How Do I Insure Upgrades to My Leased Business Space?

April 17th, 2024

5 min read

As a savvy business owner, you seized the perfect rental space, but it needed your custom touch. You invested heavily to improve the space to fit your vision. However, an unsettling question looms: what if a disaster strikes. Imagine the frustration of pouring your heart and soul into creating your dream workspace, only to have a fire or other peril destroy your improvements in an instant.

At Horan, we understand the complexities of protecting enhancements made to leased commercial properties in Central New York. Since 2009, we’ve used our expertise to help business owners like you avoid gaps that could leave them financially exposed if tragedy destroyed the workspace improvements integral to their operations.

This article provides a comprehensive strategy to insure your financial investments properly through business personal property coverage.

We’ll unveil insider tips for maximizing protection on the workspace upgrades you’ve poured your capital into. Gain confidence knowing your remodeled rental space has rock-solid insurance, allowing you to drive your business forward without worries holding you back.

Properly Insuring Improvements to Your Rented Business Space

Say you’re a growing entrepreneur leasing a space for your business. The good news? Your landlord shoulders the responsibility for the building itself, including insurance for the physical structure. This frees you from that burden, allowing you to focus on what truly matters—running your operation.

But what if the space you scored has potential, like the lighting feels dull and the flooring needs work? This is where your entrepreneurial spirit shines through. You approach your landlord with ideas to modernize. That means new light fixtures, sleek flooring, maybe even some snazzy window blinds.

The landlord is happy to oblige. After all, these upgrades enhance their property too.

Fast forward, and you’ve sunk a significant amount of money into improvements. It could be thousands of dollars’ worth of features that elevate your workspace but technically aren’t yours to take with you. This is where the question of insurance comes in.

You’ve poured your heart (and wallet) into making this rented space feel like your own, but what happens if something unexpected damages your hard work?

Maximizing Business Personal Property Coverage for Leased Spaces

Maximizing Business Personal Property Coverage for Leased Spaces

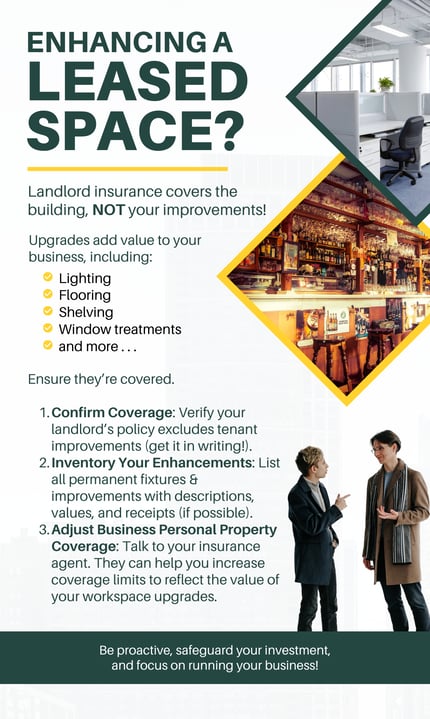

As a business owner leasing a space, you benefit from the landlord’s insurance coverage for the building itself. However, this doesn’t extend to the improvements and fixtures you’ve invested in to personalize and enhance your workspace.

Upgraded lighting, flooring, shelving, and window treatments contribute to the functionality and value of your business environment.

Here’s how to ensure these improvements are adequately covered:

- Confirm Coverage Responsibilities: Verify with your landlord, in writing if possible, that their insurance policy covers the building structure but excludes any tenant-made improvements.

- Identify Your Enhancements: Create a detailed inventory of all permanent fixtures and improvements you’ve installed. This list should include descriptions, estimated values, and ideally, receipts for reference.

- Adjust Your Business Personal Property Coverage: Contact your insurance agent and discuss the value of your improvements. They can help you determine if your current business personal property coverage limit is sufficient. If not, they’ll guide you through increasing the limit to reflect the total value of your business assets within the leased space.

By proactively addressing your insurance needs, you can safeguard the financial investment you’ve made in your workspace. Regularly reviewing and updating your coverage ensures you’re prepared for unforeseen circumstances and can focus on running your business with composure.

Beyond Light Fixtures: Protecting Unique Business Enhancements

While light fixtures and flooring are common examples, the category of business personal property for leased spaces can extend further. Here are some additional considerations:

- Attached Signage: Signage permanently affixed to the building can be a gray area. While it might seem like part of the structure, it’s actually considered your business personal property. Double-check your policy wording to ensure signage isn’t excluded from your business personal property coverage.

- Tenant-Built Structures: This applies to more substantial additions you might make within the leased space. Imagine you’re a restaurant that constructs a custom bar—the cabinetry, mirrors, shelving, the entire setup—even though it’s physically attached to the building, it counts as business personal property. In case of a fire, you’d need coverage to replace it.

- Office Modifications: Similar logic applies to modifications made by other businesses. A doctor’s office that builds a reception area with partitions and glass walls—those are business personal property that require coverage under your policy.

So, carefully assess any permanent additions or alterations you make within the leased space. These valuable enhancements likely fall under business personal property and require appropriate insurance coverage. Don’t wait for an unexpected event to discover your policy has gaps.

By proactively discussing these additions with your agent, you can ensure your business is fully protected.

Know too that the classification of business personal property encompasses more than just furniture and equipment. Certain attached additions within your leased space require special consideration.

How to Insure Permanent Attachments with Business Personal Property

We’ve established that business personal property goes beyond the typical office furniture and equipment. But what about those seemingly permanent additions you make to the leased space?

Here’s where things can get a little tricky.

Imagine the restaurant owner who builds a custom bar—a masterpiece of cabinetry, mirrors, and shelving. While it’s physically attached to the building, it’s considered business personal property because it wasn’t part of the original structure. The restaurant owner would need coverage to replace it in case of a fire.

But things can get trickier with very permanent changes. Let’s say the bar is built directly onto the existing floor. In this case, the actual flooring itself might still be considered part of the building (and therefore covered by the landlord’s insurance). But the custom cabinetry, shelving, and other elements attached to the floor would likely be your business personal property.

The Importance of Clear Communication with Your Landlord

The key is to have clear communication with your landlord. If they confirm their insurance covers the building structure but excludes tenant-made improvements, then you’ll need to factor those improvements into your business personal property coverage.

For example, the custom bar might be anchored to the floor with heavy-duty bolts. But because the landlord didn’t include the bar’s value when insuring the building, they likely wouldn’t file a claim if the bar itself was damaged. In this scenario, the financial responsibility falls on the restaurant owner.

Lease Nuances and Potential Exceptions

There’s a possibility your lease might have specific language regarding tenant-made permanent fixtures. If the lease states these fixtures become the property of the landlord, there could be some gray areas concerning insurance coverage.

The Financial Impact: Increased Business Personal Property Coverage Leads to Increased Value

While insuring business personal property might be slightly more expensive than adding it to the building’s coverage, it’s typically a much more affordable option. The cost of insuring a custom bar pales in comparison to the cost of owning, financing, and fully insuring an entire building.

In short, clear communication and a well-defined insurance policy will prevent confusion and financial burdens in case of unexpected events.

Safeguard Improvements to Your Leased Property with the Right CNY Business Coverage

Enhancing a rented workspace takes vision, dedication, and investment on your part as a business owner. You’ve transformed a blank canvas into an environment tailored to drive your company’s success.

But without proper insurance, an unexpected event could decimate those costly improvements, jeopardizing the very workspace that powers your daily operations.

We covered maximizing business personal property coverage to fully protect permanent fixtures, attached signage, custom buildouts, and renovations you’ve funded within your leased space. By confirming responsibilities with your landlord, meticulously valuing additions, and adjusting coverage limits appropriately, you circumvent dire financial losses.

Don’t overlook this crucial step. A disaster could force you to pay for improvements out of pocket, jeopardizing your business capital.

Remodeling your leased space ignites your entrepreneurial spirit. But what if a disaster strikes? Proper coverage ensures your workspace is protected. Focus on growing your venture, not worrying about unforeseen events.

We can help you secure comprehensive commercial tenant improvement coverage. Click the Get a Quote button below to connect with a Horan advisor who will develop an insurance solution specific to your situation.

Now learn the difference between commercial property insurance and business personal property insurance.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: