Is Airbnb Hosting Covered by Home Insurance?

August 28th, 2023

6 min read

Home sharing is more than just a trend. It’s a new way of living and traveling. More and more homeowners are opening their doors to guests from around the world. They are sharing their space, their culture, and their stories. By adding an Airbnb rental endorsement to their home insurance, they’re able to make money from their unused rooms.

But home sharing is not without risks.

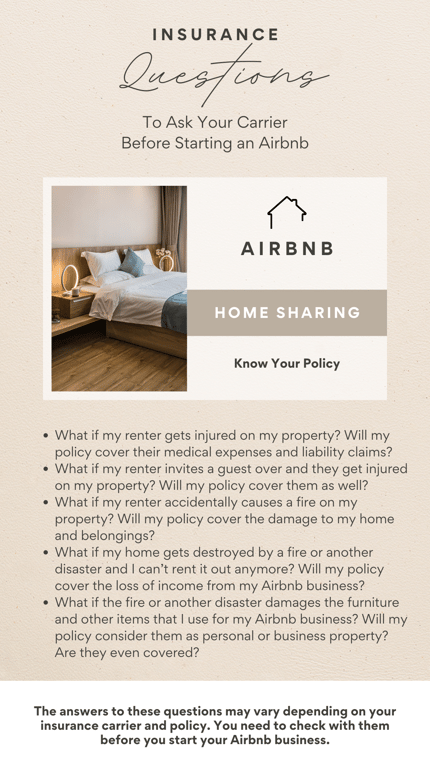

You need to be prepared for the unexpected. You need to know your rights and responsibilities

as a host. And you need to have the proper insurance to protect yourself and your property.

But we’re here to help you. We are the Horan agency, and we specialize in home insurance for home sharing. We’ve been helping Baldwinsville and CNY homeowners for over fifteen years. We can help you find the best coverage for your needs, whether you want to host occasionally or regularly.

Home sharing is an amazing opportunity, and we want to help you make the most of it.

In this article, we will explain why you need Airbnb insurance, what it covers, how much it costs, and how to get it. We will also answer some of the most common questions that hosts have about Airbnb insurance. By the end of this article, you will have a clear understanding of how to protect yourself and your property from any potential liability or loss.

So, let’s get started. Imagine you’re now a host. Here is everything you need to know about Airbnb insurance.

Airbnb Rental Liability Coverage: What You Need to Know

You’re a fabulous Airbnb host, with an impeccable “Superhost” 5-star rating. You rent out your home or property to various travelers. It’s a great opportunity to earn some extra income and meet new people. But you also face risks. As an Airbnb host, you know it’s important to have insurance.

But not just any insurance.

You need insurance that covers Airbnb rentals. Most home or landlord insurance policies don’t cover short-term rentals. You have to ask your insurer to add an endorsement to your policy that allows you to rent out your home on Airbnb. This will increase your premium, but it will also protect you.

But what many hosts don’t realize is that Airbnb’s liability coverage is primary. This means that they will be the first ones to pay out in the event of a claim. This is the same for VRBO, Booking.com, and other home sharing companies.

This is an important factor to consider. Airbnb has a $1 million Host Liability Insurance program that covers accidental injuries to guests. It also covers damage to their belongings and other things. Another program called Host Damage Protection extends $3 million in coverage. That policy insures your home and personal items against damage caused by guests.

Besides certain exclusions you should discuss with Airbnb, their policies do not cover death. For that, you need a home or landlord policy. Then you can add an Airbnb rental endorsement.

Say you have an Airbnb in the heart of Baldwinsville. You’re steps from Seneca River. An angler from Philadelphia books a one-week stay. He brings his wife and daughter along to explore the beauty of CNY. Midweek, their twelve-year-old daughter goes for a night swim in your pool. It’s dark, and she slips at the pool’s edge and is knocked unconscious. She ends up drowning.

If someone gets injured on your property, your renter is likely to sue everyone involved, including you. Airbnb has experience dealing with claims. But in the case of death, they won’t provide you with legal representation.

So it is critical to have your own insurance policy. If a guest’s injuries lead to a lawsuit, you may receive Airbnb representation. But know that you’ll be at the mercy of whatever defense they provide. Airbnb’s coverage may also not be enough to cover all of your losses. If damages exceed the limitations of that coverage, you must cover the rest.

Here are some things you can do to protect yourself as an Airbnb host:

- Make sure your property is properly insured. This includes having a homeowners or landlord insurance policy that covers your property and liability.

- Get a rider on your policy that specifically covers home-sharing rentals. This will add Airbnb-related liability coverage to your existing policy.

- Keep your property well-maintained. This will help to reduce the chances of an accident happening.

- Have a clear set of rules for guests. This will help to set expectations and avoid misunderstandings.

- Be responsive to guest concerns. If a guest has a problem, address it promptly.

- By following these tips, you can help to protect yourself from liability in the event of an

accident at your Airbnb rental property.

Here are a few other things to keep in mind:

- Airbnb’s liability coverage is capped at $1 million per occurrence. This means that if a claim exceeds $1 million, you will be responsible for the remaining amount.

- Airbnb’s liability coverage does not apply to intentional acts or omissions. This means that if someone gets injured as a result of your negligence, Airbnb will not cover you.

- You should read your Airbnb host insurance policy attentively. The terms and conditions of coverage are important to understand. If you have any questions, you should contact your insurance agent.

The Critical Difference Between Airbnb Home Sharing and Private Home Sharing

What if you tried the Airbnb route to rent out your home? Now you want to have more control over your bookings. You want to do it yourself without Airbnb. But you wonder if your home insurance will still cover you if something goes wrong. You need to know how Airbnb home sharing and private home sharing are different.

- Airbnb home sharing is when you use Airbnb, VRBO, or other large platforms to list your property. And you accept bookings through them. These platforms have master policies that offer some protection. That coverage can extend to you and your guests. Most carriers are okay with this type of home sharing.

- Private home sharing is when you market and manage your property yourself. Meaning you don’t use any platform. You collect money directly from your guests, either online or in person. You don’t have any master policy to rely on. Most carriers are not okay with this type of home sharing.

Here’s what can happen if you do private home sharing.

One of your guests who booked through Airbnb before calls you and asks to rent your place again. But they want to skip Airbnb and pay you directly. You think this is a great idea. You save on fees and bypass the rules. But you also lose your protection. If something happens during their stay, your carrier may not cover you.You need to know what your carrier is willing to do and what they’re not willing to do. Will they cover you for private home sharing? Will they require you to have a master policy from a platform? How do they define home sharing?

Don’t risk losing your coverage by doing private home sharing without checking with your carrier or agent first.

Be Transparent When Buying an Airbnb Rental Policy

Adequate protection is a must when operating an Airbnb rental. It will cover you for liability and property damage that may occur during your guests’ stay. But to get the right coverage, you need to be transparent and detailed about your home and its features.

insurance agent or carrier needs to know if you have any of the following items in your home:

- A pool

- A diving board

- A trampoline

- A dog

- A dog with a bite history

These and other items can increase the risk of accidents and injuries on your property. They may also affect the cost and availability of your insurance coverage. For example, some insurers may not cover you if you have a diving board or a trampoline. Others may charge you a higher premium or require you to install safety features such as fences or nets.

These and other items can increase the risk of accidents and injuries on your property. They may also affect the cost and availability of your insurance coverage. For example, some insurers may not cover you if you have a diving board or a trampoline. Others may charge you a higher premium or require you to install safety features such as fences or nets.

You also need to tell your insurance agent or carrier if you allow your guests to bring their own pets to your Airbnb. Pets can cause damage to your home or belongings, or they may harm other guests or animals. You need to have a clear policy on what types of pets you accept, how many, and what rules they must follow.

By being thorough and transparent about your home and its features, you can help your insurance agent or carrier find the best coverage for your Airbnb rental. You can also avoid any surprises or disputes in case of a claim.

Remember, this is all about risk management. You want to make sure that you, your home, and your guests are adequately protected. And that protection has to extend to your guests.

Adding a home-sharing endorsement to your home policy is inexpensive. As of this writing, Erie Insurance will add it for an average of about $50 per year.

Get the Airbnb Rental Protection You Need

Many people are looking for ways to make extra money in the gig economy. One of them is renting out a spare room in your home to travelers. If you like the idea of hosting guests and earning some income, consider this option. But before you do, talk to your agent or carrier and find out if your insurance policy will cover you in case of a loss.

Being an Airbnb host is not without risks. You need to be prepared for any possible scenario that may arise. You don’t want to end up in a situation where you have to pay for damages or legal fees out of your own pocket. That’s why it’s essential to have the right insurance coverage for your Airbnb rental property.

Airbnb’s liability coverage is a great benefit, but it’s not enough. It has limitations and exclusions that may leave you vulnerable. You need to have your own insurance policy that covers your property and liability. You also need to get a rider on your policy that covers Airbnb rentals. This will give you peace of mind and protect you from financial losses.

By following the advice in this article, you can ensure that your Airbnb hosting experience is safe and enjoyable. You can welcome guests from all over the world and share your home with them. You can earn extra income and make new friends. You can also avoid the pitfalls of liability and lawsuits.

But if you overlook the importance of insurance, you may regret it later. You may face a claim that exceeds your coverage or is not covered at all. You may have to deal with legal issues and stress. You may lose your property or your reputation.

Don’t let that happen to you. Take action today and get the insurance coverage you need for your Airbnb rental property. It’s the smart thing to do.

To get started with the right Airbnb rental coverage, click the Get a Quote button below. One of our insurance specialists will contact you to discuss your policy options.

Want to continue the home insurance learning journey? Read about other important riders for your home.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: