What Happens to My New Policy if I Have a Claim?

March 1st, 2024

4 min read

Let’s say you’ve switched insurance companies in Central New York (or are about to). Now you’re asking what will happen if you have a car accident or a home claim early on? Will your new provider have your back, or leave you scrambling for coverage?

Here at Horan, we know navigating the complexities of auto and home insurance can be stressful. That’s why we’re here to shed light on what happens when claims and new policies collide, empowering you to make informed decisions with confidence.

We’ve been serving Central New Yorkers like you since 2009, tailoring auto and home policies to the specific situation and needs of our clients.

So, strap in as we explore the potential impacts of filing a claim during your first year with a new carrier. We’ll answer your burning questions and offer valuable insights based on our years of experience as a Baldwinsville insurance agency.

How Your Carrier May React to a Claim on Your New Auto Policy

Your previous insurance history matters when you switch to a new carrier. Here’s what will happen if you have a claim after your new auto policy starts.

Your carrier will keep you on the policy for the first term, even if you have a claim. They will pay the claim as usual. Some of them may offer first accident forgiveness and not raise your rate. Nothing will change in your policy during that term, whether it’s six months or 12 months.

But when it’s time to renew, the carrier may reconsider their relationship with you. They may decide to non-renew your policy. That means they don’t want to insure you anymore. They will tell you in advance, usually 45 days or more. Then you’ll have to look for another option.

A non-renewal is almost certain if you have a second claim during your initial term. That’s something you should watch out for.

Claim History Matters More Than Carrier History

Carriers hope they don’t have to pay claims on a policy, especially in the first year or two. But accidents happen and that’s why we have insurance. Some people worry that their new carrier will be less forgiving than their old one if they have a claim.

Carriers hope they don’t have to pay claims on a policy, especially in the first year or two. But accidents happen and that’s why we have insurance. Some people worry that their new carrier will be less forgiving than their old one if they have a claim.

That’s a reasonable concern, but the truth is any carrier will look at your previous five years. If you had two claims with your old carrier in the last five years and you have another one with your new one, they may both non-renew you. It doesn’t matter if you switch or not.

Your loyalty to your carrier may not matter as much as you think. Carriers like it when you have a long history with another company. It shows that you’re not a jumper. But they’re not as impressed by your loyalty to them.

This comes as a surprise to many. They think that being a loyal customer for a long time will earn them some appreciation. But the truth is most carriers are looking at the numbers.

Carriers will estimate the chance of you having a loss in your insurance lifetime. They will also consider how long you’ve been with them. If you’ve held a policy with them for 10 years without a claim, they may think you’re due for one soon. That means giving some money back to you.

So your 10-year loyalty is regarded in an entirely different light. Some carriers may decide that it’s time for you to obtain insurance elsewhere.

The 60-Day Rule for Home Insurance Claims

Your home insurance may be different from your auto insurance. The carrier can write a policy for you and still leave within 60 days. They can do that if they inspect your house and find problems.

For example, your roof, siding, handrails, or sidewalks may be in bad shape. These things may increase the chance of a loss. The carrier will do one of two things:

For example, your roof, siding, handrails, or sidewalks may be in bad shape. These things may increase the chance of a loss. The carrier will do one of two things:

- They will send you a letter and ask you to fix the problems before the 60 days are over. Or,

- they will cancel your policy.

That’s very important to know.

This is also why it’s critical to be honest and accurate when you talk to your agent about your house. They’ll ask you questions about the age and condition of your roof, furnace, and other things.

They need this information to assess the risk and the price of your policy. You may not remember the exact date of your roof replacement. That’s fine. But if you bought the house recently and you don’t know when the roof was done, that may be a problem. The carrier may inspect your house and find issues.

For example, tree limbs may be too close to the roof and need trimming. That may make them cancel your policy.

Learn how to avoid home policy denials by fixing 7 property issues.

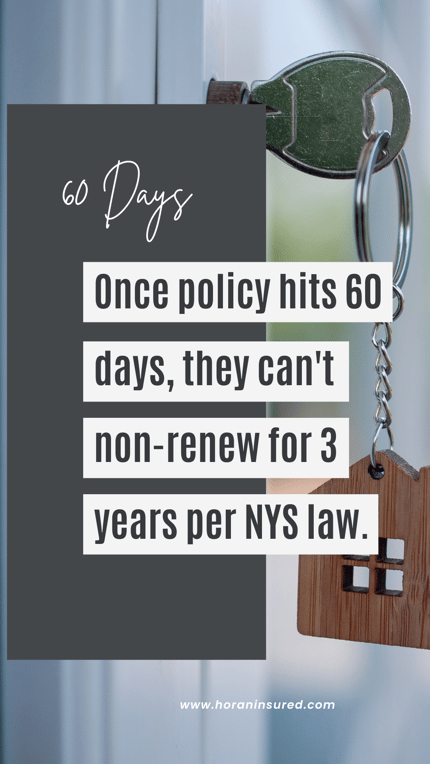

How New York State Laws Protect You From Home Policy Non-Renewal

If your home policy has been in effect for 60 days, your carrier can’t drop you for three years in New York State. That’s the law for home insurance. They have to stay on the risk, unless you don’t pay your bill.

So carriers are very careful when they write a policy. They don’t want to get stuck with a bad risk.

You can leave anytime, but they can’t. That’s a little known fact.

These are some of the things you should know if you have a claim in the first year. It depends on the type of policy you have.

We Can Guide You to a New Insurer with Ease

Maintaining a smooth relationship with a new insurer, whether for your car or home, likely won’t be derailed by one isolated incident. While a single claim won’t automatically trigger non-renewal, a pattern of accidents or property issues raises red flags.

By prioritizing safe driving, maintaining your home, and making informed choices, you can steer clear of unnecessary stress and ensure smooth sailing with your new provider.

Horan is committed to helping you navigate the ins and outs of insurance with confidence. Click the Get a Quote button below for a personalized quote and let us help you secure the right coverage for both your car and home.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: