Painter’s Insurance: When the First Coat Isn’t Enough

July 14th, 2023

6 min read

As a painting contractor, you know how to handle a brush, a roller, and a spray gun. You know how to prepare surfaces, apply coatings, and create beautiful results. But do you know how to protect yourself and your business from the risks that come with your work?

Painting is not just an art, it’s also a liability. You could face lawsuits, property damage, injuries, or accidents that could cost you a lot of money and reputation if you don’t have adequate insurance.

There are some specific things that could make you vulnerable as a painting contractor and some riders or endorsements that you should know more about. Riders or endorsements are additions or changes to your insurance policy that can increase or modify your coverage for certain situations or items.

One critical rider is Voluntary Property Damage (VPD), which can cover damage you cause to your customer’s property while painting it, regardless of legal liability.

As CNY insurance agents, we’re not just experts in the standard property and liability policy. We specialize in certain types of businesses that we know inside and out, such as painters. We know the specific risks you face and the gaps a basic policy can leave. That’s why we offer more than a generic “check the box” policy.

In this article, we’ll unpack VPD and other beneficial painter’s insurance endorsements and why you need them.

How Voluntary Property Damage Coverage Can Protect You and Your Customers

Typical business liability policies don’t cover accidental damage to a customer’s property that isn’t part of your work but that you are responsible for or can control at a job or work site.

To paint a picture of how that works, let’s say you have a job to paint a homeowner’s interior in Manlius. The homeowner insists you move furniture to gain access to walls.

As you move an expensive ornate mirror into a room that isn’t being painted, you bump a display case that sends a delicate but pricey porcelain vase tumbling. The mirror slips from your grasp and also shatters on the hardwood floor.

Will your regular liability policy pay for the shattered vase and mirror and the damage to the floor?

Since damage to those things wasn’t directly related to you actively painting a wall, your standard policy won’t cover them. This situation could happen to you. Without the right coverage, you could end up paying a lot of money out of pocket.

The policy option that basically removes the care, custody, or control exclusion is called Voluntary Property Damage (VPD). This means if you have to lift heavy antique furniture to get to a wall or remove expensive blinds, mirrors, vases, pianos, or any item of value that could be damaged, you’d be covered with no hassle.

Back-and-forth exchanges with an insurance agent and carrier representatives are the last thing on your mind. VPD coverage is the answer. It eliminates the uncertainty of care, custody, or control and saves contractors like you from possible huge out-of-pocket costs. Above all, it can satisfy your customers!

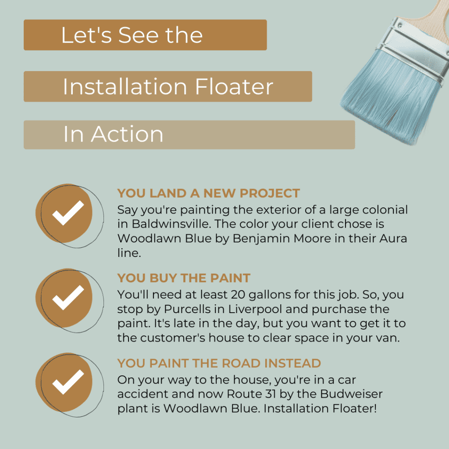

What Is Installation Floater Insurance, and Why Do Painters Need It?

When small contractors work on a project, they may need to protect the property they’re installing or building, such as building materials. This property can move from one place to another, so it needs a special type of coverage called installation floater insurance.

It’s a type of inland marine insurance that covers items that are being transported, stored, or installed at a customer’s premises. This coverage lasts until the property is used for its purpose or the client approves the work.

It protects you from losses due to theft, fire, vandalism, or other causes of damage that may occur before the materials are fully installed and accepted by the customer.

By way of example, say a refrigerator is delivered to a customer but is still in the box—the installation hasn’t happened yet. This is something that would be protected by the floater since the fridge hasn’t been unpacked, plugged in, and set up.

If a sudden fire impacts the building where the fridge is stored, any damage to the fridge would be covered by the installation floater. However, the appliance dolly that was also damaged would not be.

This insurance is especially important if you’re a contract painter who works with expensive or specialized materials, such as custom-made paints. The paints could be stolen or damaged while in transit or at the job site, resulting in financial losses.

Installation floater insurance can also cover the labor costs associated with installing the materials, such as wages, taxes, and overhead.

With installation floater insurance, you can protect your investment in materials and equipment and ensure that your projects are completed on time and within budget.

What Is a Waiver of Subrogation, and When Do Painters Need It?

A waiver of subrogation is a clause in an insurance contract that prevents the insurer from pursuing a third party who is responsible for causing a loss to the insured. In other words, it waives the insurer’s right to recover the money it paid to the insured or to a third party on behalf of the insured.

A waiver of subrogation can be beneficial for painters who want to avoid legal disputes and maintain good relationships with their clients and subcontractors.

To put it into perspective, let’s say you hire a subcontracting painter named Herman. You’ve taken Herman under your wing, but one day, he uses a spray gun to paint the exterior of a North Syracuse house, and the wind blows the paint onto the neighboring cars and windows. The vehicle owners demand compensation for the damage.

After the insurer pays for the repairs via your robust painter’s insurance policy, it decides to go after Herman. However, if you have a waiver of subrogation in your policy, the insurer cannot sue Herman to recover the money it paid.

A waiver of subrogation can also protect you from being sued by your client’s insurance company. So, if you accidentally spill paint on his wife’s mink stole, and their insurer pays for the cleaning or replacement, the carrier may try to sue you to recover its costs.

But with a waiver of subrogation in place, or if the client agrees to sign one before hiring you, the insurance company cannot pursue a lawsuit to recoup its loss.

A waiver of subrogation usually comes with an additional cost to you, as it increases the risk for the insurer. Therefore, weigh the benefits and drawbacks of having such a clause in your policy.

Also, consult with your insurance agent or broker before signing any contracts that include a waiver of subrogation clause.

Why Your Subcontractors Need to Be Insured

Contract painters often hire subcontractors to help them complete large or complex projects. You’ve probably done this too. However, hiring subcontractors also comes with risks. If a subcontractor causes property damage or injury to themselves or others, you and your client could be held liable for the costs.

That’s why you need to make sure your subcontractors have their own insurance policies. This way, the subcontractor’s insurance can cover the claims arising from their work, and you can avoid paying out of pocket or having your insurance rates go up.

Some of the insurance policies that subcontractors should have include:

- General liability insurance: Covers claims of bodily injury or property damage caused by the subcontractor’s work.

- Workers’ compensation insurance: Helps cover medical expenses and lost wages for employees who get injured or sick on the job.

- Commercial auto insurance: Helps pay for damages or injuries caused by vehicles used for business purposes.

Learn more about these painter’s insurance options.

You should always ask for proof of insurance from your subcontractors before hiring them. And request to be added as an additional insured on your subcontractor’s policies, as this gives you extra protection if a claim is filed against you because of the subcontractor’s work.

When your subcontractors have their own insurance, you can protect yourself, your clients, and your business from potential lawsuits and losses.

Get the Best Insurance for Your Painting Business

As a contract painter, you face many risks on the job that could result in costly losses or lawsuits. That’s why you need to have the right insurance coverage to protect yourself, your clients, and your subcontractors. In this article, we discussed three important endorsements that you should consider adding to your policy:

- voluntary property damage

- installation floater, and

- waiver of subrogation

These endorsements can help you avoid gaps in coverage, prevent disputes with third parties, and satisfy your customers’ expectations.

We also explained why it’s essential for your subcontractors to have their own insurance policies and how you can verify their coverage and add yourself as an additional insured. By doing so, you can reduce your liability exposure and ensure that everyone involved in your project is adequately protected.

We know that finding the best insurance for your painting business can be challenging and confusing. That’s why we’re here to help. We’re an independent agency that specializes in serving contractors like you.

We can compare quotes from multiple carriers, customize your policy to fit your needs, and provide you with expert advice and guidance. We can also help you get a certificate of insurance quickly and easily whenever you need it.

We understand the challenges and opportunities you face as a contract painter. We want to help you succeed and grow your business. Click the Get a Quote button below for a free quote and consultation.

The best insurance for your painting business is only a click away.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.