5 Must Have Riders for Home Insurance

August 14th, 2023

6 min read

Homeowners insurance is a vital protection for your most valuable asset. But did you know that your standard policy might not cover everything you need? Depending on your situation, you might want to consider adding some riders to your home insurance policy.

Riders are optional enhancements that can customize your coverage and fill in the gaps that your basic policy might leave.

In this article, we’ll explain what riders are, how they work, and which ones are the best for homeowner’s insurance.

As a leading CNY insurance agency, Horan has the expertise and experience to help you find the best solutions for your insurance needs. Whether you want to protect your jewelry, your basement, or your home’s value, we have a rider for that.

Read on to learn more about how riders can give you peace of mind and financial security.

What Are Insurance Riders?

You may still be wondering what a rider is. That’s a good question and a smart way to begin. A rider, also called an endorsement, is something that modifies the original insurance policy. Insurance riders can increase, improve, decrease, or even eliminate coverage.

Some riders will cost little or nothing, while others can be expensive. It’s important to know which riders are available, what they do, and how they can benefit you.

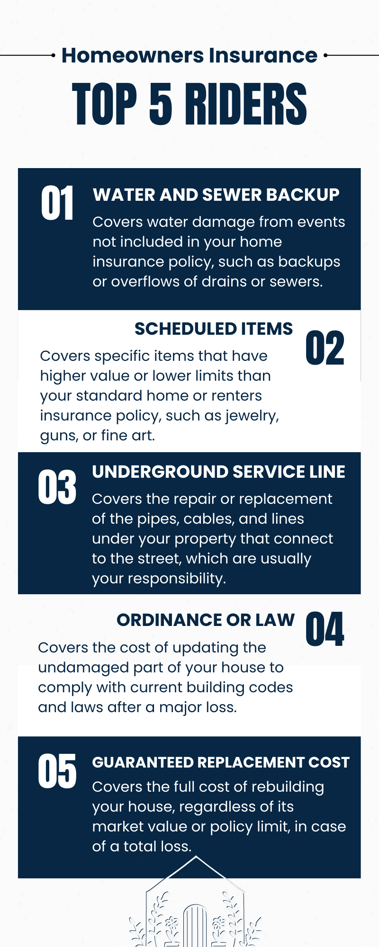

Here are five riders you should consider.

- Water and Sewer Backup

- Scheduled Items (personal articles)

- Underground Service Line

- Ordinance or Law

- Guaranteed Replacement Cost

Rider #1: Water and Sewer Backup

Water can cause severe damage to your home, and insurance policies often exclude many types of water-related losses. The water and sewer backup endorsement is a great way to protect yourself from specific events that your home insurance policy might not cover.

You might think that your town will pay for the damage if a sewer backs up into your home. But that’s not true. The municipality will only fix the problem in the system that caused the backup. You have to pay for the cleanup or repair in your home.

Heavy rains can overload your neighborhood’s storm drainage. Your sump pump might fail to remove the water from your basement. If it stops working or burns out, you could end up with a flooded basement.

You won’t find coverage for sewer or sump pump failures in your home insurance unless you’ve added this rider.

What the Water and Sewer Backup Rider Protects Against

What the Water and Sewer Backup Rider Protects Against

- Water or sewage that backs up through sewers or drains

- Water that overflows from a sump pump

Who Should Have Water and Sewer Backup Coverage?

Everyone who doesn’t have a septic/well system should have the water backup rider added to their policy.

How Much Water Backup Coverage Can I Buy?

The amount of coverage you can buy depends on the carrier. While you might want to buy $100,000 of coverage, home insurance carriers usually limit the amount.

$5,000 is the most common among carriers. Some won’t offer more, and others will let you buy up to $10,000 or $15,000. A few companies, such as Erie Insurance, give you the option to buy an amount equal to your house’s replacement value.

It’s rare that water backup would cause that much damage. But if a sewage backup ruined your finished basement, $15,000 might not cover it.

No matter how much you buy, a deductible will apply. The water backup rider has a separate deductible from the rest of the policy, typically $1,000.

How Much Extra Does Water and Sewer Backup Coverage Cost?

The cost to add this coverage varies based on the amount you buy. $5,000 will usually cost between $35 – $50 per year. As with anything else, the more you want, the more you pay.

Rider #2: Scheduled Items (Personal Articles)

Your home or renters insurance policy covers most of your belongings. But there are limits for certain things like jewelry, guns, or fine art, which you should address. You can do this by adding a scheduled items rider to your policy.

We explained how to insure your most valuable things in our article “Scheduled Personal Property Coverage.” Be sure to read that for more details.

Many insurance policies only offer $1,500 for an engagement ring damaged by fire. Fur coats and guns often have the same limit. Theft and misplacement are usually not covered either. So, you might not be happy with the amount or the scope of coverage.

By adding your valuables separately, you get better coverage for them. For example, you could drop your engagement ring in the ocean while honeymooning and still be insured.

The value of an item determines the amount of insurance coverage you can buy. You’ll need to provide the insurance carrier with proof of value through an appraisal or receipt. Each carrier has its own rules regarding appraisals, so check with your insurance agent.

Examples of things to schedule are:

- Engagement ring

- Wedding band

- Earrings or necklaces

- Watches

- Hearing aids

- Fur coats

- Any musical instrument

- Guns

- Golf clubs

- Silverware

How Much Does it Cost to Schedule Items?

More insurance means more cost, and that cost will vary by carrier. As a guide, one or two percent of an item’s value is average. So, an engagement ring worth $11,000 should cost about $165 per year to insure.

Rider #3: Underground Service Line

You might not know that you’re responsible for the condition of all the pipes, cables, and lines under your property, including the part that connects to the street. Until recently, these were not covered by insurance, leaving homeowners to pay for the expensive repair or replacement.

Now, there’s a rider you can buy for extra protection called the underground service line endorsement.

Examples of underground service lines

- Piping: gas, water, or sewer

- Electrical wiring

- Fiber optic wiring

- Cable and internet wiring

- Telecommunication wiring

What the Underground Service Live Rider Protects Against

You can’t see what’s happening to your buried service lines. But you’ll be happy to know that this insurance rider covers leaks, breaks, tears, ruptures, collapses, and arcing caused by:

- Wear and tear, marring, deterioration, or hidden decay

- Rust or other corrosion

- Mechanical breakdown or latent defect

- Weight of vehicles, equipment, animals, or people

- Vermin, insects, rodents, or other animals

- Artificially generated electrical current

- Freezing or frost heave

- An external force from a shovel, backhoe, or other types of excavation

- Tree or other root invasions

An Exception to the Underground Service Line Rider

If any form of earth movement caused those damages, you won’t be covered. Earth movement, including earthquakes, natural rising, sinking, or shifting of the ground, will cancel the coverage provided by the rider.

How Much Can I Buy and What Will it Cost?

Like other riders, the amount you can buy depends on the carrier. Some insurance companies don’t offer this coverage at all, and the ones who do limit the amount available. When a carrier does offer the endorsement, it usually starts at $10,000 and caps at $25,000 in insurance coverage.

The typical premium for this rider is between $35 – $75 per year; some won’t offer it if your house is older than 40 years. Talk to your agent for more details.

Your insurance policy deductible will apply to any claims made from using this endorsement.

Rider #4: Ordinance or Law

Building codes and laws can change over time. When those changes happen, existing homes don’t have to comply with them. But if there is a loss of more than 50 percent of the house, you’ll likely have to update the undamaged part of the building to rebuild.

Your insurance policy offers very little coverage for extra expenses you incur from having to bring the house up to code. On average, the insurance policy will offer 10% of the house’s insured value for this coverage.

It can cost more than that just to demolish and remove the undamaged part of the home. So, you’d have nothing left to put toward the cost of rebuilding.

Most carriers let you buy more ordinance or law coverage. We suggest adding as much as you can if you have an older home.

Items That Undergo Common Code Changes

- Electrical wiring

- Hardwired smoke alarms

- Plumbing

- HVAC

- Weather and fire-resistive building materials

It’s important to know what you might be responsible for if you lose most of your house to a fire. Knowing who to talk to about your property’s building codes is also important. If you live in the Village of Baldwinsville, your codes might differ from someone two blocks away in the Town of Lysander.

So, contact the right code enforcement office when doing your research.

Rider #5: Guaranteed Replacement Cost

Is your house insured enough? Chances are it isn’t. According to studies by CoreLogic, a property intelligence company, two-thirds of all U.S. houses are underinsured.

That means there’s an insurance policy in place, but it doesn’t have enough coverage to rebuild completely. The best way to avoid that is to add the Guaranteed Replacement Cost rider to your policy.

A house insured with guaranteed replacement cost is the best option for reconstruction coverage. When added, the insurance company agrees to rebuild your house no matter what its insured amount is.

As long as your policy covers the cause of the damage, you can ignore its insured value. However, if changes in building codes cause extra expenses, those will not be included in this rider. This is another reason to think about the Ordinance or Law rider we’ve discussed above.

Reasons that contribute to a home being underinsured include:

- Wrong square footage

- Inflation

- Builder grade values applied to custom upgrades

- Structural improvements

- Interior upgrades like changing from carpet to hardwoods

- General remodels

Finding a carrier who offers Guaranteed Replacement Cost, however, is not easy.

That’s because, when added, the insurance carrier’s financial obligation to you is bigger. A few, like Erie Insurance, offer this, but the list is short and isn’t growing fast. If you have the option to add this coverage, we recommend doing it.

Beef Up Your Home’s Protection with Appropriate Riders

Riders are a great way to customize your home insurance policy and fill in the gaps in your standard coverage. By adding these five riders, you can protect yourself from unexpected expenses and losses that could otherwise ruin your finances and your peace of mind.

Whether you want to cover your valuables, your basement, your service lines, your code updates, or your home’s value, we have a rider to offer greater protection.

Having served thousands of CNY residents like yourself, we can help you compare different carriers and options and choose the ones that suit your situation and budget.

Click the Get a Quote button below for a free quote and let us help you get the coverage you deserve.

And read our companion article to this one to learn more about what your homeowners insurance policy doesn’t cover and how to fix it.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: