A Comprehensive Horan Guide to Renters Insurance

May 27th, 2024

10 min read

You're considering renters insurance, but you don't want to make an uninformed decision. You worry about buying a policy that isn't quite right for your situation and you're not sure where to start or what coverage you actually need.

At the Horan insurance agency, we understand these concerns. As an independent agency working with multiple carriers in Central New York, we can provide information and guidance to help you explore coverage options that address your insurance requirements.

In this guide, we'll work to clear up the confusion around renters insurance. We'll cover who needs it, what it does and doesn't cover, and how to find coverage that fits your situation.

By reading to the end, you'll have information to help you make informed decisions about insuring your belongings with a renters insurance policy.

Jump to Article Section

- Who Should Consider Getting Renters Insurance?

- What Does Renters Insurance Cover?

- High-Value Item Coverage

- Is Renters Insurance Expensive?

- Discounts on Renters Insurance

- What's Not Covered by Renters Insurance?

- We Can Help You Explore Renters Insurance Coverage Options

Who Should Consider Getting Renters Insurance?

While it may seem obvious that anyone who rents an apartment, condo, or home needs renters insurance, they're not the only candidates. You don't have to pay rent to another party to qualify for a policy.

Renters insurance is for someone who lives in a space they don't own and isn't related to the owner or tenant. At first, this can seem unclear, so let's explain by including some examples.

The Primary Tenant

If you're the person renting the unit (apartment, house, condo, etc.), then you qualify for renters insurance. If you're related to the tenant, then you're covered by the renter's policy.

Examples include a spouse, children, parent, sibling, etc. If someone is legally in the family tree by birth, marriage, or adoption, they're covered by the tenant's renters policy.

The Roommate Situation

Have you moved in with your BFF for whatever reason? Whether you pay rent or not, you and your property won't be insured by their policy. A renters policy in your name will provide the necessary coverage for your belongings and liability.

The Live-In Partner

The Live-In Partner

You snag a snazzy seventh-floor apartment with a balcony view of the Syracuse skyline. Your boyfriend or girlfriend moves in with you and brings all their belongings. They're not covered by any existing renter's policy that may be in place. In this case, you can talk to your agent about

- adding that person to the policy, or

- having them secure their own policy.

Before adding someone to your existing renters policy, review the coverage details in the next section to help ensure you maintain adequate coverage for your belongings and liability.

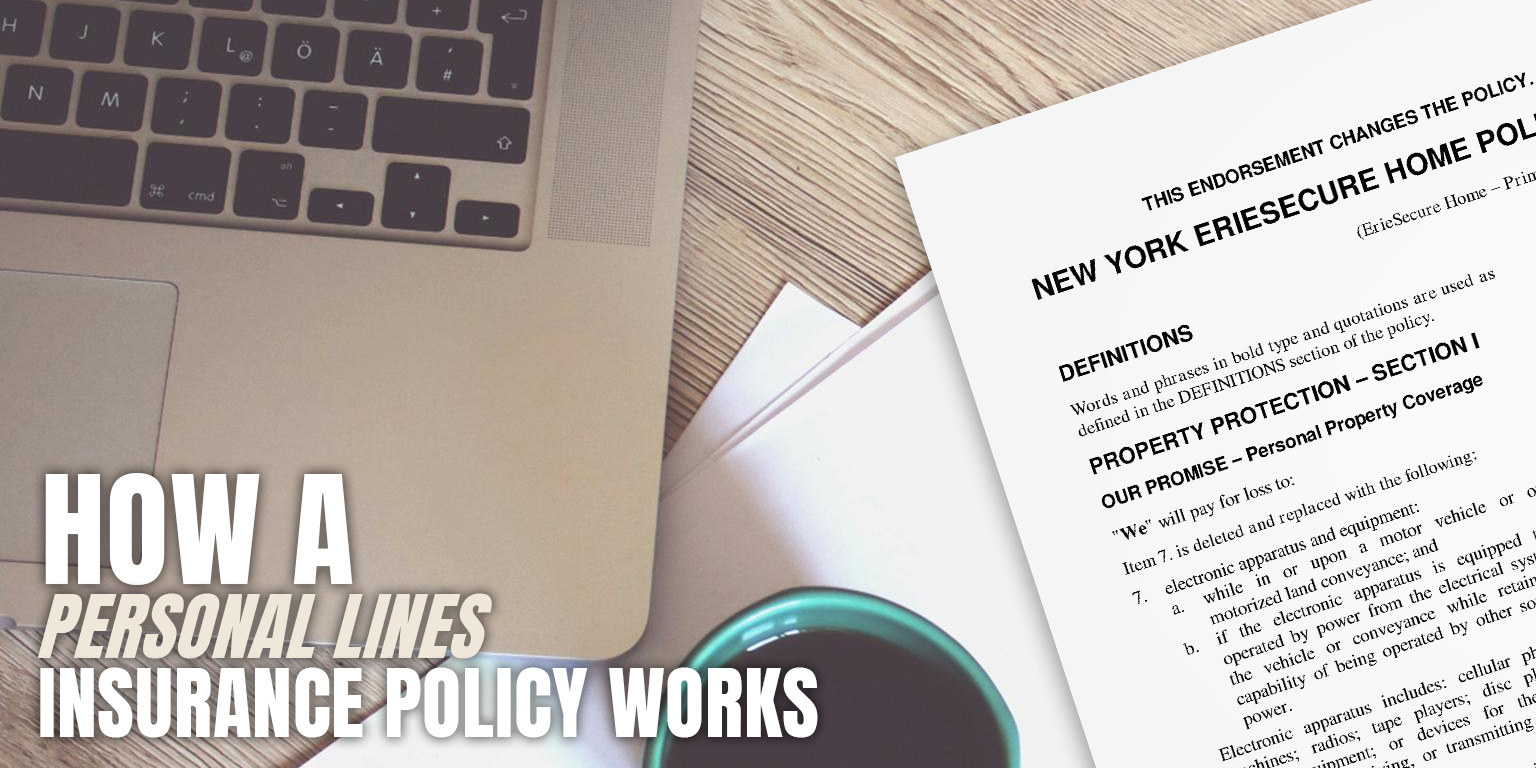

What Does Renters Insurance Cover?

Most renters policies have three categories of coverage. Specifically, they'll cover

- your personal property,

- provide liability coverage, and

- cover additional living expenses if you temporarily can't live in the unit you're occupying due to a covered event.

Like any other insurance policy, to make a claim, there must be an event that the insurance company covers. Common events include

- fires,

- broken water pipes, or

- damage from a leaking roof during high winds.

Typically, there will be coverage if something you own is vandalized or stolen.

Insurance carriers can differ in how they describe what events qualify. Still, events that are typically covered are those that are out of your control or accidental in nature. Let's review the three categories in more depth.

Personal Property Protection

This type of property includes your furniture, clothing, kitchen cookware, TV, and other electronics. An item is considered personal property if you can pick it up and move it around. So how much personal property coverage should you include with your policy? That depends on how much "stuff" you want to be covered.

If you just moved away from home and have your first apartment, you likely have less personal property than a family of four renting an entire house.

A helpful approach is to take inventory of your personal property and estimate how much it would cost to replace everything. That's how much personal property coverage you should consider requesting when getting quotes.

Estimating Your Personal Property Coverage Needs

To use an exaggerated example, if you only include $10,000 in your policy and all your belongings are destroyed in a fire, could you replace them all? If you learn after the fact that it will cost you $30,000 to cover everything, you'll only receive $10,000.

On the other hand, if you include too much coverage, then you're paying more than you need to for coverage you'll never be able to use. A good exercise is to take a video of each room and estimate what it would cost to replace those items.

You don't need to get down to the penny; you need to get "close enough." If you want to increase the amount of coverage you purchase as a "cushion" or "margin of safety," that's a decision you can make after you get a quote.

|

Coverage Amount |

Potential Outcome |

|

✘ Underinsured |

Receive less money than needed to replace belongings |

|

✔ Adequately Insured |

Receive enough money to replace belongings |

|

✘ Overinsured |

Pay more money for coverage than the value of belongings |

What if you're living in a furnished unit? That means you don't own all the items, yet they're still considered personal property. If your lease agreement makes you responsible for the personal property included with the unit, then your renter's policy may be able to cover those items..

Discuss this with your agent during the quoting process to help determine if your rented furnishings can be adequately covered.

Liability Coverage

This portion of the renter's policy will provide coverage for you if someone is injured, and you're legally responsible. This coverage extends beyond where you live and follows you wherever you travel.

The amount of liability coverage typically starts at $100,000, and you can often increase that amount. The increase in cost is usually very little compared to the amount of coverage offered.

If your dog bit someone and you were sued, it's your liability coverage that would be used. Both legal fees and potential judgments are picked up by your carrier through the liability portion.

If your dog bit someone and you were sued, it's your liability coverage that would be used. Both legal fees and potential judgments are picked up by your carrier through the liability portion.

If you want an umbrella insurance policy, you may be required to have a higher amount of liability insurance on your renter's policy. This is known as your underlying coverage, and can vary depending on the insurance company.

Learn more about personal umbrella coverage.

Additional Living Expenses Coverage

If where you live is damaged by a covered event, like a fire or broken water pipe, you may need to live somewhere else while repairs are completed. That often creates additional expenses above and beyond your typical day-to-day costs. If you temporarily move into a hotel, that's an additional cost.

If you eat out more often because of not having a kitchen, that additional cost may be included. If you must drive further to work due to the temporary housing, that may also be covered. It's important to note that not all these costs are covered, only the increase in the cost.

The entire hotel bill that exceeds your rent may be covered since that's a new cost. If your monthly rent is $850, then everything exceeding $850 may be covered. If you're still required to pay rent while repairs are completed, your entire hotel bill may be covered.

If you usually spent $200 per week for food and now you spend $300 because you must eat out more often, the extra $100 may be covered. If your commute is longer due to your temporary housing, the extra fuel cost may be covered, not your entire fuel cost.

High-Value Item Coverage

As discussed previously, personal property coverage allows you to choose the amount of coverage you want based on the inventory of your belongings. However, for some items you own, there can be limits on the amount the insurance company will pay if they're lost or damaged.

You may have an expensive piece of art or a fine piece of jewelry that would be very expensive to replace. Many policies will limit the amount of coverage to $2,500 regardless of what that item may be worth.

A portrait painted by your Aunt Edna and a portrait painted by Van Gogh will have very different values. Because the value of these belongings can vary, insurance companies have a cap on how much they'll pay out.

However, you can add specific items to the policy with an appraisal from a qualified source. Suppose the Metropolitan Museum of Art curator verifies in writing that you own a Van Gogh painting and estimates its value. In that case, the insurance company may accept that as confirmation.

If Uncle Bob hands you a handwritten note with his estimate of Aunt Edna's painting, that estimate of value won't be held to the same level of acceptance. The same would apply to the value of a piece of jewelry.

While you may have a number in your head regarding the value of Grandma's engagement ring, a certified jewelry appraisal is typically needed from an insurance company's perspective.

You can have these items added to your policy, and each item will be charged an amount to insure in full. You can learn more in our article: Scheduled Personal Property Coverage: Insuring Your Most Valuable Things.

Is Renters Insurance Expensive?

Renters insurance is very inexpensive. The most significant factor that can move the cost is the amount of personal property you include in the policy.

- Do you have all your worldly belongings after graduating from college in a studio apartment?

- Or do you have a family of four renting a home?

- Are you including the Van Gogh painting discussed above in your policy?

- Or are you proudly displaying your child's elementary artwork on the fridge?

The amount of personal property you include and the volume of highly valuable items you add to a policy will increase the total cost.

But to guide you, the policy for the studio apartment with nothing else being added could be less than $150 for the year.

The cost will increase for a family of four, but it won't be as expensive as a homeowner's policy because you're not insuring the structure, only your personal belongings.

Other factors are involved when getting any insurance policy, like your history of claims and your credit profile, so the above number of $150 is a moving target and will vary from one insurance company to the next.

We included that as a guide so that no one thinks the cost will be thousands of dollars. For the value, those who don't own the space they occupy should consider having one of these policies.

Discounts on Renters Insurance

As we mentioned, renters insurance is very inexpensive, so while there are ways you can save money, the list is not as long as a homeowner or car policy. For example, if you bundle your car and renters policy with the same insurance company, there can be potentially more significant savings on your car policy.

It's not uncommon for the savings on your car policy to be more than the cost of a renters policy, meaning you may be able to get the renters policy essentially for a reduced overall cost or even free.

In that situation, not only are your personal belongings covered, you have added liability coverage, and your overall insurance expense may go down.

Many companies will provide you with a multi-policy discount, so ask your agent. Other potential discounts may be offered to those folks with no history of making claims or if you're willing to receive communications via email rather than snail mail.

What's Not Covered by Renters Insurance?

Like every other insurance policy in existence, renters insurance doesn't cover everything.

- A life insurance policy won't pay for damage to your car.

- Your health insurance won't pay to replace your stolen iPad.

- Your renter's policy won't pay for your personal property in every circumstance.

The following sections will review events that are excluded from the policy. Please note that this is not a complete list, so just because it's not listed here doesn't mean you have coverage.

These are the most common exclusions from coverage, and each insurance company will have its own list, so make sure you ask your agent about exclusions.

Roommates' Belongings

Roommates' Belongings

If you have a roommate unrelated to you, your policy doesn't cover their property. Your renters policy won't cover your boyfriend's or girlfriend's belongings, even if you live together. Remember that your policy only includes a value for personal property that you determine at the time you purchase the policy.

Roommates should have their own policy for all the reasons already discussed. Some folks have been partners for a long time and split the cost of living expenses, and their cars are registered to the same address.

If it can be documented that the relationship is more than a “live-in friend,” the insurance company may add the partner to the renter's policy. But don't assume that your definition of “partner” automatically includes that person in your policy.

The idea of “love at first sight” and “happily ever after” are lovely, but most insurance companies desire more proof of history before allowing someone to be added.

Flood Damage

Flood Damage

Most of us think of a flood and imagine a river or lake rising over its banks and causing significant problems for a wide area. While that is a flood, the impact area doesn't need to be that large. The definition of a flood is:

“A general and temporary condition of partial or complete inundation of 2 or more acres of normally dry land area or of 2 or more properties (at least 1 of which is the policyholder's property).”

We suggest you read the flood description on the Federal Emergency Management Agency (FEMA) website.

It's essential to point out "2 or more properties" in FEMA’s definition, and the property size is not part of the definition. If you live in a residential CNY neighborhood of any kind, and a pool of water collects in your yard and your next-door neighbor's yard, that's a flood.

Your renter's policy won't cover any damage caused by this flood. You can purchase a flood policy separate from a renters policy, and the same agent with whom you have renters insurance should also be able to assist with exploring that coverage option. Further information is available at the FEMA Flood Insurance website.

Earthquake Damage

Most folks know earthquakes are caused by underground shifts that often cause shaking on the earth's surface. Renter's policies don't cover damage caused by earthquakes, but that can be available as a separate policy, much like flood insurance.

Some insurance companies allow you to add a rider for earthquakes instead of getting a separate policy, and your agent will be able to help you explore that option.

Many policies include other events in this section, specifically mudslides and earth movements.

An example is an Oswego home built on the side of a hill, and after years of slow erosion, the hill shifts. If these events destroy your patio and accompanying furniture, there will be no coverage.

An example is an Oswego home built on the side of a hill, and after years of slow erosion, the hill shifts. If these events destroy your patio and accompanying furniture, there will be no coverage.

The outcome is the same for a mudslide impacting the structure where you live. Any damage would also not be covered. In many areas of the country, this is not a serious concern.

But if you live in a Central New York area that experiences frequent earthquakes, you need to factor this into your conversation with your insurance agent. Here in CNY, we aren't concerned about earthquakes like in California.

Sewer and Water Backup

Sewer and water backup can occur when the line going out of the house gets plugged, and the drain backs up. Or perhaps your sump pump failed and stopped working. Your renters policy won't cover damage in this scenario.

However, a sewer and water backup endorsement is an example of coverage that can often be added to your policy. You can decide how much coverage you want. The more you want, the higher the cost.

Homeowners and renters policies have very similar exclusions to coverage, except that a renters policy doesn't cover any structure like a home or apartment building. More details are available by reading What Your Homeowners Insurance Does Not Cover and How to Fix It.

We Can Help You Explore Renters Insurance Coverage Options

We've covered key aspects of renters insurance, from who needs it to what it does and doesn't cover.

At the Horan insurance agency, we work to be a resource and advocate for Central New York renters, providing information to help guide you through the process of exploring coverage options. Our experience, gained from working with a range of carriers since 2009, allows us to offer insights and information to address your specific insurance requirements.

By considering the information in this guide, you'll have knowledge to help make informed decisions about insuring your belongings. Without renters insurance, you could be vulnerable to financial loss and stress in the event of an unexpected disaster.

Let us help you explore renters insurance coverage options that address your insurance requirements.

Click the Get a Quote button below to start the conversation and take the first step toward helping to protect what matters most to you.

Also be sure to read Why Young Renters in CNY Need Renters Insurance.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: