Do I Really Need Renters Insurance in Central New York?

July 31st, 2024

5 min read

As a renter in Central New York, you're juggling numerous responsibilities. The last thing you want is to make an uninformed decision about insurance. You might worry that you'll end up with a policy that doesn't fit your needs or budget. It's not just about protecting your belongings—it's about finding the right coverage without overpaying.

At the Horan insurance agency, we understand these concerns. We're not tied to a single carrier, which means we can offer you a range of options tailored to your specific situation. Our deep knowledge of the Central New York rental market, combined with our access to multiple insurance providers, puts us in a unique position to guide you.

This article will break down the essentials of renters insurance, explaining what it covers and why it matters for Central New York residents. We'll explore how the right policy can give you greater composure in your daily life, whether you're renting in Syracuse, Auburn, or any of the surrounding communities. Let's dive in and demystify renters insurance together.

Why Central New York Renters Should Consider Insurance Protection

You're a renter in Central New York, perhaps in Syracuse, Utica, or one of the charming villages like Fayetteville or Baldwinsville. You're already juggling bills for rent, utilities, and maybe student loans. The last thing you want is another monthly expense.

But here's the thing: renters insurance isn't just another bill—it's a crucial investment that could result in greater composure.

Central New York's weather can be unpredictable. From heavy lake-effect snow in the winter to the occasional summer thunderstorm, your belongings face various risks. And that's not even considering other potential issues like theft or accidents.

Renters insurance provides a safety net that can save you from significant out-of-pocket expenses if the unexpected happens.

What Renters Insurance Covers: Protecting Your Central New York Lifestyle

Let's start with the basics. Renters insurance protects your belongings in case of fire, theft, or other covered losses.

Imagine you're living in an apartment complex in downtown Syracuse. Your landlord's insurance only covers the building structure, not what's inside your unit. That means your furniture, clothes, electronics, and even your kitchen utensils are your responsibility.

Without insurance, you'd have to replace everything out of pocket if disaster strikes. With a policy, you'll only pay the deductible you choose when you set up your coverage. These deductibles typically range from $100 to $1,000.

Let's say a pipe bursts in your Cortland apartment during a particularly harsh winter, damaging your furniture and electronics. Without renters coverage, you'd be on the hook for replacing everything. But with a policy, you'd only pay your chosen deductible, and the insurance would cover the rest, up to your policy limit.

Protection That Follows You Beyond Your Central New York Home

Your renters insurance doesn't stop working when you leave your apartment or house. It travels with you, providing protection even when you're out and about in Central New York or beyond.

Picture this: You're enjoying a summer day at Green Lakes State Park. You return to your car to find someone's broken in and stolen your backpack containing your laptop and camera. Your auto insurance won't cover those personal items. But guess what? Your renters policy will.

This protection extends to various scenarios. Maybe you're a student at Syracuse University, and your bike gets stolen from outside the library. Or perhaps you're on a business trip to New York City, and your suitcase disappears at the hotel. In all these cases, your Central New York renters insurance has got you covered.

In fact, 55% of Americans have renters insurance for this very reason. They know they're protected both at home and away, giving them the freedom to enjoy life without constant worry about their belongings.

Beyond Belongings: Liability Protection for CNY Renters

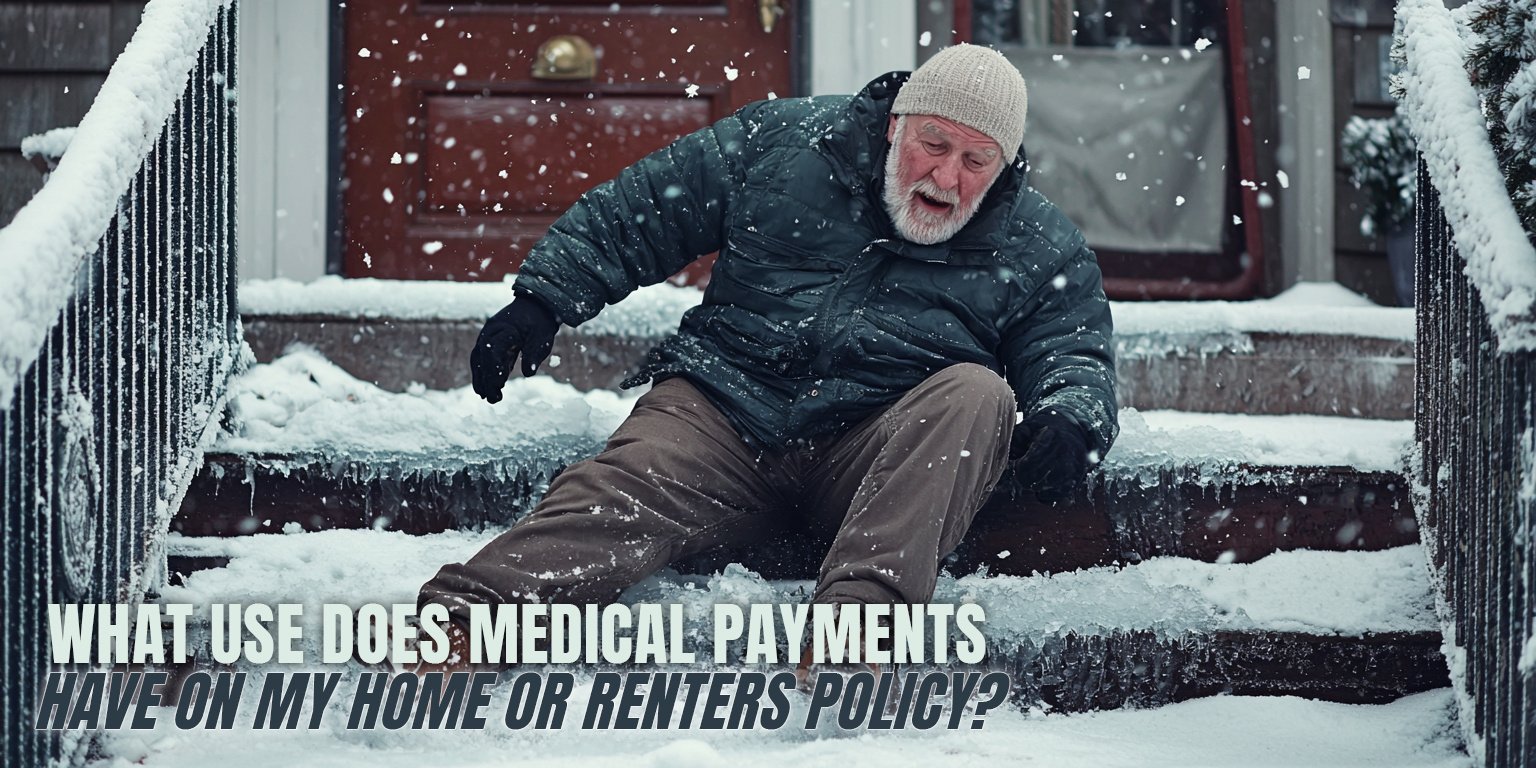

Renters insurance isn't just about your stuff. It also includes liability coverage, which can protect you if someone gets injured in your home. This coverage can range from $100,000 to $1 million, depending on your policy.

Imagine you're hosting a Super Bowl party in your Liverpool apartment. A guest slips on a spilled drink and breaks their arm. Your liability coverage could help pay for their medical bills and protect you if they decide to sue.

Imagine you're hosting a Super Bowl party in your Liverpool apartment. A guest slips on a spilled drink and breaks their arm. Your liability coverage could help pay for their medical bills and protect you if they decide to sue.

There's also medical payments coverage, which can help if someone has a minor injury on your property. This coverage usually ranges from $1,000 to $5,000. It's perfect for those smaller incidents that don't result in lawsuits but still need attention.

For pet owners in pet-friendly apartments in Camillus or Cicero, this coverage is particularly important. If your dog bites a delivery person, a visitor, or another resident, your renters policy could help cover the medical expenses and any potential legal costs.

When Regional CNY Weather Forces You Out of Home

Central New York winters can be brutal. What if a severe storm damages your rental to the point it's uninhabitable? That's where Loss of Use Coverage comes in. It can help pay for temporary housing and additional living expenses while your place is being repaired.

For instance, if an ice storm damages the roof of your Baldwinsville home, making it unsafe to live there, this coverage could help pay for a hotel stay and extra meal costs until you can return home. This ensures you're not out of pocket for these unexpected expenses on top of dealing with the stress of being displaced.

Customizing Your Coverage for Central New York Living

You can tailor your renters coverage to fit your specific Central New York lifestyle. Do you own valuable artwork purchased at the Syracuse Arts & Crafts Festival? You can add extra coverage for that.

Are you concerned about potential sewer backups, which can be an issue in older buildings in downtown Syracuse? There's coverage available for that too.

In many ways, a well-designed renters policy can offer protection similar to a homeowner's policy—minus the structure coverage, of course. This means you can enjoy many of the same protections as homeowners, even if you're renting an apartment in Armory Square or a house in DeWitt.

Ready for a deeper dive into the world of renters coverage? Read our comprehensive renters insurance guide.

The Cost-Benefit Analysis for Central New York Renters

Here's some good news: renters insurance is often more affordable than you might think. In New York, the average cost is about $150 per year, give or take—that's less than $13 per month. That's probably less than what you spend on coffee each month at your favorite Syracuse cafe.

Even better? If you bundle your renters coverage with your auto insurance from the same carrier, you might qualify for a multi-policy discount. This discount can make your renters policy feel like it's practically free. It's a smart financial move, especially if you're already paying for car insurance to navigate Central New York's roads.

A Word of Caution for Roommates

While renters insurance offers broad protection, it won't cover everything. For instance, it doesn't extend to your roommate's belongings. If you're sharing an apartment in Eastwood or a house near Le Moyne College with someone who's not a family member, they'll need their own policy to protect their stuff.

This is particularly important for college students or young professionals in shared housing situations. Each roommate should have their own policy to ensure all belongings are adequately protected.

Is a Renters Policy Right for You in Central New York?

Given the extensive coverage and affordable price point, a renters policy is a wise choice for most Central New York renters. It provides a safety net that can save you from significant out-of-pocket expenses if the unexpected happens.

It's not just about replacing your belongings—it's about protecting yourself from potential liability and ensuring you have a place to stay if disaster strikes. When you weigh the small monthly cost against the potential benefits, renters coverage becomes less of a “nice to have” and more of a “need to have.”

Whether you're renting a studio apartment in downtown Syracuse, a townhouse in Manlius, or a cottage in Skaneateles, renters insurance offers composure and needed protection. It's an essential part of responsible renting in Central New York, allowing you to fully enjoy all that this beautiful region has to offer without worrying about the “what ifs” of renting.

Secure Your Central New York Rental with the Right Coverage

Renters insurance isn't just another policy—it's a shield for your lifestyle in Central New York. We've covered why it matters, what it protects, and how it can give you composure and security. Without it, you risk facing unexpected costs and stress that could disrupt your life.

At Horan, we strive to be your advocate in the insurance landscape. Our independence allows us to offer diverse options tailored to your situation. We don't just sell policies, we provide solutions based on our deep understanding of Central New York's rental market and our access to multiple carriers.

Don't leave your belongings and future to chance. Take control of your rental experience today. Click the Get a Quote button below to start a conversation with us. Let's work together to find the renters insurance that fits your Central New York life.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: