4 Ways to Know Your House is Underinsured and How to Fix It

April 8th, 2024

5 min read

Discovering that your home is underinsured can be a disappointing and potentially costly revelation. Without adequate coverage, you may find yourself shouldering significant out-of-pocket expenses in the event of a loss or damage to your property.

To avoid this predicament, it’s crucial to periodically assess your insurance policy and ensure it aligns with the true replacement value of your home.

We’re the Horan insurance agency, and since 2009, we’ve been helping Central New York homeowners like you secure the right coverage to meet the risks associated with owning a home in our region.

To help you avoid the predicament of being underinsured, let’s explore four effective ways to determine if your current coverage aligns with your home’s true replacement costs.

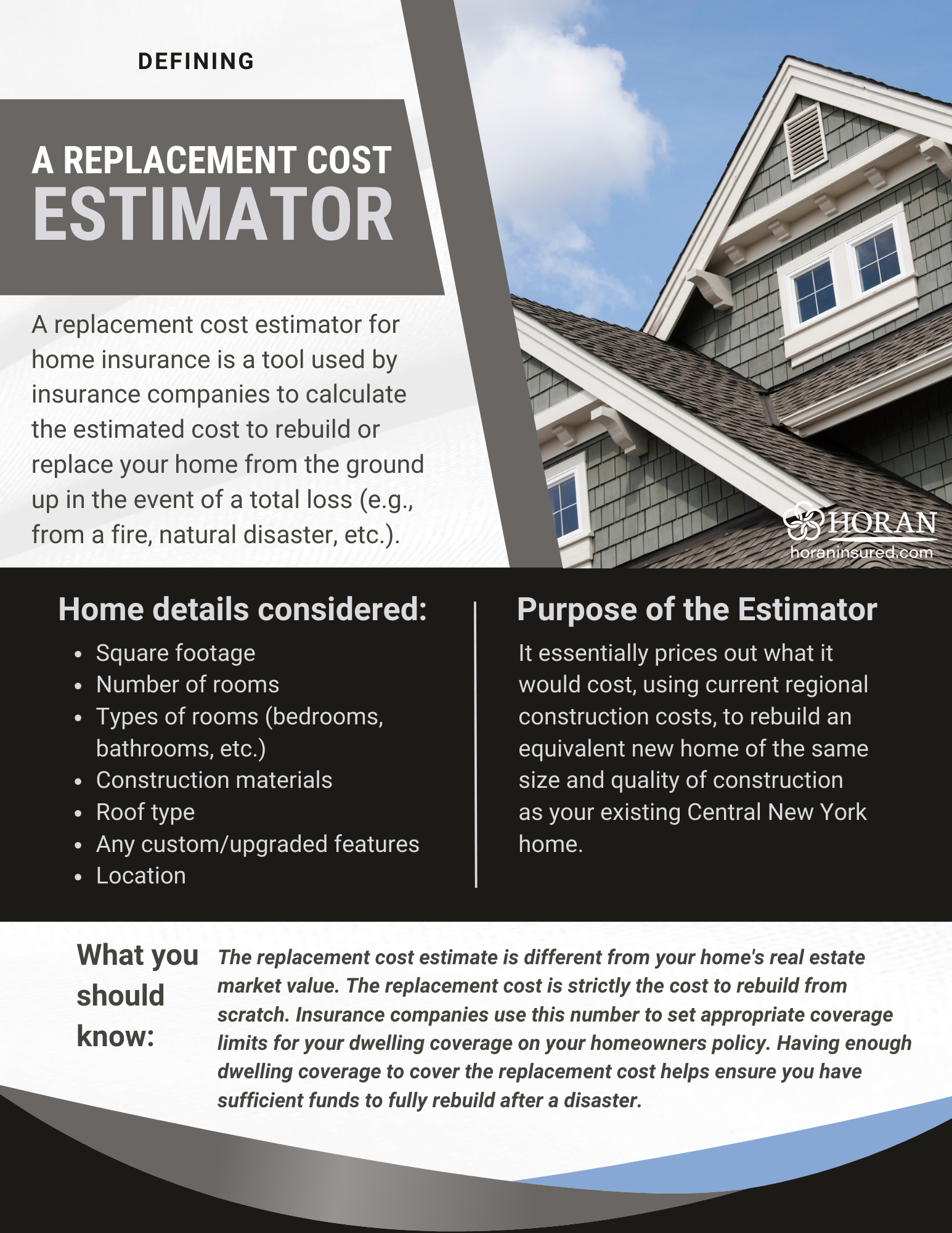

#1—Getting an Accurate Replacement Cost Estimate

When it comes to insurance, knowing the ins and outs of your policy is crucial. You’re not alone if you’re unsure about whether your home’s coverage is sufficient. Many homeowners find themselves underinsured, often discovering it too late.

To determine if you’re in this group, start by giving your insurance agent or provider detailed information about your home. They need to know

- the size,

- the number of bathrooms,

- the type of flooring,

- ceiling heights, and

- whether you have central air or a fireplace.

And if it’s a fireplace, what kind? Gas or masonry? Do you have a deck? They’ll need the dimensions and materials.

This isn’t just busywork. Each detail contributes to the replacement cost estimator, which calculates a figure that should reflect the true cost to rebuild your home. If this figure exceeds the coverage limit on your current policy, it’s a red flag that you’re underinsured.

Assess Home Coverage Using Independent Verification

But maybe you’re skeptical. Perhaps you’re thinking, “Insurance companies always want to sell more coverage.”

While that’s not always the case, in such instances, we recommend independent verification. In other words, seek out a third-party appraiser who can provide an unbiased assessment of your home’s replacement cost. This way, you’ll have a solid foundation for adjusting your coverage, ensuring you’re protected without overpaying.

#2—Obtaining a Builder’s Estimate

If you’re considering a more hands-on approach to determine if your home is underinsured, you might think about reaching out to a local builder. You could say,

“I’ve got a 2200 square foot colonial with a 2-and-a-half-car garage. If the land was ready to build on, how much would you charge to construct a new one?”

This initial estimate gives you a baseline for the construction costs alone.

However, rebuilding involves more than just construction. You’ll need to clear debris and conduct environmental checks before anything new can rise from the old foundation.

These additional costs can quickly add up. If the builder’s quote already surpasses your current insurance coverage, it’s a clear sign you’re underinsured. And that’s before factoring in the extra expenses.

It’s a process, indeed, but it’s worth the effort. Once you have the builder’s estimate, compare it with your policy. Then, have a candid conversation with your insurance agent about the true cost to rebuild your home in the event of a total loss.

This figure is the cornerstone of adequate insurance coverage. We’re focusing solely on the house here, not the contents or other assets. It’s a straightforward yet effective method to ensure your home’s insurance is up to par.

#3—The Dangers of Bare Minimum Home Coverage

When it comes to insuring your home, skimping on coverage can be a high-stakes gamble. If you’re carrying only the bare minimums, especially for property coverage, you might be setting yourself up for a financial pitfall. It’s not just about meeting legal requirements or ticking off boxes. It’s about ensuring your home is fully protected.

- The Dwelling Dilemma: Often, homeowners focus solely on the dwelling coverage, which is indeed crucial. But what does it mean to be underinsured here? The dollar amount isn’t the only factor. Also consider whether your coverage reflects the true cost of rebuilding your home as it stands today. If your policy says $700,000 and the actual cost is closer to $820,000, you’re underinsured, plain and simple.

- The Missing Piece—Riders: Beyond the basic policy, there are additional coverages, known as riders, that you might overlook. For instance, if you live at the bottom of a hill, your basement could be at a higher risk for flooding. Without water and sewer backup coverage, you're vulnerable. It's not just about floods. Any plumbing in your basement, like a toilet or shower, can cause significant damage if backed up. This is critical coverage to consider, regardless of your location. Without the right endorsements in place, your home could be underinsured.

#4— Updating Your Policy for Home Renovations and Upgrades

Home renovations that add square footage or increase the value require a policy update. Your insurance covers rebuilding your home as it was previously, so improvements raise the rebuild cost.

Now, new windows don’t necessarily increase value unless you added more. But a new kitchen, granny suite, or luxury features do increase your home’s rebuild cost.

It’s a common scenario: homeowners finish their basement but choose not to inform the town. The reasons? They don’t want their property taxes to increase, and perhaps they didn’t obtain the necessary permits, making their new living space not up to code.

While it might be tempting to keep these upgrades under wraps, it’s important to understand the insurance implications. Failing to update your insurance policy after significant home improvements can lead to being underinsured, since you’re adding value.

What should you do about home renovations and add-ons?

- Be Transparent with Your Insurance Carrier: Even if you skipped some steps with local codes, it’s crucial to ensure your home improvements are covered.

- Understand the Risks: Not being up to code can have its own set of legal and financial risks, separate from insurance issues.

- Consider the Long-Term: While you might save on taxes now, being underinsured could cost you significantly more in the event of a claim.

Ultimately, it’s about safeguarding the investment in your home. While insurance aims to provide that protection, it can only do so if your coverage accurately represents your home’s present condition, including any upgrades or additions. It’s better to address these issues now than to face the consequences later.

We Can Help You Avoid Having an Underinsured House

The path to ensuring your home receives the coverage it deserves begins with understanding factors that contribute to underinsurance. We covered key areas—from minimum coverage limits to renovation impacts—that demand your attention.

Overlook them, and you risk facing out-of-pocket costs that strain your finances after a disaster. But embrace proactive assessments, and you safeguard yourself against unforeseen expenses.

Imagine a scenario where you’ve taken the steps to verify your policy accurately reflects your home’s true rebuild value, including recent upgrades. When the unthinkable occurs—a fire, storm, or other catastrophe—you face it with composure and security.

Your policy kickstarts the recovery process, funding reconstruction efforts seamlessly. You avoid draining your savings or accruing burdensome debt.

Contrast this with the alternative of clinging to outdated coverage limits. One event exposes the gap between your policy’s boundaries and reality. You now carry the weighty burden of making up the shortfall, potentially setting back your long-term financial well-being.

We don’t want you to experience that kind of hardship. We understand reviewing insurance details isn’t always an exciting task. However, taking the time to verify your home is properly covered provides tremendous composure against the unpredictable.

Take control and align your insurance with your home’s evolving needs. Spare yourself future regrets by investing time to understand if you’re underinsured.

This proactive approach provides the first layer of protection for your most valuable asset. Why risk the consequences when the solution lies within reach?

Click the Get a Quote button below to connect with a Horan insurance expert. We’ll walk you through a thorough review of your home’s details and replacement costs, ensuring your policy provides adequate coverage tailored to your unique situation.

Also be sure to read, Why is My Homeowners Coverage Higher Than the Home’s Value?

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: