful acts in your roles. It covers your personal losses and the legal costs of the organization.

Without D&O, you and the board could face serious consequences. You could lose your personal assets and your professional reputation. You could also damage the trust and goodwill of the organization and its supporters.

D&O is not a luxury or a waste. It is a necessity and a priority. It is a smart and affordable investment.

We are Horan, an experienced insurance agency in Central New York. We have been providing insurance solutions for companies and non-profits since 2009. We understand the challenges of organizations like yours. After all, some of us here at Horan are current or past members of non-profit boards.

In this article, we will explain what D&O is and why you need it. We will also share some examples of how D&O can help you in various scenarios and situations. Finally, you’ll learn how to get the best D&O policy for your organization.

Why Non-Profit Boards of Directors Need D&O Insurance

Non-profit boards of directors are often made up of people who have different motivations and backgrounds. Some join a board to network and grow their business. Some join because they care deeply about the cause of the organization. Some join for other reasons.

But no matter why they join, they all have one thing in common: they are responsible for the governance and oversight of the organization. They create policies and appoint executives who carry out those policies. They make decisions that affect the organization’s

- finances,

- operations, and

- reputation.

And sometimes, those decisions can lead to lawsuits.

Lawsuits from employees, donors, members, regulators, creditors, or other parties who claim that the board or its members did something wrong. Wrongful acts such as breach of fiduciary duty, mismanagement, negligence, discrimination, harassment, or fraud.

Even if they have good intentions, volunteer board members might do or plan something that causes harm to someone else, who then sues them. This does not imply that they broke the law, just that their actions had negative effects.

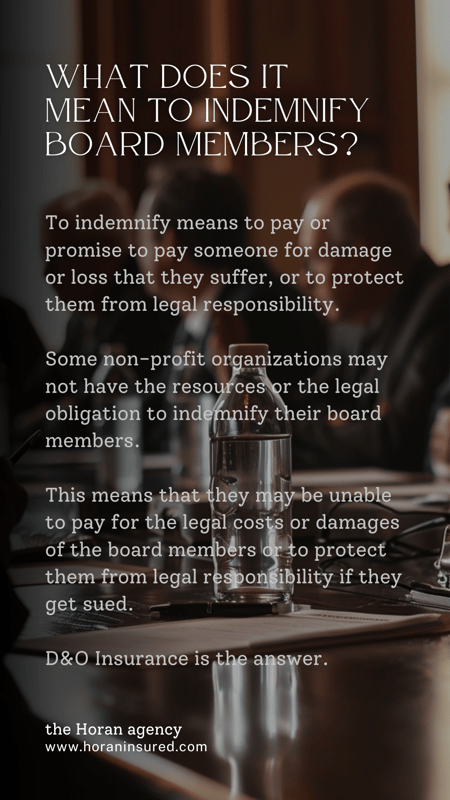

These lawsuits can be costly and time-consuming. They can damage the organization’s reputation and mission. They can also put the personal assets of the board members at risk. Because, unlike for-profit corporations, non-profit organizations may not have the resources or the legal obligation to indemnify their board members.

That is why non-profit boards of directors need D&O insurance. D&O insurance can cover the personal losses of the board members and the legal costs of the organization. It can also help them defend against criminal and regulatory charges. It can give them confidence and security as they serve the organization and its cause.

D&O Insurance Can Save a Non-Profit Board from a Disaster

Imagine this: You are a non-profit board member who organized a charity event for kids. You raised some money and decided to give away bike helmets to promote safety. You thought it was a great idea.

You held the event in a church parking lot on a weekday afternoon. You expected a moderate turnout, but you were surprised by how many people showed up. The event was a huge success. You had a lot of media attention and positive feedback.

But then, something terrible happened. As you were handing out the bike helmets, the line of kids and their bikes got too long. One of the kids at the end of the line was sticking out into the street. A car drove by and hit the kid and the bike. The kid was injured and had to be taken to the hospital.

The next thing you know, you’re facing a lawsuit from the kid’s parents. They accuse you and the board of negligence, recklessness, and breach of duty. They claim that you failed to provide adequate security, supervision, and traffic control. They demand a large sum of money for

- medical bills,

- pain and suffering, and

- emotional distress.

You are shocked and devastated. You didn’t mean to harm anyone. You just wanted to do something good for the community.

How could this happen?

This is where D&O insurance can save you. D&O insurance can cover the legal expenses of the board and the individual board members. It can also cover the settlement or judgment if you lose the case. It can help you avoid personal bankruptcy and protect the reputation and assets of the organization.

Without D&O insurance, you and the board would have to pay for everything out of your own pockets. You could lose your savings, your home, and your future. You could also damage the trust and goodwill of the organization and its supporters.

D&O insurance can make a difference between a minor setback and a major catastrophe. It can help you focus on your mission and your vision instead of worrying about potential lawsuits.

D&O Insurance Can Protect a Non-Profit Board from Employment Issues

D&O Insurance Can Protect a Non-Profit Board from Employment Issues

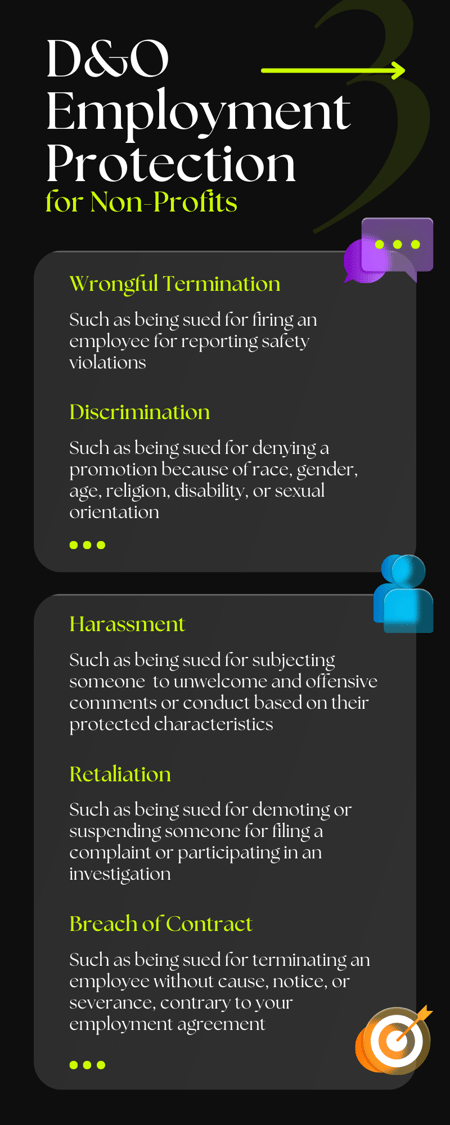

To be sure you're getting the most from your D&O insurance policy, you’ll want to add coverage for Employment Practices Liability. This is known as an EPL rider. This critical coverage extends beyond paid staff. It protects volunteers and fellow board members.

The EPL rider is beneficial since another common source of lawsuits against non-profit boards stems from employment issues. These can include

- wrongful termination,

- discrimination,

- harassment,

- retaliation, or

- breach of contract.

These issues can arise from the board’s relationship with the staff, volunteers, or contractors of the organization.

Here is an example of how employment issues can affect a non-profit board:

Suppose you’re a board member of a non-profit organization in Liverpool. You have one employee, the executive director, Jason. Jason does the tasks that the board assigns. The board hires and supervises Jason.

But Jason doesn’t do well. The board decides to fire him.

Jason sues the board for wrongful termination. He says that the board fired him unfairly and illegally. Jason also says that the board discriminated against him.

The board is shocked and angry. The board thinks that it had the right to fire its executive director. The board thinks that it followed the rules and policies. The board also thinks that it treated Jason well.

But the board still has to face the lawsuit. The lawsuit costs a lot of money and stress. It takes a lot of time and energy away from the board’s work and mission. It also hurts the board’s reputation and credibility in the community.

That’s why the board needs D&O insurance.

D&O insurance pays for the legal costs and damages of the board and the board members. It also pays for hiring a new executive director. It helps the board solve the employment problem and move on with its goals.

Without D&O insurance, the board has to pay for everything itself. The board could lose its personal assets and professional reputation. The board could also lose the trust and support of its members and partners.

D&O insurance protects the board from the risks and liabilities of being a non-profit employer. It helps the board manage its staff and culture. And it helps the board attract and keep good staff, volunteers, and contractors.

D&O Insurance Can Cover a Wide Range of Scenarios for Non-Profit Boards

Non-profit boards are involved in many activities that can expose them to legal challenges. Activities such as hiring and firing staff, organizing and hosting events, raising and spending funds, communicating and collaborating with stakeholders, and complying and reporting with regulations.

Here is an example of how these activities can create problems for a non-profit board:

Say you’re a board member of a local travel baseball organization. You create teams, find practice facilities, communicate with parents, and sign up for tournaments and other events. You do this to promote youth sports and community spirit.

But you also face many risks and liabilities. Risks such as

- injuries,

- accidents,

- property damage, or

- theft.

And liabilities such as

- contracts,

- permits,

- waivers, or

- insurance.

You have to be careful with what you recommend or arrange for your events. You have to follow the appropriate laws and procedures for New York State and your organization.

But sometimes, things can go wrong. Things such as

- a player getting hurt during a practice,

- a parent suing you for not vetting coaches properly,

- a facility owner accusing you of damage or misuse, or

- a regulator auditing you for tax compliance.

These things can result in lawsuits, fines, penalties, or sanctions.

D&O insurance is vital for these reasons. It can cover a wide range of scenarios and situations that can affect non-profit boards. It can cover the legal costs and damages of the board and the individual board members. It can also cover the costs of restoring the reputation and goodwill of the organization.

Without D&O insurance, you would have to deal with the consequences yourselves. You could lose your personal assets and our professional credibility. You could also lose the trust and support of your players, parents, partners, and donors.

D&O insurance can help you avoid or minimize the impact of these scenarios. It can help you manage your risks and liabilities effectively and efficiently. It can help you continue your activities and achieve your objectives.

D&O Insurance Can Be a Smart and Affordable Investment for Non-Profit Boards

As a non-profit board in New York State, you shouldn’t think that you can skip D&O insurance. You shouldn’t depend on waivers, policies, or goodwill to shield you from lawsuits.

D&O insurance can save you from a lot of trouble and loss.

Here is why non-profit boards should invest in D&O insurance:

- D&O insurance is not expensive. It is reasonable compared to the potential costs and damages of a lawsuit. For $1,000,000 in coverage, the average annual premium is between $800 and $2,000. That’s a small price to pay for a large amount of protection.

- D&O insurance is essential. It covers D&O liability. D&O liability covers claims based on wrongful acts in the roles of directors or officers, such as breach of fiduciary duty, mismanagement, negligence, discrimination, harassment, or fraud. These types of liability can arise from the board’s activities and decisions.

- D&O insurance is comprehensive. It covers many scenarios and situations that can affect non-profit boards. Scenarios such as events, contracts, fundraising, reporting, or compliance. Situations such as claims, lawsuits, or investigations.

- D&O insurance is safe. It covers the legal costs and damages of the board and the individual board members. It helps the board resolve employment disputes and move on with their goals.

But know that D&O insurance is not unlimited. It doesn’t cover everything. It doesn’t cover intentional or fraudulent acts, bodily injury or property damage, or claims by the organization itself against the board.

It has its benefits and limitations, and it should be understood and used wisely.

Directors and Officers Liability Insurance: What is it and Who Needs it?

Directors and officers liability insurance (D&O) protects people who serve as directors or officers of a company or organization. They may face legal action for alleged wrongful acts in their roles. D&O covers their personal losses and the legal costs of the company or organization.

But adding the Employment Practices Liability (EPL) coverage as an endorsement to the D&O policy adds further protection, as we stated earlier. Lawsuits arising from hirings, firings, or harassment are covered with its addition.

Here is an example of how D&O and the EPL rider work:

You’re the chief operating officer of a Central Square company. You don’t have a board of directors who appointed you. You got hired like most people. That is your role. There is no group of people above you who said, we appoint you.

But, one day,

- a former employee decides to sue you for fraud, retaliation, and defamation over a firing?

- the company goes bankrupt and can’t pay for your defense? Or,

- the company fires you after going public and giving up control to a board of directors?

That’s the benefit of D&O/EPL insurance. It can cover your personal losses and the legal fees of the company or organization. It can also help you defend yourself against criminal and regulatory charges. It can give you security as a leader of the company or organization.

How to Get Started with the Right D&O Insurance

As we discussed, D&O insurance is a type of insurance that protects you and the board from lawsuits that allege wrongful acts in your roles. It covers your personal losses and the legal costs of the organization.

You may think that you don’t need D&O insurance. You may think that you have enough money and goodwill to avoid lawsuits. You may think that you can use your funds for other purposes that are more aligned with your mission and vision.

But that’s not the case.

If you overlook this advice, you’re taking a huge risk. You’re exposing yourself and your board to legal challenges that can ruin your personal and professional lives. You’re also jeopardizing the reputation and mission of your organization and its supporters.

You’ll be gambling with your future and your cause.

We understand that you joined the board to make a difference. We understand that you care deeply about the cause of the organization. You simply want to serve your community.

To that end, we want to help you.

Horan has years of experience guiding companies and non-profits to tailored D&O policies. We can help you find the right D&O policy for your organization.

To get started on the path to a D&O made for you, click the Get a Quote button below. An experienced Horan insurance specialist will contact you to discuss your policy options.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.