Is Everyone Who Lives in or Visits Your Home Covered by Your Home Insurance Policy?

August 2nd, 2023

5 min read

Do you have family members, friends, renters, or guests staying with you or visiting you often? If so, you may be wondering who is covered by your homeowners policy.

Do you know what would happen if someone gets hurt or damages your property or if you need to make a claim?

This could cause confusion and anxiety, especially if you have people living with you or visiting frequently. There are also possible gaps in your coverage and the need for extra insurance you may be unaware of.

We know that your home is more than just a building. It’s where you and your loved ones live, laugh, and create memories. It’s also where you welcome your friends, relatives, and guests.

You want to make sure that everyone who enters your home is safe and protected, and that you’re not liable for any accidents or mishaps that may occur.

That’s why we wrote this article, to help you understand this aspect of your homeowners policy. We want to give you peace of mind and confidence that you have the right coverage for your unique situation.

We’re a local and experienced agency that has been writing homeowners policies for CNY homeowners for years. We understand the diverse and dynamic living situations of our clients, who may have guests, extended relatives, best friends, or other people staying with them or visiting them regularly.

This article will help you understand what your homeowners policy covers, who is covered by it, who are not, and how to get more coverage if you need it.

By reading this piece, you’re demonstrating that you’re a wise and savvy homeowner who knows the importance of having the right policy for your home. You’re proactive and diligent in researching the best options and features for your coverage.

Who is Covered By Your Homeowners Policy?

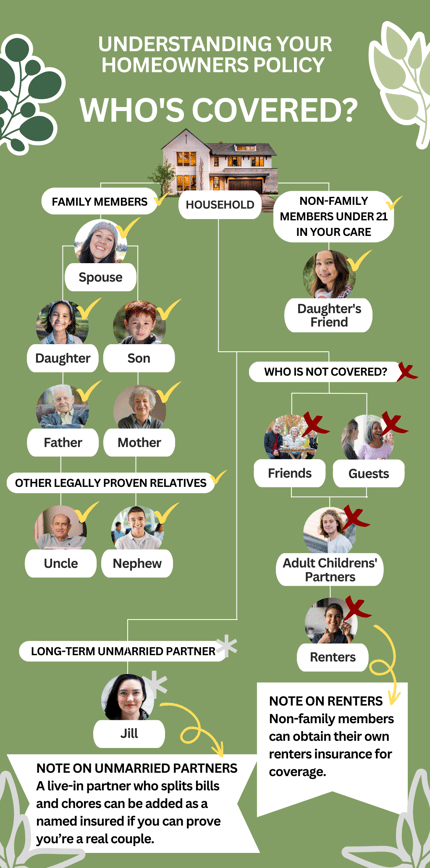

Family Members

Your homeowners policy automatically covers your family members who live with you. This includes your spouse, children, parents, and other relatives connected to you by a legal document, such as a marriage certificate, birth certificate, adoption decree, etc.

For instance, your aunts, uncles, and cousins are considered family members if you can prove your relationship through your parents’ birth certificates.

However, your spouse or adopted children are the only family members you can choose. Your policy covers them regardless of where they live. Other family members are covered only if they reside in your household. You can still ask them to leave your property if you want to.

Non-Family Members

Your homeowners policy covers one exception to the family rule. If your child has a friend under 21 who lives with you and depends on you for their basic needs, such as food and shelter, they’re covered. This is because they’re considered under your care, just like your child.

However, this coverage ends when they turn 21. After that, your homeowners policy will not cover them anymore.

Who is Not Covered By Your Homeowners Policy?

Your homeowners policy doesn’t cover anyone who isn’t a family member or a child under age 21 under your care. This means your friends, guests, or adult children’s partners are not covered while they stay with you or live with you. It doesn’t matter how long they stay or what their reason is.

- Do your friends need a place to crash while their kitchen is being renovated? They’re not covered by your policy when they’re in your home.

- Say your college buddy wants to stay with you for a couple of weeks—doesn’t matter why. They’re not covered.

- Your child’s 30-year-old partner moves in until they find their own place. The partner isn’t covered until they marry your child.

- Your girlfriend/boyfriend lives with you or stays with you. They’re not covered even if they live there full-time.

The One Exception to This Aspect of Homeowners Coverage

The One Exception to This Aspect of Homeowners Coverage

The only exception is if you have a long-term partner you’re not married to who lives with you and shares the household expenses and responsibilities. You may be able to add them to your policy as a named insured if you can prove you’re a couple in every way except for marriage. A named insured is equivalent to the owner of the insurance policy and, like the owner, will be designated by name in it.

This means that both of your cars are registered to your address, and you both contribute to the household income and chores.

However, this exception is not automatic. You have to contact your insurance company and request to add your partner as a “named insured.” If you don’t do this, they will not be covered by your policy.

Adding them as a “named insured” usually doesn’t affect your premium, so it’s a good idea to do this if you have a long-term partner living with you.

People Who Rent From You Aren’t Covered.

If you charge someone to stay in your home, they’re considered a renter and are not covered by your policy. This applies even if they’re your friend or relative and offer to pay you some money to help with your expenses. Accepting money doesn’t make them part of your household or your policy.

Renting Your Home Through Airbnb or Other Services.

You may be tempted to rent your home or a part of it through Airbnb or other online platforms. However, this could affect your coverage in two ways.

- The people who rent from you aren’t covered by your policy for any injuries or damages they may cause or suffer.

- You may not have coverage for your own home if something happens while you have renters. Some insurers may consider this a business activity and exclude it from your policy.

You shouldn’t assume that your policy covers you for renting your home. You should check with your insurance agent before you do so and find out what options you have. You may need to buy additional coverage or switch to a different policy.

You can learn more about this issue in the article Is Airbnb Hosting Covered by Home Insurance?

How to Get Coverage For Non-Family Members

If you have non-family members who live with you or stay with you frequently, they can get their own coverage by buying a renters insurance policy. This policy will cover their personal property and their liability for any injuries or damages they may cause to others. It will not cover your home or affect your policy in any way.

Renters insurance is very affordable and easy to get. You can find out more about the different types of coverage that renters insurance offers in our comprehensive renters insurance article.

Protect Yourself and Your Household Members with the Right Homeowners Policy

By referring to this article and applying what we’ve discussed, you’ll benefit from having a clear and accurate understanding of who is covered by your homeowners policy. And there’ll be no unpleasant surprises or disputes with your insurer if you need to file a claim.

You’ll also be able to protect yourself and your assets from potential lawsuits or liability claims that may arise from accidents or damages involving people who live in or visit your home. Getting additional coverage for non-family members who need it, such as renters insurance or named insured status, won’t confuse you.

Peace of mind and confidence will be enjoyed because you’ll know how to get the right coverage for your home and household members.

So don’t overlook the advice in this article. If you do, you may end up with gaps in your coverage or unexpected expenses. You may also face legal troubles or disputes with your carrier. You don’t want to risk losing your home or savings because of a lack of knowledge or action.

But you’re reading this because you’re not willing to settle for a generic or inadequate policy that may leave you vulnerable or exposed. You want to make sure that you and your loved ones are fully protected and that you get the most value for your money.

We’re rooting for you to have the best homeowners experience, which is why we’re here to help you to that end.

We have the expertise and knowledge to help you find the best coverage for your needs and budget. We can review your current policy and identify any gaps or exclusions that may put you at risk.

We know how to tailor your policy to cover everyone who lives in or enters your home and to protect you from any liability claims that may arise. To get this started, click the Get a Quote button below, and one of our insurance specialists will reach out to you with the next steps.

If you’d rather speak via phone about coverage options for your current policy, call 315-635-2095.

To read about another topic that may interest you or affect your coverage, learn how to insure your most valuable things—such as jewelry, art, or collectibles—by reading Scheduled Personal Property Coverage: Insuring Your Most Valuable Things.

It will help you understand how to make sure your prized possessions are adequately covered in case of theft, damage, or loss.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.