Understanding Uninsured and Underinsured Motorist Coverage

May 4th, 2023

5 min read

You’re doing the limit while slicing through Lakeland along Interstate 690 East toward Syracuse. The day is cool and clear, and traffic is sparse for the most part. You say to yourself, “I’ll make my appointment with time to spare.”

But before you could finish the thought, a jalopy from the mid-90s tries to cough past you in the left lane, and the struggle results in a blowout that shoots tire shreds across your hood and sends the nose of the jalopy careening into your C-pillar.

You spin out of control and grind the guardrail until you stop short of the jalopy, which pulled into the shoulder ahead of you.

You’re a little banged up, but the other driver is fine. When you get out to exchange information with him, you find out he’s been driving without any car insurance. There’ll be nothing on his part to cover your injuries.

This is where ample uninsured motorist coverage (UM) and underinsured motorist coverage (UIM) are worthwhile.

You don’t want to be stuck with a huge medical bill if an uninsured or underinsured driver hits you. Sadly, that’s a real possibility because nearly 13 percent of U.S. drivers have no car insurance, according to a 2019 report.

And many more drivers only have the bare minimum coverage required by New York State.

That’s why you need adequate uninsured and underinsured motorist coverage on your auto insurance policy. This coverage can help you pay for your medical expenses if you’re in an accident with a driver who can’t or won’t cover them.

As a CNY agency, we’ve written hundreds of auto policies with UM and UIM for drivers like you. We can guide you to the right coverage for your needs and budget, as we’ve done with many clients.

We understand how frustrating and overwhelming it can be to face the aftermath of an accident with an uninsured or underinsured driver. That’s why we’re here to help you obtain the proper UM and UIM coverage, providing peace of mind as you travel life’s roads.

In this article, we’ll explain why you need uninsured and underinsured motorist coverage, how it works, and how much you need to stay protected.

What is Uninsured and Underinsured Motorist Coverage?

Uninsured and underinsured motorist coverage is insurance protection you buy from your auto insurance carrier to cover your medical bills if you’re hit by a driver who doesn’t have any car insurance or has insurance coverage that is too low to cover your expenses. But UM and UIM work differently, as you’ll see below.

Uninsured and underinsured motorist coverage is insurance protection you buy from your auto insurance carrier to cover your medical bills if you’re hit by a driver who doesn’t have any car insurance or has insurance coverage that is too low to cover your expenses. But UM and UIM work differently, as you’ll see below.

- Uninsured motorist coverage (UM) covers you in case of an accident with a driver who has no insurance or whose insurance company denies or cannot pay their claim.

- Underinsured motorist coverage (UIM) covers you in case of an accident with a driver who has some but not enough insurance to cover all of your injuries.

The Danger of Uninsured Drivers

Driving without insurance is a serious problem in the United States. According to a March 2021 report by the Insurance Research Council (IRC), nearly 13% of drivers (meaning one out of every eight drivers in the United States) had no car insurance in 2019.

The IRC’s data showed that the percentage of uninsured drivers has increased steadily since 2010, and it is likely that the number of uninsured drivers has continued to increase since 2019. This means that there are millions of drivers on the road who are not financially responsible for any damage or injuries they may cause in an accident.

IRC found that uninsured drivers are more likely to be involved in accidents (including fatal ones) and cause more damage and injuries than insured drivers. There are three reasons for this:

- They’re likely to drive more recklessly. Drivers who don’t have insurance may be more likely to drive recklessly because they don’t have to worry about the financial consequences of an accident. They may be more likely to speed, drive under the influence of alcohol or drugs, or engage in other risky behaviors.

- They tend to shirk the rules of the road. Drivers without insurance may be less likely to obey the rules of the road because they don’t have to worry about getting a ticket. They are also more likely to run red lights, speed, or tailgate.

- Their vehicles are often in poor working order. These drivers are also less likely to have their cars in good working order because they don’t have to worry about the cost of repairs. They often drive cars with bald tires, faulty brakes, or other mechanical problems.

This is why it’s important to have adequate UM and UIM protection against uninsured drivers. This coverage can protect you financially if you’re involved in an accident, regardless of whether the other driver is insured.

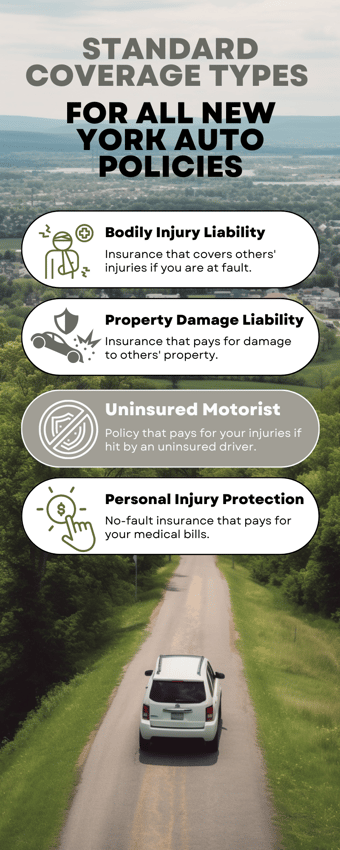

The Mandatory New York State Minimum UM and UIM Coverage

In New York State, car insurance policies come standard with some protection against uninsured drivers. However, the minimum requirement is identical to the state’s bodily injury liability limits, meaning that the most you would have available if severely injured by an uninsured driver is $25,000.

If other passengers in your vehicle were also hurt, the maximum available would be $50,000, with no one person exceeding a $25,000 payment.

It’s important to note that if you were in an accident with an insured driver visiting from Pennsylvania, where the minimum insurance requirement is only $15,000, underinsured motorist (UM) coverage can fill the gap between the other driver’s bodily injury limit and your underinsured limit.

Since uninsured and underinsured limits are combined and share the same coverage amount, you’d have $10,000 available in this scenario.

Supplementary Uninsured and Underinsured Coverage Options

As mentioned in our comprehensive auto insurance article, you have options beyond the low $25,000 limit for uninsured and underinsured motorist coverage. One option is to add supplementary uninsured and underinsured motorist coverage, or SUM for short.

SUM coverage works in the same way as its UM counterpart, but it gives you the option to build upon the low $25,000 limit per injured person.

With SUM insurance, you can purchase as much coverage as your carrier will allow, with one stipulation: your SUM limits cannot be higher than your bodily injury liability limits. For example, if you carry $250,000 per person bodily injury coverage, you can purchase up to that amount in SUM coverage.

While it’s possible to buy less SUM coverage compared to your bodily injury limits, you must sign a form indicating your intention to do so. But we don’t recommend this as the added cost of SUM coverage is negligible compared to the rest of the policy.

Will UM or SUM Cover Damages to My Vehicle?

So far, we’ve been discussing injuries to you as a person, but what about damage to your car caused by an uninsured driver? In New York, your UM or SUM coverage will not cover this. Your only option would be to file a claim using your policy’s collision coverage.

Without collision coverage on your auto policy, there would be no coverage provided by your insurance. Even if you have collision coverage, you would still be responsible for paying your collision deductible.

Is UM and SUM the Same as “No-Fault” Coverage?

Neither UM nor SUM coverage is the same as no-fault or Personal Injury Protection (PIP) insurance. They have their differences.

- No-Fault or PIP coverage is designed to protect you financially if you’re injured in an accident, regardless of who is at fault.

- UM and SUM coverage is designed to protect you financially if an uninsured or underinsured driver causes an accident that injures you.

While UM, SUM, and PIP provide coverage for similar claims, UM and SUM are considered secondary to your PIP insurance coverage and are generally not used until your PIP insurance has been depleted.

In New York, PIP provides a mandatory $50,000 in coverage for both you and your passengers. Any injury expenses come from your policy first, regardless of the other driver’s insurance status. To learn more about how this coverage works, read our article “What is New York No-Fault Insurance?”

Increase or Supplement UM Coverage for Better Protection

With a possible rise in uninsured and underinsured drivers on the road whose reckless behavior remains unchecked, being struck by one of these drivers is a real danger.

Uninsured motorist (UM) coverage helps pay for your long-term pain and suffering and medical bills if you’re hit by one of these drivers. But the base $25,000/$50,000 limit won’t be enough to cover you after an accident that leads to substantial injuries.

You deserve better protection.

Supplementary uninsured and underinsured motorist (SUM) coverage is available with higher limits, as we’ve stated, often up to the amount of the policy’s liability (bodily injury) limits. It provides better protection with higher coverage limits for bodily injury you may suffer. We strongly advise you to increase UM coverage or supplement UM with SUM to safeguard assets and increase protection against uninsured drivers. You should contact your agent to do so.

As a CNY agency with years of experience and hundreds of auto policies to our name, we can review your policy and help you make any adjustments. Simply click the Get a Quote button below to get started.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: