Insurance Claims: Frequency vs. Severity

January 9th, 2026

3 min read

When it comes to understanding insurance coverage, making informed decisions can feel overwhelming. Many people find themselves concerned about purchasing a policy that doesn't align with their situation or struggling to understand the complexities of how insurance companies evaluate risk and set premiums.

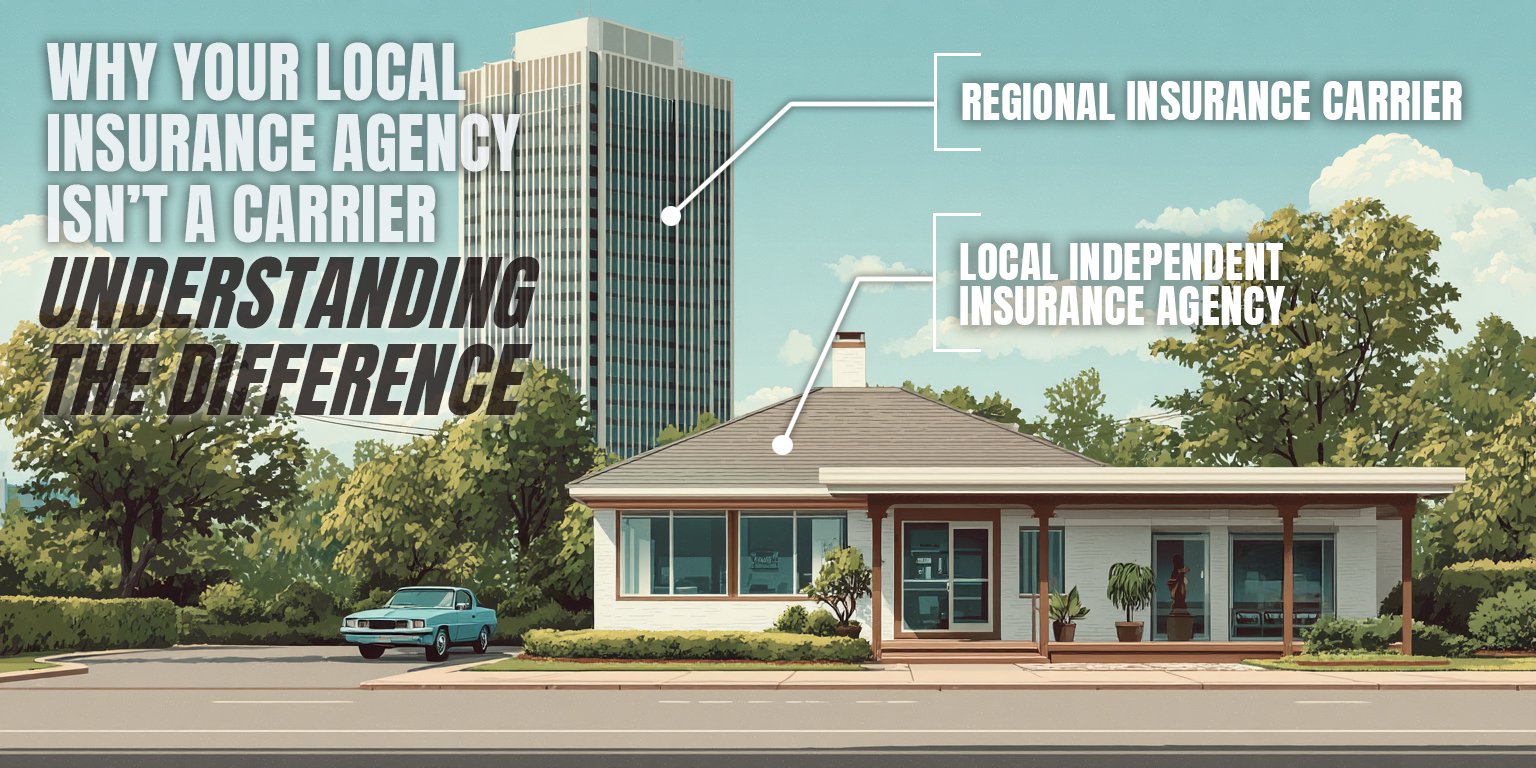

At the Horan insurance agency in Central New York, we work with multiple carriers to help clients understand how insurance companies view claims history. Our experience gives us insight into factors that affect coverage options and pricing.

In this article, we'll explore a key aspect of insurance that often creates confusion: the impact of claim frequency versus severity on your policy.

By reading to the end, you'll have a better handle on the differences between filing multiple small claims versus one large claim and how insurance companies evaluate each scenario. Let's explore how insurers assess claims to help you make informed decisions about your coverage.

How Insurance Companies View Risk

Insurance companies assess risk based on two key factors:

- claim frequency and

- claim severity.

Frequency refers to how often claims are filed, while severity refers to the financial impact of each claim.

Minimizing both frequency and severity generally works in a policyholder's favor. Infrequent, low-cost claims tend to be viewed most favorably from an insurer's perspective. High-severity claims, while costly, may be considered acceptable if they occur rarely. However, a high frequency of claims, even if they're low in severity, can lead to higher premiums or difficulty obtaining coverage.

Working with an insurance agent to review claim history and identify potential risk areas can be valuable for maintaining a strong risk profile and helping to maintain access to competitive rates and coverage options.

The Unwritten Rule of Insurance

A high frequency of small insurance claims can have a longer-lasting negative impact than a single high-severity one. It's an unwritten rule in the insurance industry: the fewer claims, the higher the likelihood of having the policy renewed. It can be challenging to square this philosophy with the mindset of “That's what insurance is for!”

A high frequency of small insurance claims can have a longer-lasting negative impact than a single high-severity one. It's an unwritten rule in the insurance industry: the fewer claims, the higher the likelihood of having the policy renewed. It can be challenging to square this philosophy with the mindset of “That's what insurance is for!”

There's nothing wrong with expecting that a covered loss will result in a paid claim. The general point of an insurance policy is to make the policyholder whole again.

If a fire breaks out in a home in Lysander, let’s say, the loss will be claimed on the policyholder's homeowners insurance. And if a car gets mangled in an accident on I-690, that will be called in for the auto policy too. Of course, those are serious examples, but what about the less serious ones?

This refers to the claims that don't amount to much more than the deductible. Over time, those filed claims could cost you more than the expense of the losses themselves. When it comes to insurance, the frequency of claims matters just as much as their severity, and understanding this unwritten rule is key to maintaining continuous insurance and working toward coverage that fits your situation.

The 5-Year Review Period for Most Carriers

On average, insurance carriers review the last 5 years of claims history when determining what to charge or if they even want to offer a policy. The more claims filed over those five years will significantly impact the quoted premium. The dollar amounts paid on the past claims, while noteworthy, are not what carries the most weight.

A house fire is catastrophic and usually leads to hundreds of thousands of dollars paid in insurance claims. However, if that was the only claim in 5 years, a carrier will usually not decline the insurance application.

A house fire is catastrophic and usually leads to hundreds of thousands of dollars paid in insurance claims. However, if that was the only claim in 5 years, a carrier will usually not decline the insurance application.

The belief is that the policyholder suffered an isolated and unordinary experience. While the payout was expensive, the likelihood of another soon after is slim.

On the other hand, a series of smaller dollar claims can send a red flag to the insurer that the risk is too high and that it's only a matter of time before the big claim comes along. That leads to the rejection of the insurance application.

The Consequences of Frequent Claims

Once insurers begin to decline an application, finding comparable coverage becomes challenging. That’s because the only carriers left can be ones that might be less desirable and offer fewer coverage options.

While that might not seem like a big deal, they'll often charge more than the leading companies who are now turning you down.

Managing Your Risk Profile

To maintain a favorable risk profile with insurance companies, these strategies may help, whether you own a business or have personal coverage:

- Implement robust safety protocols and training to minimize the occurrence of claims

- Set aside a budget to cover minor losses out-of-pocket, rather than filing a claim

- Work closely with your insurance agent to identify and address potential risk areas

- Regularly review and update your risk management plan to adapt to changing circumstances

By proactively managing risk and being strategic about when to file claims, policyholders can help keep premiums in check and maintain access to competitive coverage options.

We Can Help You Explore Coverage Options

Understanding how insurance companies evaluate claims can feel complex, but you don't have to figure it out alone.

At the Horan insurance agency, we work to be a resource for Central New York clients, providing information and insights to help with insurance decisions. Our experience working with multiple carriers gives us a perspective on how to approach risk management considerations.

The strategies we've covered—from safety protocols to strategic claims filing—can help you maintain a favorable position with insurers and work toward competitive rates and coverage that fits your situation. Composure and confidence come from understanding how your choices affect your insurance options.

On the other hand, overlooking these principles can lead to higher premiums, limited coverage options, and unnecessary stress.

Let us help you understand your insurance options. Click the Get a Quote button below to start a conversation with our knowledgeable team and learn how we can help you explore coverage that fits your situation.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: