A Guide to General Liability Insurance in Central New York

December 12th, 2023

14 min read

As a business owner in Central New York, you face many daily risks. You may have to deal with property damage, lawsuits, accidents, or other unexpected events that can hurt your bottom line. You need insurance to help protect your business from these threats. But not just any insurance. You need general liability insurance.

General liability insurance is the most basic and essential type of insurance for any business. It covers the bodily injury and property damage that you cause to others by your work or presence. It also covers the personal and advertising injury that you cause to others by your words or actions. It can save you from paying huge legal fees or settlements out of your pocket.

But general liability insurance is not enough. It doesn’t cover everything that can go wrong in your business. It has many exclusions and limitations that you need to be aware of. You may need other types of insurance to cover the specific risks associated with your business.

That’s why we created this guide. We want to help you understand

- what general liability insurance is,

- what it covers, and

- what it does not.

We want to help you choose the right general liability insurance for your business. We want to help you avoid the common pitfalls and mistakes that can cost you money and reputation.

We are Horan, an independent insurance agency in Baldwinsville, New York. We’ve been providing comprehensive insurance services since 2009. We have the experience, the knowledge, and the passion to help you secure your business future.

In this guide, we will walk you through the seven components of general liability insurance. We will explain each component in detail, with practical examples and insights. We will also show you the exclusions and limitations of general liability insurance and the other types of insurance you may need.

We will give you some tips and best practices on choosing the right general liability insurance for your business.

By the end of this article, you will have a clear and compelling understanding of general liability insurance. You will be able to make informed decisions about your insurance coverage. You will have more knowledge of what it takes to help protect your business from the risks you face every day.

Jump to Article Section

- How General Liability (GL) Insurance is Structured

- General Liability is the Foundation of Your Business Insurance Package

- "General Liability" is One Component of GL Coverage

- Bodily Injury and Property Damage Explained

- Policy Limits for GL Coverage

- How Legal Defense is Covered

- How Products and Completed Operations Coverage Works

- How Personal and Advertising Injury Works

- How Medical Payments and Fire Legal Coverage Work

- General Liability Coverage is Only the Beginning

- How to Get the Right Commercial GL Coverage for Your CNY Business

How General Liability Insurance is Structured

A commercial general liability policy covers many things. It has different components inside it. One of them is general liability coverage. This is what most people think of when they hear the term. But there are also other components, such as:

- Products and completed operations. This covers the liability for the products or services that you sell or provide.

- Personal and advertising injury. This covers the liability for any harm you cause to others through your words or actions, such as defamation, invasion of privacy, or false advertising.

- Medical payments. This covers the medical expenses for anyone who gets injured on your premises, regardless of fault.

- Damage to premises rented to you (or fire legal). This covers the damage you cause to the property that you rent for your business, such as a fire or a water leak.

These are the main components of a general liability policy. Each of them has its own details and exclusions. For this guide, we will give you a brief overview of what they are and why they matter.

General Liability Insurance is the Foundation of Your Business Insurance Package

The purpose of this guide is to introduce you to the concept of general liability insurance. If you’re a new or prospective business owner, you need to know that this is the minimum level of insurance you should have.

No matter what kind of business you run, you need to help protect yourself from the risks that come with it. General liability insurance is the first step to doing that. It covers the most common and basic claims you may face.

However, not every component of general liability insurance may be relevant or valuable to your business. Some of them may apply to you, and some of them may not. You cannot remove or add anything to the policy. It is a standard package that you have to accept as is.

If you want to customize your coverage, you need to look for other options, such as endorsements or package policies. These are ways to modify or combine different types of insurance to suit your needs. Depending on your business, you may need to add property insurance or other types of liability insurance, such as employment practices liability.

“General Liability” is Only One Component of Commercial General Liability Insurance

Let’s talk about how commercial general liability insurance works. Within its many components is general liability itself. It’s like a band that names a song on an album the same as the album title. They also have other songs on the album. With general liability, you have to accept the whole package. You can’t change it.

General liability coverage is the main component. It covers the slip and fall claims. It helps protect you from the harm that you cause to others by being there.

For example, if you’re a contractor and damage someone’s property or injure someone while working, that is general liability. But it has to be reasonable. You’re not liable for everything that happens because you’re there. You’re only liable for injuries or damage you cause or contribute to. That is the idea of general liability.

Bodily Injury and Property Damage Coverage Explained

What is Bodily Injury?

What is Bodily Injury?

Imagine you’re a restaurant owner in Canastota. In the evening, an elderly customer, Gus, enters and orders the usual. He sits at the table and eats for a while. Then Gus stands up to use the restroom. But Gus’s foot accidentally hooks the table leg, and he trips and falls.

Gus hurts his ankle, left knee, and shoulder. This is general liability, but the bodily injury portion. It doesn’t matter if you were negligent or not. It doesn’t matter if the floor was uneven or wet.

The customer got hurt at your place. That is enough. You have to file a claim under general liability coverage.

As mentioned above, general liability combines two types of coverage:

- bodily injury and

- property damage.

You have a single limit for each occurrence, which is the most your policy will pay for any claim involving both types of damage.

Examples of Property Damage

Property damage is when you damage someone else’s property by being there.

Say you’ve been contracted to paint a house in Camillus. You use a spray gun for the job. The wind blows the paint toward the neighbor’s Toyota Land Cruiser. Now the SUV has spots of Polished Slate blue exterior house paint on it. This is property damage. You caused it by being there.

Another example of property damage is if you’re repositioning your ladder and it slips. It hits the owner’s birdbath—which happens to be an expensive Italian import. The birdbath tips over and crashes onto the concrete patio. Pieces break off, and large cracks appear. This is also property damage. You wouldn’t have broken it if you hadn’t been there.

Property damage is not always clear. For instance, say you're a local plumber. You drive your van to a house to do a project, get too close, and damage the siding. That is property damage. But it’s not general liability. That falls under auto liability, a different type of insurance.

When you get out of the van, the damage you cause enters the domain of general liability.

Policy Limits for General Liability Coverage

Policy Limits for General Liability Coverage

General liability has a limit per occurrence. This is the maximum amount that the policy will pay for each claim. The usual limit is $1 million. You cannot go over this limit and still be covered. General liability also helps protect you from lawsuits. If someone sues you for the damage that you caused, the policy will pay for your legal defense.

This can be costly and complicated. Sometimes, the case will settle out of court. Sometimes, it will go to trial. You need to have enough coverage to handle the outcome.

You can increase your limit if you want more coverage. You can do this in two ways. One way is to buy a commercial umbrella policy. This is an extra layer of coverage that kicks in after you reach your limit.

Another way is to raise your underlying limit. This means you have a higher limit for each occurrence. You can have $2 million instead of $1 million. Some carriers offer this option.

You can also decrease your limit if you want less coverage. Some carriers allow this too. So you can have $100,000 instead of $1 million. But this is risky. You may not have enough coverage if something goes wrong. As a rule, you should have enough coverage to help protect your assets and income.

What We Strongly Recommend for an Initial General Liability Policy Limit

Our advice is to start with at least $1 million of general liability coverage. This is the minimum requirement for most places that ask for proof of insurance. You may need more depending on your business. General liability has a limit per occurrence and a limit per year.

The limit per year is the maximum amount the policy will pay for all claims in a year. The usual limit per year is $2 million. You can have multiple claims under this limit as long as each claim is under the limit per occurrence.

For example, you can have four claims of $300,000 each. That is $1.2 million in total. You’re still covered. But if you have one claim of $1.3 million, you’re not covered for the extra $300,000. You have to pay that out of pocket because you passed the per-occurrence cap of $1 million. That’s how it works.

How Legal Defense is Covered

If someone sues you for the damage that you caused, the policy will pay for your lawyer. This does not affect your limit per occurrence. It is a separate coverage. The insurance company will decide whether to fight or settle the case.

Sometimes, they will settle even if you’re not wrong. They will do this if it is cheaper than going to court. For example, they may pay $30,000 to settle a case that would cost $300,000 to defend. This may upset you, but it’s their choice.

Sometimes, they will fight the case if it’s serious. For example, if your paint roller hit and killed a child. They may believe you’re not responsible for that based on available information. They may go to the limit of your policy to prove your innocence. That is their choice too.

Sometimes, the insurance company will pay the claim even if it is small. For example, if you accidentally spray paint a Corvette, they will pay $30,000 to fix it. They will do this because it’s cheaper than fighting it.

How Products and Completed Operations Coverage Works

Another component of general liability is products and completed operations. It covers two different things. One is product liability. The other is completed operations. Let’s talk about product liability first.

Product Liability Coverage

Product liability is when you make and sell a product. The product causes harm to someone who uses it. For example, if you make a dip or a jam and someone gets sick from eating it. Or if you make a toy and someone gets hurt from playing with it. This is product liability. It’s not general liability. It is not about being there. It’s about making something that causes harm.

Product liability is part of commercial general liability. But it’s not enough for all products. Some products are riskier than others. For instance, you might make children’s toys that have small parts. The small parts can choke children. This is a serious risk. The same applies if you make foods with allergens. You need a special product liability policy for these products. General liability will not cover it.

Completed Operations Coverage

Completed Operations Coverage

Now let’s look at completed operations. This coverage is important for contractors.

Say you’ve been hired to build a deck for a vacation home in Lacona. The house is on a slope. The deck is high above the ground. You also build a staircase and a railing. You finish the job and get paid, so you leave. Everyone is happy. But a few days later, the wife, Tammy, goes to the deck. She leans on the railing, and it breaks. Tammy falls to the ground and breaks her neck.

This is terrible. How did this happen? It happened because you forgot to screw in the railing. You were in a hurry and made a mistake. This is completed operations. You gave the client something that was done. You said it was done. You left. If you were still working on it, it would be general liability. But you weren’t still working. You were done.

That is the difference. Completed operations covers the harm your work causes after you complete the project and leave.

Products and Completed Operations Policy Limit

Products and completed operations has the same limit as general liability. It’s usually $1 million per occurrence and $2 million per year. You need to have enough coverage for this. You never know what can happen after you leave.

You can choose your limit for general liability. You can have more or less than $1 million per occurrence and $2 million per year. But you should have enough to cover your risks. Most places require at least $1 million of general liability coverage.

How Personal and Advertising Injury Works

Personal and advertising injury cover two different things. One is personal injury. The other is advertising injury. Let’s talk about personal injury first.

Personal Injury Coverage

Personal injury is when you harm someone’s reputation or privacy. For example, if you post a picture of a client on social media without their permission. You also reveal their personal information, such as their name, birthday, age, family, and address. You think you’re being nice and friendly. But you’ve violated their privacy and rights.

They can sue you for personal injury. This is a serious matter. Never do this. Be careful to respect your clients’ privacy and dignity. This is personal injury. It’s part of general liability. It will cover you if you make this mistake. But you should avoid it.

Advertising Injury Coverage

Advertising injury is when you harm someone else’s business or reputation by your advertising. For example,

- if you say something negative or false about your competitor, or

- if you use someone else’s name or image without permission, or

- if you copy someone else’s work or idea.

This is advertising injury. It’s not personal injury. It’s not about harming someone’s privacy or dignity. It’s about harming their business or brand.

Advertising injury can lead to lawsuits. Here are some examples:

- Taco Bell used 50 Cent’s name and image in an ad without his consent. He sued them for defamation. He said the ad damaged his reputation.

- Survivor sued Newt Gingrich for using their song “Eye of the Tiger” in his political campaigns without their consent. They sued him for copyright infringement. They said he violated their rights.

- Red Bull used the slogan Red Bull gives you wings. They faced a lawsuit for false advertising. The plaintiffs said the slogan misled consumers about the product’s effects. Red Bull settled the case and changed their marketing.

These are examples of advertising injury. It’s part of general liability. It will cover you if you make these mistakes. But do your best to avoid them. Be mindful to include honesty and respectfulness in your advertising.

How Medical Payments and Fire Legal Coverage Work

The last two parts of general liability are medical payments and damage to premises rented to you, otherwise known as fire legal. Let’s talk about them.

Medical Payments Coverage

Medical payments are when someone gets hurt at your place of business or because of your work. You don’t want them to sue you. You want to pay for their medical bills. The policy will do that for you. You just need to notify the carrier and cooperate with them.

The usual limit for medical payments is $5,000. You can have more or less if you want. But it’s not a lot of money. It’s just a way to avoid lawsuits.

Fire Legal Coverage

Damage to premises rented to you is also known as fire legal. It’s when you rent a space for your business and accidentally cause a fire or other catastrophic loss like a burst pipe or explosion. For example, if you plug too many tools into one outlet and start a fire. It burns the whole building, which has five units. Each unit is the same size, one of which you rent. The other four units belong to other businesses.

You’re liable for the damage you cause to the other units. But you’re not liable for the damage you cause to your own unit. You have a contract with the landlord. You have to take care of your own unit. The general liability portion of the policy will pay for the damage you cause to the other units. This is where fire legal coverage steps in.

Fire Legal Policy Limits

The limit for fire legal coverage is usually $1 million. However, some carriers may offer lower or higher limits, depending on the policy and the carrier. The limit you choose should match the cost of repairing or replacing the premises you rent or lease in case of a fire.

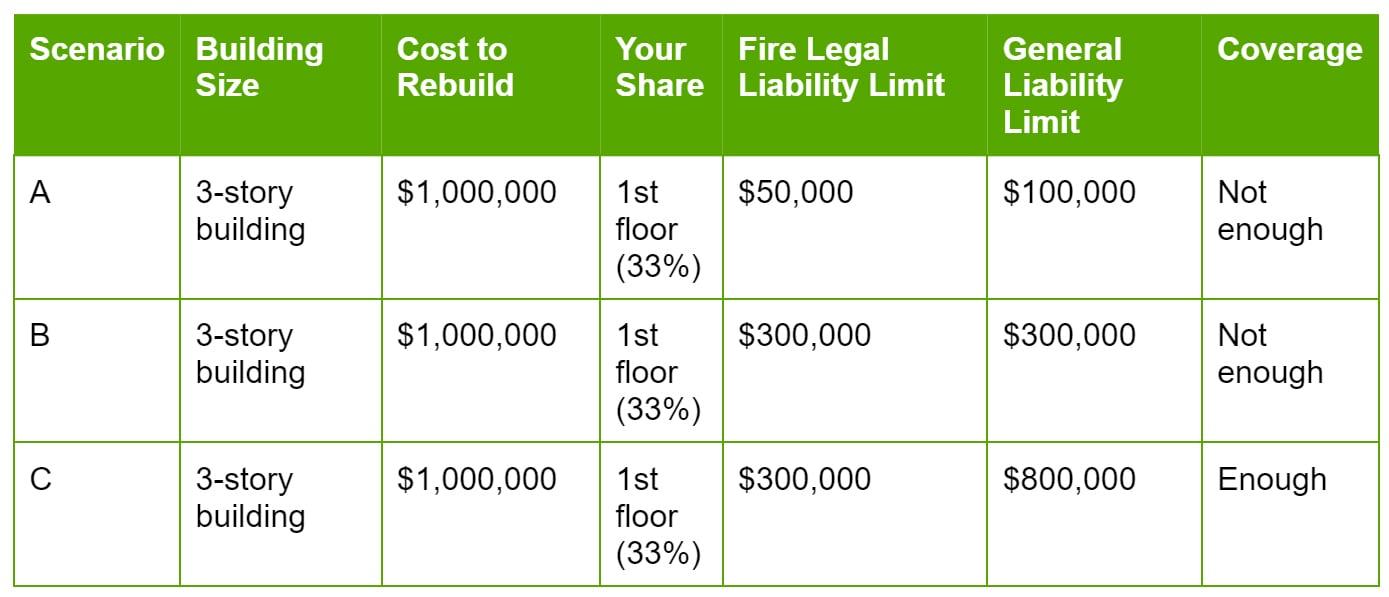

Let’s do the math. Suppose you rent a building that costs $900,000 to rebuild. If a fire damages your space and the rest of the building, you’re responsible for the repair costs. The amount you have to pay depends on your general liability insurance limit and your fire legal liability coverage.

For example, say you have $1 million in general liability insurance and $300,000 in fire legal liability coverage. If the fire causes $300,000 worth of damage to your space and $800,000 worth of damage to the rest of the building, your insurance will cover the following:

- Your fire legal liability coverage will pay for the $300,000 damage to your space.

- Your general liability insurance will pay for the $800,000 damage to the rest of the building.

In this case, you’re fully covered and don’t have to pay anything out of pocket. However, if the damage exceeds your insurance limits, you will have to pay the difference. You may not be covered if the building is bigger or more expensive. You may have to pay the difference. That is how it works.

The fire legal liability limit may vary depending on the carrier and the policy. Some carriers may offer as low as $50,000 or $300,000, while others offer up to $1 million or more. You shouldn’t overlook this limit. Pay close attention to it. The fire legal limit could make a big difference in how much you have to pay in case of a fire.

Fire Legal Coverage in Action

To illustrate, imagine you rent a large portion of a three-story building—say, the first floor. If you cause a fire that damages the entire building, you’re liable for the repair costs of your space and the rest of the building. If your fire legal liability limit is too low, you may not have enough coverage to pay for the damage to your space.

If your general liability limit is too low, you may not have enough coverage to pay for the damage to the rest of the building. Either way, you will have to pay a large amount out of pocket.

You should choose a fire legal liability limit that matches the size and value of your rented space. Also, choose a general liability limit that matches the potential damage you could cause to the rest of the building. Consult with your insurance agent to find the best option for your business.

But General Liability Insurance is Only the Beginning for Many CNY Businesses

General liability is a big policy. It has many parts and covers many risks. It’s the engine of your commercial insurance, and you need it for your business. Since it’s the foundation of your coverage, you shouldn’t skimp on it. Get enough coverage to meet the risks associated with your business.

You should understand what the policy covers and what it doesn’t. Also, review your policy regularly and update it as your business changes.

General liability may not be enough for your business. It doesn’t cover everything that can go wrong. It has many exclusions. These are things that aren’t covered by general liability. You should know what they are and get other types of insurance to cover them.

Here are some examples of exclusions:

- Errors and omissions: This is a type of liability insurance that covers your business against claims of inadequate work or negligent actions in your professional services. For example, if you are an accountant and you file a wrong tax return for a client. They can sue you for errors and omissions. You need a professional liability policy for this.

- Directors and officers: This covers you for claims from your actions as a director or officer. It can help you pay for your legal costs and help protect your assets and reputation. It can also reimburse the company or organization for defending you.

- Commercial auto: This type of car insurance covers vehicles used for business purposes. It can help you pay for damages and injuries caused by your business vehicle in an accident. It can also help protect you from lawsuits and claims by other parties. You need a commercial auto policy if you or your employees drive for work.

- Spoiled property: This coverage is for when your property gets damaged or destroyed by something out of your control. For example, if you’re a restaurant owner and lose your food due to a power outage. You can’t sell your food or serve your customers. You need a property insurance policy for this.

These are some things that aren’t covered by general liability. There are more. You should read your policy carefully and understand what it covers and what it doesn’t. Be sure to get the right insurance for your business. For many CNY businesses, general liability may not be enough coverage. It’s usually just the start.

How to Get Commercial General Liability Coverage for Your CNY Business

We know that insurance can be complex and confusing. There are many factors and variables that can affect your insurance options. There are many risks and challenges that can change your business situation and goals. There are many questions and doubts that can arise as you navigate the insurance world.

That’s why we’re here for you.

Together we can help you find general liability insurance for your business. We can help you customize your policy to fit your specific business and budget. We can help you review your policy regularly and update it as your business changes.

But remember, general liability insurance may not be enough for your business. It’s not all-encompassing insurance coverage. You may need other types of insurance to cover your specific risks.

If you overlook these facts, you may face serious consequences. You may have to pay huge legal fees or settlements out of your pocket. You may lose your business assets or income. You may damage your business reputation or brand. You may jeopardize your future.

Don’t let this happen to you. Take action now and get the right general liability insurance for your business. Click the Get a Quote button below to start securing coverage for your business.

See how general liability works with diverse businesses in CNY, whether you're a

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.