Ordinance or Law Coverage: When Your CNY Home Policy Needs It

February 5th, 2024

6 min read

You love your home in Central New York. It has history, charm, and character. But it also has some hidden risks that could cost you a lot of money if you don’t have the right insurance coverage.

One of the risks your home faces is the need to comply with the current building codes, which is often overlooked by homeowners and agents alike. Ordinance or law coverage–when added–is the part of your home insurance policy that pays for this extra expense when you repair or rebuild your home after a covered loss.

Without it, you could be stuck with a huge bill that your standard policy won’t cover.

That’s why you need Horan since we specialize in ordinance or law coverage. We’ve helped many homeowners in Central New York get the right amount of coverage for their homes.

In this article, we’ll explain how ordinance or law coverage works and why it matters. We’ll also show you some examples of how this coverage can save you from costly repairs, especially if you have an older home. We’ll tell you how to add this coverage to your policy, or increase it, and how much it will cost.

By the end of this article, you’ll understand why ordinance and law coverage is one of our favorite endorsements and why you need it for your home.

How Ordinance or Law Coverage Protects Your CNY Home

Ordinance or law coverage is an important feature of your home policy. It covers the extra costs of rebuilding your home according to the current codes and standards. We’ll explain how it works.

When you build your home, it has to follow the current codes and standards of the day. These codes and standards will change over time, but your home is grandfathered in. This means you don’t have to update your home to meet the new codes and standards, unless you want to. Even if you sell your home, the buyer doesn’t have to update it either.

But what if your home suffers a loss, such as a fire?

But what if your home suffers a loss, such as a fire?

The amount of damage to your home affects your ordinance or law coverage. If your home has a partial loss, it means the damage is less than 50 percent of your home. Some municipalities may have a lower threshold, but let’s use 50 percent for this example.

In this case, you only have to rebuild the damaged part of your home according to the new codes and standards. The undamaged part of your home is not affected by the codes and standards. Your home policy will pay for the cost of rebuilding the damaged part of your home, and your ordinance or law coverage will pay for the extra cost of updating the damaged part of your home.

Ordinance or Law Coverage: The Difference Between Partial and Total Losses

We looked at partial losses above. But if your home has a total loss, it means the damage is more than 50 percent of your home. In this case, you have to rebuild the entire home according to the new codes and standards.

The undamaged part of your home is also affected by the codes and standards. Your home policy will pay for the cost of rebuilding your home as it was before the loss, but it will not pay for the extra cost of updating the undamaged part of your home. This is where you need ordinance or law coverage.

It will pay for the extra cost of updating the undamaged part of your home, up to a certain limit. You have to choose the limit of your ordinance or law coverage when you buy your policy.

Ordinance or law coverage is very important for total losses, but it’s also useful for older homes, which may have outdated codes and standards. Depending on how old your home is and how many codes and standards have changed, the extra cost of updating your home can be very high.

You may have to strip down your home to the studs, or worse, to meet the new regulations. Even one change in the codes and standards can make your home obsolete.

You also need a permit and a contract to rebuild your home. Without ordinance or law coverage, you would have to pay for the extra cost of updating your home out of pocket. This can be a huge financial burden for you. Ordinance or law coverage can help you avoid this situation.

The Impact of Ordinance or Law Coverage on Your Living Expenses

Ordinance or law coverage can also affect your living expenses while your home is being rebuilt. Sometimes, insurance carriers will offer you an ordinance or law endorsement or include it in a bundle. You may not pay much attention to it.

They may put a limit of $10,000 on it. That’s not enough money. A $10,000 limit may not even cover the cost of planning how to update your home, let alone the work and the materials.

You have to remember that everything is connected. You’re moving out of your home while it’s being rebuilt. That means using your homeowners loss of use coverage to pay for your extra expenses while you’re out. But if the delay in getting back in is because of an ordinance or law issue that your carrier does not cover, your loss of use coverage will run out, too.

Your carrier won’t pay for your living expenses for something that they don’t cover. But if you have the ordinance or law endorsement, and you have enough money and time, your carrier won’t cut you short. They’ll pay for your living expenses until your home is rebuilt.

If you have an older home, choose a limit that is enough to cover the extra cost of updating your home and your living expenses.

How to Choose the Right Amount of Ordinance or Law Coverage

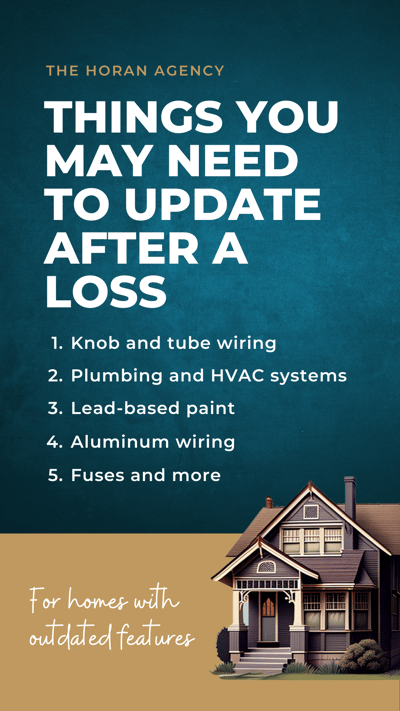

Having an old house doesn’t mean you need to focus on ordinance or law coverage. Many old houses have been updated over time. But you still want to make sure your house meets the current codes and standards. Some things that may not meet those requirements are:

Having an old house doesn’t mean you need to focus on ordinance or law coverage. Many old houses have been updated over time. But you still want to make sure your house meets the current codes and standards. Some things that may not meet those requirements are:

- Non-active knob and tube wiring

- Plumbing and HVAC systems

- Lead-based paint

- Aluminum wiring

- Fuses and more

If you have these things in your house, you may have to update them if you have a loss. You also need to do your homework on what the municipality requires. They may have specific types of materials, strengths, or ratings that you have to use to rebuild your home. If you don’t use them, you won’t get a certificate of occupancy.

If you know your house doesn’t meet the codes and standards in many areas, you need to upgrade your ordinance or law coverage. This will help you if you have a loss that is more than 50 percent of your home. The older your house, or the more things that could be a concern, the more attention you should pay to this coverage.

You also need to make sure you have enough coverage. Remember, some carriers may have a limit on how much they’ll pay for ordinance or law coverage. They may stop at $40,000 or $50,000.

Others may go up to the limit of your home. They may say they’ll cover your home and then give you ordinance or law coverage up to the same amount. This is like extra money for updating your home.

Ordinance or law coverage can be worth it, but it can also be expensive. Having it won’t double your premium, but it will increase it. The more coverage you get, the more you’ll pay. You may pay $200 to $300 more per year if you get the maximum coverage.

You may pay less if you get half of that, or something in between. It’s worth looking at the numbers and the differences to see what the cost would be.

Ordinance or law coverage can help you get back in your home. You want to make sure you have the right coverage for your situation.

How Ordinance or Law Coverage Can Save You From Costly Repairs

Ordinance or law coverage is especially important for older homes in our area. For example, in Baldwinsville, there are many houses that date back to the 19th or early 20th century. These houses may have outdated features that don’t comply with the current building codes.

One of these features is aluminum wiring, which was common in the 1970s but is now considered a fire hazard. If you have aluminum wiring in your home and it suffers damage, the code enforcer will not let you repair only the damaged part. You’ll have to replace the entire wiring system with copper, which is safer but more expensive.

The problem is that your standard home insurance policy won’t cover this extra cost because it’s related to ordinance or law coverage. You can add the endorsement to your policy or increase it if you already have it. Otherwise, you’ll have to pay out of pocket for the wiring code upgrades, which can be thousands of dollars.

This can happen even if your home isn’t very old, as long as it has features that are no longer up to code. So don’t assume that your home is safe from ordinance or law issues. Know what you have in your home and make sure you have enough coverage to protect it.

Ordinance or law coverage is an essential endorsement because it can save you from a lot of trouble and expense. But it’s rarely talked about, so many homeowners are unaware of it.

Avoid Expensive Code Upgrades After a Covered Loss with the Right Ordinance or Law Coverage

We covered how this endorsement can save you from costly repairs, especially if you have an older home with outdated features. We also told you how to add or increase this coverage to your policy and how much it will cost.

Ordinance and law coverage is one of our favorite endorsements because it can give you composure and security when you face a covered loss. It can also help you preserve the history, charm, and character of your home while making it safer and more efficient. If you don’t have enough ordinance and law coverage, you’re taking a big risk.

You could end up paying thousands of dollars out of pocket for code upgrades that your standard policy won’t cover. You could also face delays, fines, or legal issues with the code enforcers in our area.

That’s why you need Horan, the experts in ordinance and law coverage. We can guide you through the process of adding or increasing ordinance and law coverage to your existing policy. We can also answer any questions you may have about this endorsement and how it applies to your home.

Click the Get a Quote button below to get things started. One of our knowledgeable insurance specialists will reach out to discuss your policy options.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: