Differences Between Renters Insurance and Landlord Insurance in CNY

December 4th, 2023

3 min read

Are you renting a property in Central New York? If so, you may have some questions about insurance. You may wonder what kind of insurance you need to protect yourself and your belongings.

Will a landlord’s policy cover you, or do you need a personal renters insurance policy?

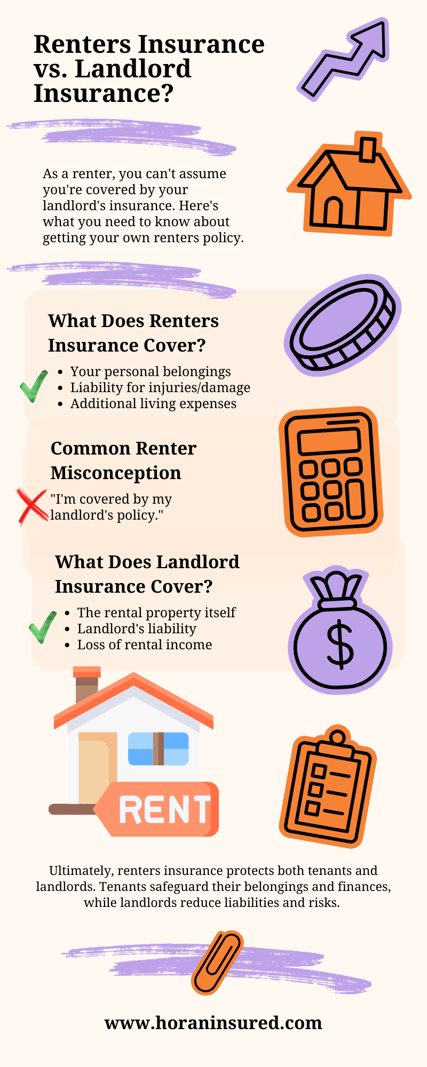

Renters insurance and landlord insurance are two different types of policies that cover different risks and liabilities. If you don’t have renters insurance, you could expose yourself to huge financial losses and legal troubles.

That’s why we at Horan want to help you understand the differences between renters insurance and landlord insurance. And it’s why you should get renters insurance if you’re a tenant.

We’re a local insurance agency in Baldwinsville. We have been serving Central New York renters like you since 2009. We have the experience and expertise to help you find the best insurance solution for your situation.

In this article, we will explain what renters insurance and landlord insurance are and what they cover. We will also bust some common myths and misconceptions that renters have about landlord policies.

By the end of this article, you will have a clear idea about the differences between the two policies.

Renters Insurance vs. Landlord Insurance: Which One Will Cover Me as a Tenant?

If you’re renting a property in Central New York, you may wonder what kind of insurance you need to protect yourself and your belongings. You may also assume that your landlord’s insurance will cover you in case of a

- fire,

- theft, or

- lawsuit.

It doesn’t.

Here are some of the main differences renters insurance and landlord insurance and why you should consider getting a renters policy if you are a tenant.

What is Renters Insurance?

What is Renters Insurance?

Renters insurance is a policy that covers your personal property, liability, and additional living expenses if you’re renting a home, apartment, or condo. It protects you from losses caused by unexpected perils such as

- fire,

- smoke,

- lightning,

- windstorm,

- hail,

- explosion,

- vandalism,

- theft, and

- water damage (excluding floods).

It also covers your legal responsibility if you accidentally injure someone or damage their property. Additionally, it pays for your extra costs if you have to move out temporarily due to a covered loss. These are good reasons for purchasing renters insurance as a tenant.

What is Landlord Insurance?

Landlord insurance is a policy that covers the property, liability, and income of the owner of a rental property. It protects the landlord from losses caused by damage to the building, such as

- fire,

- wind,

- hail,

- vandalism, or

- tenant negligence.

It also covers the landlord’s legal liability if someone gets hurt on the property or sues the landlord for negligence. Furthermore, it covers the loss of rental income if the property becomes uninhabitable due to a covered loss.

What are the Misconceptions Renters Have About Landlord Policies?

Many renters mistakenly believe they don’t need renters insurance because their landlord’s insurance will cover them. This is a myth.

The landlord’s insurance only covers the landlord’s property and liability, not the tenant’s. This means that if your belongings are stolen or damaged by a fire, you will have to pay for the replacement or repair out of your own pocket.

And if you cause damage to the property or injure someone, you’ll be liable for the costs and legal fees. The landlord’s insurance will not help you in these situations.

How Does Renters Insurance Benefit Both Tenants and Landlords?

Renters insurance is not only beneficial for tenants but also for landlords.

Benefits of Renters Insurance for Tenants

As a tenant with renters insurance, you can protect yourself from financial losses and lawsuits that could otherwise ruin your life. You can also avoid conflicts with your landlord over who is responsible for the damage or injury.

Renters insurance can also save you money in the long run, as it is usually cheaper than paying for the losses out of pocket or facing a lawsuit.

Benefits of Renters Insurance for Landlords

Landlords can also benefit from renters insurance by reducing their own risks and liabilities. By requiring their tenants to have renters insurance, landlords can ensure their tenants have a first line of defense in case of a loss or lawsuit.

This way, the landlord’s insurance will not be the first one to pay, which could lower their premiums and deductibles. Landlords can also avoid disputes with their tenants over who should pay for the damage or injury, which could improve their relationship and retention.

What is Our Recommendation for Renters and Landlords in CNY?

Our recommendation for renters and landlords in CNY is simple: get insurance that’s designed for you.

If you’re a renter, you should get renters insurance to protect your personal property, liability, and additional living expenses.

It’s a small price to pay for great reassurance that you’re properly covered.

If you are a landlord, you should get landlord insurance to protect your property, liability, and income. You should also require your tenants to get renters insurance, as it will benefit both of you in the long run.

We understand that renting or owning a property in CNY can be challenging, especially in times of uncertainty and crisis. That’s why we want to help you find the best insurance solution for your situation. Whether you are a renter or a landlord, you deserve to have security for your belongings, your finances, and your future.

We’re here to guide you through the process and answer any questions you may have along the way. We want you to feel confident and comfortable with your insurance choice.

If you need help finding the best renters insurance or landlord insurance in CNY, click the Get a Quote button below. We are a local, independent insurance agency that can help you compare quotes and coverage from multiple carriers.

To learn more about these policies, read our companion renters insurance and landlord insurance articles.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: