What is the Best Way to Compare Homeowners Insurance Quotes?

October 6th, 2023

10 min read

You love your home in Central New York. It’s more than just a building. It’s where you make memories, raise your family, and express your personality. It’s also one of your biggest investments. You want to protect it from any damage or loss. That’s why you need homeowners insurance.

Of course, you need to get quotes before buying a policy. But how can you tell if one quote is better than another? Even the presentation of the quote varies from carrier to carrier. There are so many options and details to consider. You may feel confused and overwhelmed by the process. You may wonder if you’re getting the right coverage, the best price, and the best service.

You’re not alone.

Many CNY homeowners struggle with comparing homeowners insurance quotes. They don’t know what to look for, what to ask, or what to avoid. They don’t have the time or the expertise to do the research and the analysis. They need someone to help them navigate the complex and competitive insurance market.

That’s where we come in. We are Horan, a Baldwinsville-based agency that specializes in homeowners insurance. We have been serving Central New York since 2009. We have helped hundreds of homeowners like you find the best policy for their situation.

In this article, we’ll show you the best way to compare homeowners insurance quotes. We will explain

- what homeowners insurance covers and what it doesn’t

- what factors affect your premium and your coverage

- ways to save money and get more value

- some of the common mistakes and pitfalls to avoid when comparing quotes

By the end of this article, you will have the confidence and the tools to successfully compare your quotes and land on the best homeowners insurance for you.

Compare Homeowners Insurance Quotes the Right Way By Following These Steps

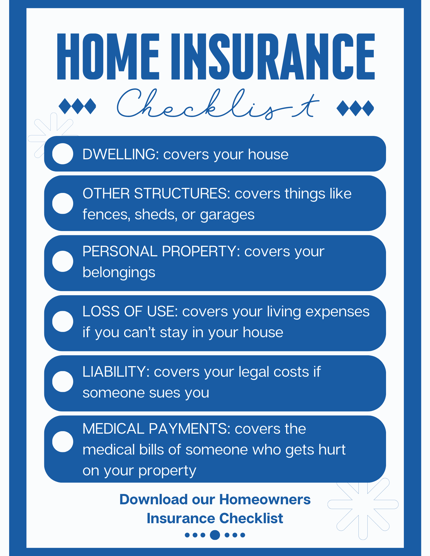

Homeowner’s insurance has six main parts. We call them the Big Six, but that’s not an official term. They are:

- Dwelling: covers your house

- Other structures: covers things like fences, sheds, or garages

- Personal property: covers your belongings

- Loss of use: covers your living expenses if you can’t stay in your house

- Liability: covers your legal costs if someone sues you

- Medical payments: covers the medical bills of someone who gets hurt on your property

Every home insurance company offers

these six parts. But how do you compare them? You need to look at two things:

- Coverage type: are you covered for replacement cost or guaranteed replacement cost?

- Coverage amount: how much money will the company pay if something happens?

Replacement cost means the insurer will pay the current cost of rebuilding or replacing your house or belongings. Guaranteed replacement cost means the company will pay more than the current cost if needed.

So, the first thing to compare is the guaranteed replacement cost coverage. This is the amount the carrier will pay if your house costs more to rebuild or replace than the coverage amount. Some companies will pay 25 percent more, some will pay 50 percent more, and some will pay any amount.

You should know how much replacement cost coverage you’re getting. This is important because you want to cover the full rebuilding cost of your house. You might wonder why your homeowners policy would come up short on coverage. Look no further than inflation.

Guaranteed replacement cost coverage pays for the full cost of rebuilding your house, regardless of inflation or appreciation. This means you don’t have to worry about the risk of being underinsured due to the rising prices of labor and lumber, which exploded in 2021.

Learn more about the benefits of guaranteed replacement cost coverage.

Compare Other Structures Coverage

The next thing to compare is the other structures coverage. This covers things like fences, sheds, or garages.

This coverage will be at least 10 percent of your dwelling amount. And $200,000 in dwelling coverage will yield an additional $20,000 for other structures. Some carriers automatically provide 20 percent or more for no additional cost. Still, that might not be enough for you.

You should check if you need more.

Some CNY residents don’t need more. They have a small shed courtesy of the Home Depot or a garage attached to their house. They have enough coverage with 10 percent or 20 percent.

But some residents need more. They have a large custom-built barn or a garage with an in-law suite. That requires more coverage for their other structures.

Compare Personal Property Coverage

The next thing to compare is personal property coverage. This covers your belongings. You don’t need to worry too much about this. Most companies offer the same coverage for personal property.

They’ll pay the current cost of replacing your belongings. They’ll also give you an option to increase your coverage if you have expensive items.

Most people don’t need to increase their personal property coverage. What is offered is usually enough to cover their belongings. But if you have expensive items, like jewelry, art, or electronics, you may want to increase your coverage. You can do this by adding an endorsement to your policy.

We go into more detail on the subject in our Scheduled Personal Property Coverage article.

For the record, every quote we do at Horan includes replacement cost coverage. You don’t have to worry about that issue with us. We always give you the best coverage unless you tell us otherwise.

Compare Loss of Use Coverage

Next on our comparison list is loss of use coverage. This is the amount the insurer will reimburse you if you have to live somewhere else because your house is uninhabitable. You should make sure you have enough coverage for your living expenses.

Some carriers will give you a dollar amount, like $88,000. Some will give you a time limit, like 12 months. Some will give you both.

You should think about how long it would take to rebuild or repair your house if something happens. It could take longer than you expect, especially if there is a weather event that affects many houses. You don’t want to run out of money or time before your house is ready.

Choose the coverage that makes sense for you. You can also add an endorsement to extend your coverage if you want. For example, if you live in a rural part of Cazenovia or Hamilton, you may have fewer options for temporary housing. You may want to have more money or time to find a suitable place to stay.

Compare Liability Coverage

Compare Liability Coverage

The next thing to compare is the liability coverage. This is the amount the company will pay if someone sues you for causing injury or property damage. You should make sure you have enough coverage for your legal costs. Most insurers quote $300,000, but some might come in lower.

Liability coverage in the amount of $300,000 as a kind of default has not changed for 25 years, but everything else has become more expensive. You may want to increase your coverage to $500,000 or more. The additional premium is minimal and worth it should you need to use the coverage.

You should also check if the quotes have the same liability coverage or not. If they don’t, you should know the difference. You may be paying less or more for a quote, but you may also be getting less or more coverage. You should choose the coverage that suits your needs and budget.

Compare Medical Payments Coverage

The last thing to compare is the medical payments coverage. This is the amount the carrier will pay if someone gets hurt on your property, but not so badly that they may want to sue you. You should make sure you have enough coverage for their medical bills. Some insurance companies will offer $1,000, but that may not be enough.

You can find $5,000 or more from most carriers. You may want to increase your coverage to that amount or higher.

The quotes may have different amounts of coverage. Be aware of the difference. The price of the quote may reflect the amount of coverage. You may pay more or less depending on the coverage. But pick the coverage that works for you.

In our experience, this is the best way to compare the standard coverage portion of homeowners insurance. You should compare these six parts across different quotes and carriers. Also, look at the optional coverage and endorsements that you can add to your policy. We will talk about them in the next section.

Compare Optional Coverages and Policy Endorsements

The next thing to look at is the optional coverage and endorsements. These are the extra features you can add to your policy or that the carrier includes in their policy. They can make your insurance better or more suited to your needs. They can also make your insurance more expensive or cheaper.

Take a Close Look at Jewelry Coverage

One optional coverage is jewelry coverage. This is how much the carrier will pay if your jewelry is lost, stolen, or damaged. You should know the limit and the conditions of this coverage. Some companies will give you a standard amount, like $2,500, for one piece of jewelry.

But they may only cover theft, not misplacement. Some companies will offer you more coverage or cover both theft and misplacement. You can add this coverage by paying more or by choosing a different policy.

Think about how much your jewelry is worth and how often you wear it. Also consider how likely you are to lose it or have it stolen. If you don’t care about your jewelry or don’t have any, you don’t need to worry about this coverage. You can skip it or keep the standard amount.

But if you care about your jewelry or have expensive pieces, you may want to increase your coverage or choose a policy that covers both theft and misplacement. You can do this by adding the scheduled personal property coverage endorsement we discussed above. For the most suitable policy, compare jewelry coverage across different quotes and insurers.

Compare Water and Sewer Backup Coverage

Any longtime Central New Yorker knows how hard a sump pump has to work. Especially as heavy spring rain melts the last 8 inches of snow in the yard.

So, another optional coverage to look at is water and sewer backup coverage. This is how much the carrier will pay if water or sewage backs up into your house from the drains, pipes, or sump pump. You should know that this coverage is not included in the standard policy. You have to add it by paying more or by choosing a different policy.

Water or sewer backup problems can happen to anyone. If plumbing runs throughout your home, you may want to have this coverage. But you should also compare the amount and the deductible of this coverage across different quotes and carriers. Some carriers will give you the same amount as your house coverage if you ask for it. But some will limit it to $10,000.

Some insurance companies will have a separate deductible for this coverage, which may be higher or lower than your regular deductible. You should know the difference and choose the coverage that works for you.

Learn more about water and sewer backup coverage by reading our companion article.

Compare Underground Service Line Coverage

Another optional coverage to look at is underground service line coverage. This is how much the insurer will pay if the underground utility lines serving your home are damaged. These may include several lines buried beneath your property, such as:

- sewer lines

- electrical lines

- water lines

- phone lines

- cable lines

You, as the homeowner, are responsible for those lines. And if your CNY house was built more than 40 years ago, you should give this some strong consideration.

You should know that this coverage is not included in the standard policy. You have to add it by paying more or by choosing a different policy. You should also compare the amount and the deductible of this coverage across different quotes and insurers.

Some insurers may offer more or less coverage than others. Some may have a separate deductible for this coverage, which may be higher or lower than your regular deductible.

Underground service line problems can creep up without notice. You may be sitting on top of aging Infrastructure that can give at any moment. Having this coverage will protect you from financial loss should the worst happen.

But you should also be aware of the exclusions and limitations of this coverage. It may not cover all types of damage or all types of lines. For example, it may not cover fuel tanks, heating and cooling systems, septic systems, or wiring or piping that runs through water.

Learn more about underground service line coverage.

This policy endorsement can help you avoid costly repairs and disruptions to your utilities. It can also cover the expenses of excavation and landscaping that may be needed to fix the damage. You should check if the quotes have this coverage or not. If they don’t, you should ask how you can add it to your policy. Then choose the coverage that works for you and your budget.

Review and Compare Your Regular Deductible

The last thing to look at is the regular deductible on your home policy. This is the amount you have to pay out of your pocket before the carrier pays for the rest of the claim. You should know how much your deductible is and how it is calculated. You should also compare the deductible across different quotes and companies. You may be able to lower or raise your deductible to change your premium.

Some carriers will offer a fixed dollar amount for your deductible, like $250, $500, or $1,000. Some will offer a percentage of your house coverage, like 0.5 percent or 1 percent. Some will offer both options. Consider how much you can afford to pay if something happens to your house.

Also, think about how often you expect to file a claim. If you have a higher deductible, you will pay less for your premium, but more for your claim. If you have a lower deductible, you will pay more for your premium, but less for your claim.

Review and compare the quotes and check to see if they have the same deductible or not. If they don’t, you should know the difference. You may be paying more or less for a quote, but you may also have a higher or lower deductible. You should choose the deductible that works for you and your budget.

That’s all for the optional coverage and endorsements. You should look at these extra features and compare them across different quotes and companies. You should also look at the total premium and the discounts that you can get. We will talk about them in the next section.

Compare the Discounts

Compare the Discounts

The last thing to look at is the total premium and the discounts. This is how much you have to pay for your policy and how much you can save by bundling or qualifying for other discounts. You should compare the total premium and the discounts across different quotes and companies.

You may be able to lower your premium by choosing a different company or a different policy.

One of the biggest discounts you can get is the multi-policy discount. This is when you have more than one policy with the same carrier, like home and auto. This can save you a lot of money on your premium. Verify if the quotes have this discount or not. If they do, this means your auto insurance is also with the carrier.

Some insurance companies may assume that you will bundle your policies and give you a discount, but that may not be true. You should confirm if you want to bundle your policies or not.

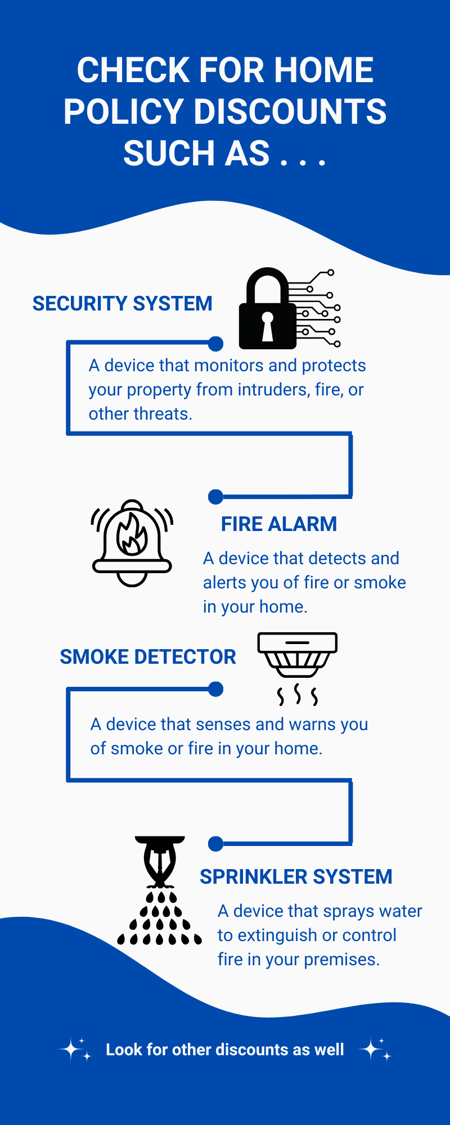

Also, check if there are any other discounts you can get. These may include discounts for having

- a security system,

- a fire alarm,

- a smoke detector, or

- a sprinkler system.

They may also include discounts for being a senior, a veteran, a teacher, or a member of a certain group. You should know what discounts you qualify for and what discounts the carriers offer. Compare the discounts across different quotes and insurers. Choose the ones that suit your needs and budget.

Protect Yourself from Surprise and Disappointment with the Right Homeowners Insurance Policy

We’ve discussed the best way to compare homeowners insurance quotes. We covered what factors affect your premium and your coverage. We also looked at some of the common mistakes and pitfalls to avoid when comparing quotes.

Armed with this info, you can find the best homeowners insurance policy for your home. You can protect yourself from financial loss. Peace of mind and confidence will accompany your choice. You can also enjoy your home and your life without worrying about the unexpected.

But if you don’t follow the advice in this article, you may end up with an inadequate policy. You may pay too much for too little coverage. You may miss out on important features and discounts. You may also face gaps and exclusions in your policy.

Don’t let that happen to you. Follow the advice in this article and compare homeowners insurance quotes the right way. Or better yet, let us help you.

As an established independent agency, we can do the work for you and find the best policy for your situation. Click the Get a Quote button below to get started.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: