Understanding Dwelling Fire Insurance: The Basics

March 6th, 2024

6 min read

Worried about your Central New York property that doesn’t fit the mold for traditional homeowners insurance? Fear not! There’s a handy solution for your unique situation: dwelling fire insurance.

Whether it’s a charming vacation cabin tucked deep in the Adirondacks, a cherished rental property in the Finger Lakes, or a beloved historical building in the Tug Hill region, unexpected events like fire can wreak havoc. But with the right dwelling fire insurance plan, you can face challenges with confidence, knowing your investment is protected.

We’re the Horan insurance agency, and we’ve been helping property owners like you secure their rustic getaways in Central New York since 2009.

This article delves into the different forms of dwelling fire insurance, from basic to comprehensive, helping you find the perfect fit for your property and budget. We’ll also explore crucial add-ons like liability and personal property coverage, ensuring you have complete security.

What is Dwelling Fire Insurance and How Does it Work?

Dwelling fire insurance is a type of property insurance that covers structures that aren’t eligible for homeowners insurance. There are many reasons why a structure may not qualify for a home policy, such as:

- The owner does not live in it full time and it is not their secondary home.

- The location is too far from a fire department, fire hydrant, or water source.

- The age, style, or condition of the structure or the roof is poor.

In these cases, dwelling fire insurance can provide coverage for the structure and its contents in the event of a fire or other perils.

The three forms of dwelling fire insurance are:

- Basic (DP1): This is the most limited form of coverage, which only protects the structure from fire, lightning, and internal explosion. This means that if the structure is damaged by any other cause, such as wind, hail, theft, or vandalism, the policy will not pay for the repairs or replacement.

- Broad (DP2): This is a more comprehensive form of coverage, which protects the structure from the perils covered by the basic form, plus some additional ones, such as falling objects, weight of snow or ice, water damage, and collapse. However, this form still excludes some common perils, such as ice damming.

- Special (DP3): This is the most extensive form of coverage, which protects the structure from all perils, except those that are specifically excluded by the policy. This means that unless the policy states otherwise, the structure is covered for any damage that occurs, regardless of the cause. This form also provides replacement cost coverage, which means that the policy will pay for the full cost of repairing or rebuilding the structure, without deducting for depreciation.

Basic Form Coverage for Dwelling Fire Insurance

We’ll explore DP1 a little further, this being the basic form of dwelling fire insurance. Since DP1 is the most limited and cheapest form of coverage, it may not suit your needs.

You can add more coverages to the DP1 policy, such as:

- Windstorm or hail

- Explosion (not only internal, but also external, such as a grill exploding outside the house)

- Smoke

- Aircraft and vehicles (if they crash into your house)

- Riot or civil commotion

- Volcanic eruption

- Vandalism and malicious mischief (but only if the premise is not vacant for more than 30 days)

The DP1 policy doesn’t include liability coverage, unlike the homeowners policy. You can add it if you want, but you have to ask for it. Otherwise, you won’t have that protection.

The DP1 policy covers four things:

- Dwelling

- Other structures

- Personal property

- Additional living expenses or loss of rent

Broad Form Coverage for Dwelling Fire Insurance

Broad form coverage is the second form of dwelling fire insurance. It covers more perils than the basic form, such as:

- Burglary damage

- Falling objects

- Weight of ice, snow, or sleet

- Tearing apart, cracking, burning, or bulging of appliances

- Accidental discharge or overflow of water and steam

- Freezing of plumbing

- Electrical damage from artificially generated current

However, broad form coverage does not cover damage to tubes, transistors, electronic components, and other items. It also does not cover some common perils, such as flood, earthquake, or mold.

Broad form coverage may not be available for some structures, depending on their condition.

For example, if your roof is old or weak, the insurance company may not offer you broad form coverage, because they’re afraid your roof may collapse under the weight of ice, snow, or sleet. In that case, you may only get basic form coverage, which doesn’t cover that peril.

Special Form Coverage for Dwelling Fire Insurance

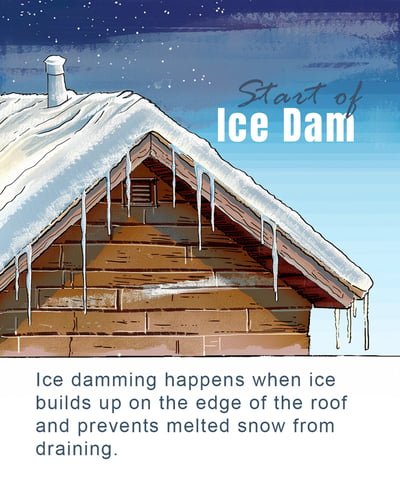

Special form coverage is the third and best form of dwelling fire insurance. It covers ice damming, which is a common problem in cold CNY climates. Ice damming happens when ice builds up on the edge of the roof and prevents melted snow from draining.

This can cause water to leak into the house and damage the walls, ceilings, and insulation.

Special form also covers all other perils, except those that are specifically excluded by the policy. This means you’re covered for any damage that happens to your structure, unless the policy says otherwise.

This is different from the basic and broad form coverage, which only cover the perils that are named in the policy. With special form coverage, you have more protection and less uncertainty.

Some of the perils that are excluded by special form coverage are:

- Earthquake or earth movement

- Flood or water damage from outside sources

- Wear and tear or deterioration

- Mold, fungus, or rot

- Insects, rodents, or animals

- Nuclear hazard or war

- Government action or ordinance

These are just some examples of the exclusions. You should always read your policy carefully to know what’s covered and what isn’t.

If your structure is damaged by a peril that isn’t excluded, you’re covered by special form coverage.

For example, if your roof caves in and there’s no sign of earth movement or any other excluded peril, you’re covered. However, if the insurance company can prove that your roof caved in because of an excluded peril, such as wear and tear or mold, you’re not covered.

Liability Coverage for Dwelling Fire Insurance

Liability coverage is important because it protects you from legal claims if someone gets injured or their property gets damaged on your land. If you have a homeowners policy, you may have liability coverage for your vacant land.

But if you build a structure on that land and insure it with a dwelling fire policy, you’ll lose the liability coverage from your homeowners policy.

Adding liability coverage to your dwelling fire policy limits your exposure to lawsuits. This is a very important step you shouldn’t overlook.

You can add liability coverage to any form of dwelling fire insurance, whether it’s basic, broad, or special. But check with your insurance company or agent to learn how much it will cost and what it will cover.

You should also compare the different forms of dwelling fire insurance and choose the one that suits your situation and budget.

Personal Property Coverage for Dwelling Fire Insurance

Personal property coverage is optional for dwelling fire insurance. If you add it, it will cover the items inside your structure, such as

- furniture,

- appliances,

- clothing, and

- electronics.

However, it will only pay for the actual cash value of your items, which means the original cost minus depreciation. This may not be enough to replace your items if they’re damaged or destroyed.

You may have the option to increase your personal property coverage to replacement cost, which means the full cost of buying new items of the same kind and quality. This will give you more protection and less loss. You should check with your insurance company if this option is available and how much it will cost.

Learn more about actual cash value and replacement cost coverage.

The main point of dwelling fire insurance is that it’s an alternative to homeowners insurance for structures that don’t qualify for that policy. It isn’t for commercial use, but for your own personal use.

Why Dwelling Fire Insurance Isn’t Cheaper Than Homeowners Insurance

Dwelling fire insurance is not as good as homeowners insurance. That’s mainly because a dwelling fire policy doesn’t cover as many things as homeowners insurance does. But that doesn’t mean dwelling fire insurance is very cheap.

In fact, dwelling fire insurance may be more expensive than homeowners insurance, even though it covers less.

With that in mind, you shouldn’t just pick any dwelling fire policy without doing your research.

Some people may think that they should pay less because they have less coverage. But they’re not considering certain factors.

Look at it this way: the insurance company is taking a risk by insuring your structure.

People are often less attentive to these properties when compared to their primary homes. Carriers also don’t know if your structure is safe or not. But they’re giving you some protection, even though they have less control and more uncertainty.

So carriers charge you a fair price for that protection. With that in mind, don’t expect to pay less for it than homeowners insurance.

The Difference Between Homeowners and Dwelling Fire Insurance

As we’ve shown, homeowners insurance is better than dwelling fire insurance. It covers more things and usually costs less. That’s because you live in your home all the time. You take care of it and fix any problems quickly.

You don’t want to live in a leaky or damaged house, after all.

But dwelling fire insurance is for structures that you do not live in all the time. For example, you may have a rustic cabin way up in St. Lawrence County, tucked in remote woods with a hidden creek brimming with largemouth bass. But it’s a place you only visit once in a while.

You may not know what happens to it when you’re not there. It may get damaged by fire, weather, or animals. And you may not find out until it’s too late.

The insurance company knows this. They know that they’re taking a bigger risk by insuring your cabin. They know that they may have to pay more to repair or replace it. For this reason, they may charge you more for dwelling fire insurance.

Secure Your Property with the Right Dwelling Fire Insurance

Central New York winters can be harsh, and unexpected events can strike any time. Don’t let a fire turn your cherished property into a smoldering memory. Secure your haven with the right dwelling fire insurance, crafted by the experts at Horan.

Imagine facing challenges with composure, knowing your investment is shielded from financial blows. Picture the security of a protected future, free from the worries of unforeseen disasters.

Neglecting the right insurance can leave you exposed. Don’t take the chance.

Click the Get a Quote button below and let us guide you toward the dwelling fire insurance solution that grants you the security you deserve. It’s time to trade worry for confidence. Your unique property deserves it, and so do you.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: