The 6 Most Common Home Insurance Claims in Central New York

November 16th, 2023

6 min read

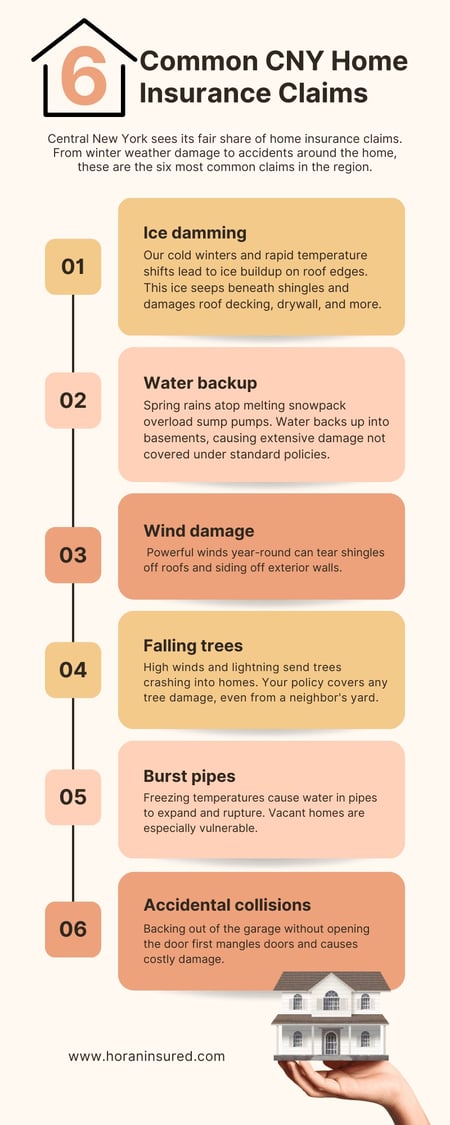

Dealing with home insurance claims can be stressful, especially when damage costs are high. Disruptive water leaks, storm damage, and accidents can be devasting for Central New York homeowners like you.

That’s why we put this guide together, to help you avoid the most common pitfalls. We’re Horan, a Baldwinsville-based independent insurance agency with over a decade of home policy experience. That gives us unique insight into the types of damage we see most.

In this article, we’ll explore the six biggest causes of home insurance claims in CNY. You’ll learn some simple damage prevention tips and understand how to file claims smoothly when the unfortunate does occur.

Let our experience work for you. With the right home insurance coverage and preparation, you can rest easy knowing potential home hazards are covered. Read on to protect your property and wallet from the region’s most prevalent home damage threats.

1. Prevent Expensive Ice Dam Damage Home Insurance Claims

Ice damming is one of the top causes of home insurance claims in Central New York. Our cold, snowy winters, coupled with occasional warm spells, create ideal conditions for ice dams.

Here’s what happens:

Snow piles up on the roof over the winter. On sunny days or when a warm front moves in, the top layer melts. The water runs down and refreezes at the roof’s edge, where temperatures remain below freezing.

As this ice builds up, it forces more melting snow to back up beneath the shingles instead of running off the roof. This water seeps into tiny cracks and openings, soaking roof sheathing, exterior walls, insulation, drywall, and even furniture and carpets.

Extensive repairs are often needed to fix the water damage caused by ice dams. Costs frequently exceed $10,000, especially if mold remediation is required. Most home insurance policies cover ice dam damage, but you’ll still need to pay your deductible.

Improve Attic Insulation

The best way to prevent ice dams is to improve attic insulation. Heat loss through the ceiling warms the snow on the roof, contributing to the melt/refreeze cycle. Adding insulation keeps the attic cooler and reduces ice buildup.

Clear Snow From the Roof

Clearing snow off the roof’s edge and installing heating cables also help. But proper insulation is the first line of defense for minimizing ice dam damage to your home.

2. Protect Against Basement Flooding Home Insurance Claims

During Central New York’s snowy winters, a tremendous amount of moisture accumulates on the ground. Come spring, melting snow coupled with heavy rains can overload sump pumps. This causes water to back up into basements with devastating results.

When water seeps into a finished basement, it quickly causes damage. Carpets, furniture, drywall, and personal belongings are often complete losses after just an inch or two of standing water. Mold remediation adds greatly to the costs.

Unfortunately, most standard home insurance policies don’t cover water backup damage. But it’s considered preventable through proper maintenance of sump pumps and drainage systems.

Get Water Backup Coverage

Get Water Backup Coverage

If you’re concerned about basement flooding, you should add water backup coverage through an endorsement. For a small premium, this provides protection in the event a sump pump fails or becomes overwhelmed.

Consider getting a backup battery or generator for your sump pump. Take time each fall to service your pump and check that drainage lines are flowing well. Take these preventative measures now and rest easy knowing you have backup coverage just in case.

3. Dealing with Wind Damage Home Insurance Claims

Windstorms occur year-round in Central New York, and they can wreak havoc on your home. Powerful gusts can tear shingles off roofs and rip siding right off the exterior walls. The damage may allow water intrusion that then leads to rot, mold growth, and additional repairs.

After any storm with high winds, thoroughly inspect the exterior of your home. Look for missing or loose shingles and gaps or bowing in the siding. These are signs that wind damage may have occurred.

Document any damage with photos and contact your insurance agent right away to file a claim. Most policies cover wind damage minus your deductible. But prompt action is key to prevent further issues down the road.

You can fortify your home against wind damage. Secure loose siding or roofing. Trim trees back from the house. And consider impact-resistant siding and shingles when it comes time to replace exterior materials.

With severe wind gusts a fact of life in our region, don’t get blown away by unexpected repair costs. Inspect after storms and file claims for wind damage before it leads to bigger problems. Your homeowners insurance is there to help. And so is your independent agent.

4. Home Insurance Claims Stemming from Fallen Trees

High winds and lightning storms are all too common in Central New York. These weather events send trees toppling onto homes, causing damage that home insurance must cover.

Often, the tree doesn’t even need to be on your property. If your neighbor’s unhealthy maple tree crashes onto your roof during a storm, you can still file a claim to repair the damage.

Falling trees can smash roofs, break windows, dent siding, crush fences, and more. A really large tree may even destroy an entire section of your home. Repair bills run into the tens of thousands in severe cases.

Prevent Fallen Tree Claims

While insurance will pay for tree damage, your rates may increase after filing claims. That’s why preventing fallen trees through proactive trimming is so important.

Survey mature trees on your property and cut back dead branches that could break off in high winds. If a tree leans precariously over your house, have it removed. Keep power lines clear of overhanging limbs as well. The Arbor Day Foundation offers guidance on safely pruning trees to reduce storm damage risks.

Take steps now to mitigate the risk of fallen trees in storms. But if one does hit your home, document the damage thoroughly and file an insurance claim right away. Don’t let a fallen tree blow your budget.

5. Managing Burst Pipes Home Insurance Claims

Freezing CNY temperatures can wreak havoc on your home’s plumbing. As water in the pipes expands, it puts pressure on pipe walls. If a pipe is especially weak or water-logged, it may rupture and burst open.

This causes water to spray out at high pressure, flooding the area. Burst pipes can release hundreds of gallons in just hours. The resulting damage to carpets and floors, drywall, and low-lying personal items is devastating.

Homes that are vacant in the winter are most susceptible. Without heat running regularly, pipe temperatures can dip below freezing. But occupied homes are also at risk if heat is turned down for savings.

Prevent a Burst Pipe Home Insurance Claim

To avoid burst pipes, maintain at least 55°F inside your home during cold weather, even in unused rooms or unoccupied vacation homes. Insulate pipes in drafty unfinished basements and crawl spaces.

When away, have a trusted person check on the house daily. Or call a plumber to shut off the water supply at the main valve so pipes remain empty and cannot burst.

Frozen and burst pipes are a common cause of insurance claims during Central New York winters. Don’t let yours be next. Follow these tips to keep your plumbing intact and avoid a frigid flood.

6. Avoid Accidental Garage Door Collision Home Insurance Claims

An unexpected source of home damage comes from within – literally inside your own garage. Backing out absentmindedly without opening the garage door first results in collisions that crush doors and cause costly damage.

These embarrassing but not uncommon mishaps bend and buckle garage door panels. The tracks get knocked out of alignment, motors are destroyed, and the door is left completely inoperable. Replacement garage doors often cost well over $1,000 fully installed.

Surprisingly, damage from hitting your own garage door does not fall under auto insurance. Since the home itself is damaged, claims must go through the homeowner’s policy instead.

To avoid backing into a closed garage door, stay focused when getting into your vehicle. Put down your phone and other devices that distract attention. Check your backup camera before shifting into reverse. Wait for the door to fully open before accelerating.

Accidents happen, but totaling your own garage door is one that’s easily preventable. Stay alert when exiting and save yourself the headache of an unwelcome insurance claim. Your wallet and ego will thank you.

Rest Easy Knowing Your Home is Protected with the Right Policy

The threat of property damage is an unfortunate reality for Central New York homeowners. But this article arms you with insider knowledge on avoiding the most common pitfalls.

Put these preventative measures into action, and your risk of major claims will plummet. Your home will stand strong in the face of ice dams, floodwaters, wind gusts, and other hazards.

Yet if damage does occur, you can file claims with confidence, knowing exactly how your homeowners insurance works. We’ll smoothly guide you through the process so you can focus on repairing and rebuilding your home.

At Horan, we’ve seen it all when it comes to local property damage. By learning from our experience, you’ll dodge many headaches down the road. Your home will be protected, your wallet preserved, and you’ll maintain composure.

Click the Get a Quote button below for homeowners coverage that’s optimized to handle Central New York’s unique risks. With the right policy, even ice dams and flooded basements won’t overwhelm you.

Now that we’ve covered the 6 most common home claims, discover The 6 Most Common Auto Insurance Claims in Central New York.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: