Why Off-Road Vehicle Insurance is Essential in Central New York

January 15th, 2024

6 min read

You love your off-road vehicle. You enjoy riding it on the trails, in the snow, or on the farm. You’ve invested a lot of time and money into it. You want to keep it safe and secure.

But you also know that off-road vehicles come with risks. You could get into an accident, damage your vehicle, injure yourself or someone else, or have your vehicle stolen. You could face legal, medical, or repair bills that could ruin your finances. You could lose your vehicle and your fun.

That’s why you need off-road vehicle insurance. It’s not just a legal requirement in certain instances. It’s a smart way to protect your off-road vehicle and yourself from the unexpected.

But not all off-road vehicle insurance policies are the same. You need a policy that covers your specific needs and risks. You need a policy that fits your budget and preferences. You need a policy that gives you security.

That’s where we come in. We are Horan, a local insurance agency that specializes in off-road vehicle insurance in Central New York. We have been serving the off-road vehicle community since 2009. We know the ins and outs of off-road vehicle insurance.

In this article, we will explain what off-road vehicle insurance is, why you need it, and what coverage options are available. We’ll also discuss the benefits of off-roading in our region. By the end of this article, you will have a clear understanding of why coverage is necessary for your off-road vehicle in Central New York.

Off-Road Vehicle Insurance in New York State

Off-road vehicle insurance is a type of insurance that covers your liability and your vehicle in case of an accident, injury, or damage involving your off-road vehicle. It is similar to auto insurance, but it is tailored to the specific needs and risks of off-road vehicle owners and operators.

In New York State, you need liability insurance to operate any off-road vehicle anywhere in the state, except on your own property. Liability insurance covers the medical and property expenses of other people if you cause an accident with your off-road vehicle.

It does not cover your own expenses or your own vehicle. The minimum required coverage amounts for liability insurance in New York State are:

- $50,000/$100,000 for death

- $25,000/$50,000 for injury

- $10,000 for property damage in any one accident .

You need to register your off-road vehicle with the Department of Motor Vehicles (DMV) and display a registration sticker on it. You also need to have a valid driver’s license or learner’s permit to operate an off-road vehicle in New York State.

Liability insurance and registration are the legal requirements for off-road vehicle insurance in New York State. But they are not enough to protect you and your vehicle from all the possible risks and costs. That’s why you need additional coverage options, such as:

- Comp and collision coverage: This covers the repair or replacement of your own vehicle if it is damaged or stolen, regardless of who is at fault. It could also cover the towing and labor costs if your vehicle breaks down or gets stuck. Comp and collision coverage is optional, but highly recommended, especially if your vehicle is new, expensive, or financed. See our related comp vs. collision coverage article for more info.

- Uninsured/underinsured motorist coverage: This covers your medical expenses if you are involved in an accident with another off-road vehicle that has no insurance or not enough insurance to cover your damages. It also covers you if you are hit by a hit-and-run driver. Uninsured/underinsured motorist coverage is optional, but advisable, as many off-road vehicle owners and operators do not have adequate insurance or any insurance at all. See our related uninsured/underinsured motorist article for more info.

- Medical payments coverage: This covers your medical expenses if you or your passengers are injured in an accident involving your off-road vehicle, regardless of who is at fault. It also covers you if you are injured by another off-road vehicle as a pedestrian or a bicyclist. Medical payments coverage is optional, but beneficial, as it can supplement your health insurance or cover your deductibles and co-pays.

- Custom parts and equipment coverage: This covers the cost of repairing or replacing any custom or aftermarket parts and accessories that you have added to your off-road vehicle, such as lights, racks, winches, stereo systems, or performance enhancements. Custom parts and equipment coverage is optional, but valuable, as these items are usually not covered by your standard policy or have a low limit.

These are some of the common coverage options for off-road vehicle insurance. You can choose the ones that suit your needs and budget. You can also adjust the coverage limits and deductibles to fit your preferences and risk tolerance. Speak with an experienced insurance agent to obtain the proper coverage.

Does a Home or Auto Policy Cover My Off-Road Vehicle?

Some reading this might ask, “Does a home or auto policy cover my off-road vehicle?” The answer is no.

Your home policy may cover low-powered vehicles on your property. For example, a UTV that you use to move brush around your land. But this only covers your liability. And it may not apply if you take your vehicle off your property. That’s why you need a separate policy for your off-road vehicle.

An off-road vehicle policy is affordable and it protects you from more risks. Learn more about why home and auto policies don’t extend adequate coverage to off-road vehicles.

Types of Off-Road Vehicles in Central New York

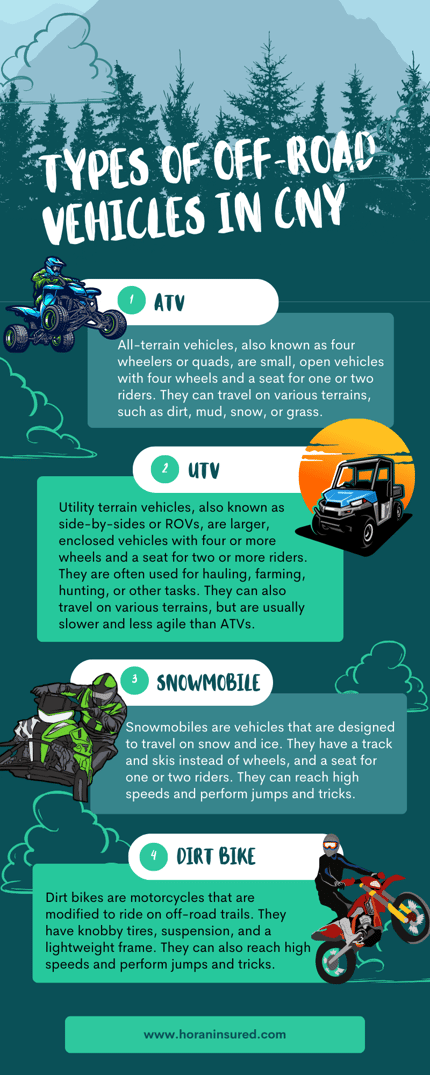

Off-road vehicles are very popular in Central New York. Many people enjoy riding them for fun, recreation, or work. Some of the common types of off-road vehicles are:

- ATVs: All-terrain vehicles, also known as four wheelers or quads, are small, open vehicles with four wheels and a seat for one or two riders. They can travel on various terrains, such as dirt, mud, snow, or grass.

- UTVs: Utility terrain vehicles, also known as side-by-sides or ROVs, are larger, enclosed vehicles with four or more wheels and a seat for two or more riders. They are often used for hauling, farming, hunting, or other tasks. They can also travel on various terrains, but are usually slower and less agile than ATVs.

- Snowmobiles: Snowmobiles are vehicles that are designed to travel on snow and ice. They have a track and skis instead of wheels, and a seat for one or two riders. They can reach high speeds and perform jumps and tricks.

- Dirt bikes: Dirt bikes are motorcycles that are modified to ride on off-road trails. They have knobby tires, suspension, and a lightweight frame. They can also reach high speeds and perform jumps and tricks.

Exceptional Off-Roading in the Tug Hill Region

There are many places where people like to ride their off-road vehicles in CNY. High on that list is the Tug Hill Region. It encompasses a vast rural area between Lake Ontario and the Adirondacks. It is known for its heavy snowfall, rugged terrain, and scenic views.

Tug Hill has hundreds of miles of trails for off-road vehicles, especially snowmobiles and ATVs. It also has many events and festivals for off-road vehicle lovers. Some notable events include:

- Tug Hill Snowmobile Challenge: This annual event draws snowmobilers from across the Northeast to compete in a challenging endurance race.

- Tug Hill ATV Rally: This rally offers ATV enthusiasts a weekend of riding, camping, and socializing.

But as thrilling as off-roading in the Tug Hill Region can be, it also comes with many hazards and uncertainties. You never know when you might encounter a collision, a breakdown, a theft, or an injury that could ruin your adventure and cost you a fortune.

Get the right off-road vehicle insurance, tailored for the snow-dusted trails and hidden creeks that make this region a paradise for off-road enthusiasts. Ride with confidence, knowing you're protected from the unexpected twists and turns of Central New York’s off-road landscape.

Economic Benefits of Off-Road Vehicles for New York State

Off-road vehicles are a source of fun and adventure, as well as a source of income and tourism for New York State. Outdoor recreation, which includes activities such as operating recreational vehicles, provided $21.1 billion in economic activity and supported over 241,000 jobs in New York in 2020.

Off-road vehicles are part of this growing sector that benefits many local businesses and communities across the state. However, the specific economic impact of off-road vehicles in Central New York is not well documented.

The off-road vehicle market size in the United States was estimated to be $16.06 billion in 2023 and projected to grow to $19.65 billion by 2028, but there is no regional breakdown available. Therefore, more research is needed to assess the exact contribution of off-road vehicles to the economy and tourism of Central New York.

Off-road vehicles may be a big part of CNY’s culture and economy, but they also come with risks and responsibilities. That’s why you need off-road vehicle insurance.

Protect Yourself and Your Off-Road Vehicle with the Right Insurance

Off-road vehicles are a great way to enjoy the outdoors and have fun in Central New York. But it’s vital to protect yourself, your vehicle, and others from the unforeseen perils.

Off-road vehicle insurance is a smart investment that can save you money and hassle in the long run. It can also give you composure and security when you ride the trails.

At Horan, we understand the needs and risks of off-road vehicle owners and operators. We have been serving the off-road vehicle community since 2009. We offer customized and affordable off-road vehicle insurance policies that cover your specific situation and preferences.

If you want to learn more about off-road vehicle insurance or get a free quote, click the Get a Quote button below. We’re here to help you get the best coverage for your off-road vehicle.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: