Do I Need Off-Road Vehicle Insurance if I Already Have a Home or Auto Policy?

January 12th, 2024

3 min read

Do you love riding off-road vehicles? Do you have a dirt bike, an ATV, a UTV, or a snowmobile? If you do, you know the thrills and risks they bring. You could crash, damage your vehicle, or injure someone else. That’s why you need off-road vehicle insurance. It’s essential.

You may think that your auto or home policy covers your off-road vehicle. But that’s not true. Those policies are not designed for off-road vehicles. They have many gaps and limitations. They may not cover you at all if you take your vehicle off your property. And they won’t cover your vehicle if you damage it or if someone steals it.

However, not all policies are equal. You need a policy that covers the type of vehicle you have and the way you use it.

That’s where we come in. We are Horan, the off-road vehicle insurance experts in Central New York. We’ve been helping off-road vehicle owners like you since 2009.

In this article, we will explain why you need off-road vehicle insurance and what kind of coverage to get.

Why Your Home or Auto Policy Won’t Cover Your Off-Road Vehicle

Do I need off-road vehicle insurance if I already have an auto policy? The answer is yes. Your home policy may cover low-powered vehicles on your property.

For example, a UTV that you use to move brush around your land. But this only covers your liability. And it may not apply if you take your vehicle off your property. This requires a separate policy for your off-road vehicle.

It’s affordable and it protects you from more risks.

The Dangers of Riding Off-Road Vehicles Without Proper Coverage

Riding off-road vehicles can be dangerous. You or someone else could get hurt or killed. If it’s you, your insurance won’t matter. You can’t be liable to yourself. But if someone else gets injured or their property gets damaged, you’re liable. That’s where off-road vehicle insurance matters most

You can’t rely on your home policy. It may have some language that covers you, but it’s not comprehensive. It’s not designed for off-road vehicles. A policy that’s designed for off-road vehicles will have fewer gaps and more protection.

In Central New York, where places like the Tug Hill Plateau boast miles of snowmobile trails and hidden ATV tracks winding through dense forests, off-roading thrills meet unique challenges. Unlike other regions, our harsh winters and rugged terrain demand specialized coverage.

Don’t let your standard auto insurance sputter out on the icy slopes of Tug Hill, exposing you to financial risks. Liability laws here are stricter, and unexpected encounters with wildlife are more common. A fender bender or a runaway snowmobile can turn your Central New York adventure into a legal nightmare.

Get the specialized off-road vehicle insurance you need to conquer Central New York’s trails with confidence. Contact Horan for a quote!

Protect Your Vehicle and Yourself with Comp and Collision Coverage

Comprehensive and collision coverage protect your liability and your vehicle. Comprehensive coverage pays for damage to your off-road vehicle from things like fire, theft, or weather. Collision coverage pays for damage from hitting another vehicle or object.

Without these coverages, if you damage your vehicle, your home policy won’t cover it. It’s not a covered peril. Your off-road vehicle will be like a toy that you crashed.

If you accidentally crash someone’s personal property, you have no coverage. Off-road vehicles can be pricey. You want to protect your investment. Comp and collision coverage takes care of that. This also includes theft coverage.

Your home policy may cover some theft, but not much. And it usually excludes motor vehicles. We’re talking tractors, ride-on lawnmowers, and golf carts. Those are not off-road vehicles anyway.

To learn more about off-road vehicle coverage, including comp and collision, read our companion article: “Why Off-Road Vehicle Insurance is Essential in Central New York.”

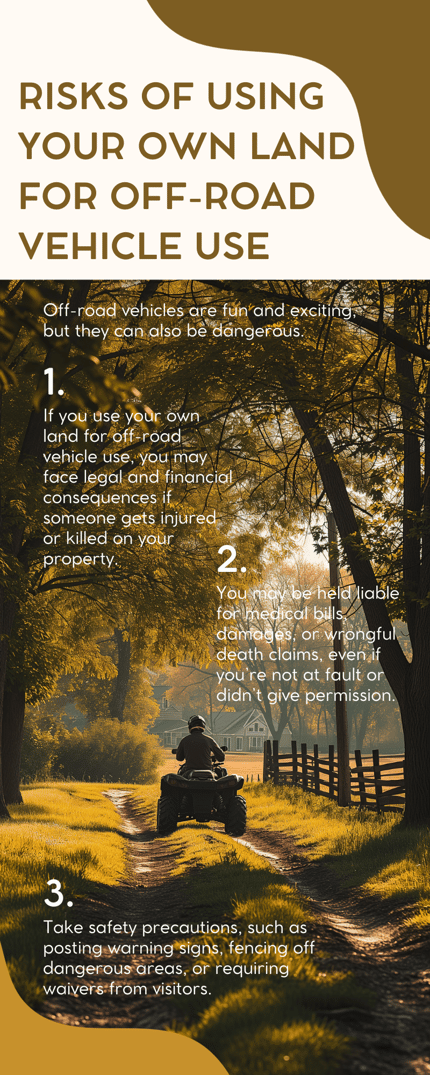

The Risks of Using Your Own Land for Off-Road Vehicle Use

The Risks of Using Your Own Land for Off-Road Vehicle Use

Here is something else to consider. Be very careful if you use your own land for off-road vehicle use. Maybe you think it would be cool to have a dirt bike track on your property. Maybe you let your friends or your kid’s friends use it.

Maybe you let snowmobiles or four wheelers go through your woods. That’s a big risk.

If someone gets hurt or killed on your land, your liability and exposure skyrocket. You don’t want that. You want to enjoy your off-road vehicle, not worry about lawsuits. So be cautious and get the right coverage. It could save you a lot of trouble.

Get the Best Off-Road Vehicle Insurance Policy Made for You

We’ve discussed why you need off-road vehicle insurance and what kind of coverage to get. We've also covered the risks of relying on your home or auto policy. We've shown you the benefits of getting a separate policy for your off-road vehicle. It will protect you, your vehicle, and your assets. And it will also give you the security you deserve.

We know that riding off-road vehicles is your passion. You love thrills and adventure. You don't want to worry about accidents or lawsuits. You want to enjoy your off-road vehicle with confidence. Off-road vehicle insurance is the answer. It's essential.

We’re here for you. Horan has the experience and the knowledge to help you. We have competitive rates and excellent service. We can tailor a policy to fit your lifestyle and off-road vehicle.

Click the Get a Quote button below to start your journey to the proper coverage. We’ll answer all your questions and guide you through the process.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: