Rental Car Reimbursement Coverage: What It Is and How It Works

November 21st, 2025

7 min read

As a policyholder in Central New York, you may face uncertainty and confusion about getting a rental car after an accident. Depending on who caused the accident and what kind of insurance coverage each party has, you may have to deal with different scenarios and outcomes.

For instance, you may have to use your own insurance, pay out of pocket, or take legal action to get reimbursed for a rental car. You may also have to choose a rental car that meets your transportation needs and fits your budget. These decisions can be stressful and overwhelming, especially when you're already dealing with the aftermath of an accident.

The challenge you face is making an informed decision about rental car coverage without fully understanding how it works in different accident scenarios. Your biggest concern isn't just the financial impact—it's buying a policy that doesn't actually address your situation when you need it most. Without clear guidance, you risk paying for coverage you can't use or going without coverage that would have saved you significant expense.

As an independent insurance agency in Baldwinsville, we work with multiple carriers across Central New York. This gives us insight into how rental car reimbursement works across different policies and scenarios—insight that helps us explain your options clearly.

In this article, we'll cover how rental car coverage works when the other driver is at fault versus when you cause the accident. You'll learn what determines whether you can get reimbursed, what your rental options are, and when this coverage applies. We'll also explain how it differs from roadside assistance, so you can make informed decisions about your policy.

Will the Other Driver’s Policy Pay for Your Rental Car?

This first question can benefit from a frame of reference, so let’s picture a scenario.

You were in an accident that wasn’t your fault. Now your vehicle is being repaired, and you need to use a car in the meantime. The good news is that the other driver’s property damage coverage, which pays for the repairs to your car, will even cover the rental reimbursement of a vehicle. More good news there. But—

That is If the other person has enough coverage. To gain a better understanding of everything that property damage coverage entails, read “What Does Property Damage Liability Cover?”

You may have heard that rental car coverage is an optional add-on to your policy and not a requirement. This is true for your specific policy, and you’re not obligated to include this coverage.

However, if you needed a rental after an accident and neglected to add rental reimbursement, you’d be banking on the chance the other driver has adequate coverage and is at fault for the accident. And there are other options we’ll discuss below.

What if the Other Driver Doesn’t Have Enough Property Damage Coverage?

Say you need a rental car after an accident that wasn’t your fault. But the other driver’s insurance can’t cover the full cost of your repairs and rental. Here are some alternative measures you can consider:

- Use your own insurance. If you have rental car reimbursement coverage on your policy, you can use it to pay for the rental car while your car is being fixed. As stated, this is an optional coverage you can add to your policy for an extra fee. Just be sure it’s added before an accident.

- Pay out of pocket. If you don’t have rental car reimbursement coverage on your policy, you’ll have to pay for the rental car yourself. This may not seem fair, but it’s the only option if the other driver’s insurance isn’t enough.

- Take legal action. You may be able to sue the other driver for the damages they caused to your car and your rental expenses. This may take time and money, and there’s no guarantee that you’ll win or collect the money.

And bear in mind that the minimum property damage liability coverage in New York State is $10,000. This means the other driver’s insurance will pay up to $10,000 for your repairs and rental car. If your damages are more than that, you’ll need to use one of the options above.

What if the Other Driver is at Fault But Doesn’t Have Insurance?

If the other driver caused the accident but has no insurance, the above options also apply here. You’ll need to rely on your own policy to pay for a rental car. This depends on whether you have rental car reimbursement coverage on your policy.

If you have it, you can get reimbursed for renting a car while your car is being fixed. If you don’t have it, you’ll have to pay for the rental car yourself. By now, you should be seeing a pattern develop around the other driver’s lack of sufficient coverage when he’s at fault for an accident.

Let’s turn the table.

How to Get a Rental Car When the Accident Is Your Fault

If you cause an accident and need a rental car while your car is being fixed, you’ll need rental reimbursement coverage on your policy. It will only pay for your rental car, not anyone else’s.

If you cause an accident and need a rental car while your car is being fixed, you’ll need rental reimbursement coverage on your policy. It will only pay for your rental car, not anyone else’s.

However, rental reimbursement coverage is not enough by itself. You also need to have both comprehensive and collision coverage on your policy. These are optional coverages that pay for the damage to your car.

Learn more about the difference between these options by reading our article comparing comp and collision.

Without comprehensive or collision coverage on your policy, your car has no coverage if you cause an accident. This means that the insurer will not pay for your repairs or your rental car.

In fact, the carrier won’t let you add rental reimbursement coverage if you don’t have comprehensive or collision coverage first.

Your Rental Car Options After an Accident

If you need a rental car after an accident, you may wonder what kind of vehicle you can rent. The answer depends on who is paying for the rental car and how much coverage you have.

The Accident is the Other Driver’s Fault

If the other driver is at fault, their insurance will pay for your rental car while your car is being repaired. However, they won’t pay for certain cars you’ve set your sights on. So that pulse-quickening performance sports car powered by eight cylinders won’t be hugging corners with you at the wheel.

The insurer will pay for a car that is similar to your car in size and function. For example, if you drive a four-door sedan, you’ll get a four-door sedan. But if you drive an exotic import vehicle, you’ll likely get a four-door sedan. That’s because the goal of the insurer is to provide you with transportation, not luxury.

If you drive a minivan because you have four children in car seats, you may be able to rent a van. A smaller car would not meet your transportation needs. However, the van may not have all the features that your personal van has.

If you need any upgrades or additional features, you may have to pay extra. You should always check with the rental car company or the insurance carrier before you make any changes to your reservation.

The Accident is Your Fault

If the accident is your fault, your insurer will pay for your rental car if you have rental reimbursement coverage on your policy. It will pay for your rental car up to a certain limit per day or per month. You can choose how much coverage you want when you add rental reimbursement to your policy.

The more coverage you choose, the more expensive your policy will be. You should choose enough coverage to rent a car that meets your transportation needs.

In other words, if you need a minivan for your family, be sure to choose enough coverage to rent a minivan.

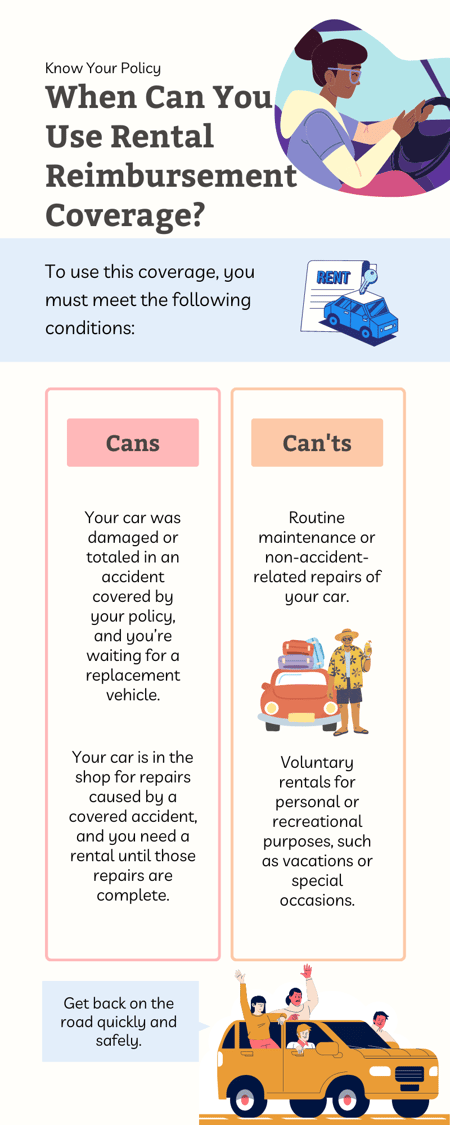

When Can You Use Rental Reimbursement Coverage?

This coverage is designed to help you pay for a rental car when your car is being repaired or replaced after an accident. To use this coverage, you must meet the following conditions:

- Your car was damaged or totaled in an accident covered by your policy, and you’re waiting for a replacement vehicle.

- Your car is in the shop for repairs caused by a covered accident, and you need a rental until those repairs are complete.

This coverage does not apply to any other situations where you may need or want to rent a car. For example, you cannot use this coverage for:

- Routine maintenance or non-accident-related repairs of your car.

- Voluntary rentals for personal or recreational purposes, such as vacations or special occasions.

You should also note that this coverage only pays for the rental fee of the car, not for any damages or liabilities that may occur while you’re driving it. Your New York car insurance policy will cover you for those risks, just as it would for your personal vehicle.

Does Rental Reimbursement Cover Towing?

Rental reimbursement and towing or roadside assistance are two different types of coverage that you can add to your car insurance policy. They have different benefits and costs, and they’re not automatically included together. Let’s explain what each one does:

- Rental reimbursement pays for the cost of renting a car when your car is being repaired or replaced after a covered accident. You can choose the amount and duration of coverage that suits your needs and budget.

- Towing or roadside assistance pays for the cost of towing your car to a repair shop or providing other services, such as changing a flat tire, jump-starting a battery, or delivering fuel when your car breaks down on the road. You can choose the level of coverage that matches your driving habits and preferences.

You can add either or both of these coverages to your policy, depending on what you want and how much you’re willing to pay. They’re optional but recommended for most drivers who want to avoid out-of-pocket expenses in case of car trouble.

Learn more about roadside assistance coverage by reading “The Benefits of Adding Roadside Assistance to Your Car Insurance Policy.”

Making Informed Decisions About Rental Car Coverage

We've covered how rental car reimbursement works in different accident scenarios, from dealing with inadequate coverage from at-fault drivers to understanding your own policy's rental benefits. You should now have a better understanding of the conditions that must be met to use this coverage and how it differs from roadside assistance.

With this knowledge, you can evaluate whether rental car reimbursement fits your situation. If you commute to work, transport children regularly, or rely on your vehicle for daily obligations, going without transportation during repairs could disrupt your life. Suitable coverage can help you maintain your routine while your vehicle is in the shop.

Without adequate coverage, you're depending on unknown factors—whether an at-fault driver has sufficient insurance, whether you can afford out-of-pocket rental costs, or whether you can manage without a vehicle during repairs. These aren't ideal circumstances when you're already dealing with accident aftermath.

The choice to include rental car reimbursement in your policy is yours to make based on your transportation needs, budget, and comfort level with the alternatives we've discussed.

To learn more about adding this coverage to your policy, call (315) 635-2095. One of our licensed insurance agents will be happy to assist you.

If you're not currently a client and would like to discuss your policy options, click the Get a Quote button below to get things started. We look forward to hearing from you.

You’ve learned a lot about rental car reimbursement coverage and how it differs from towing or roadside assistance coverage. If you want to learn more about car insurance in general, you can read our guide on car insurance next.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: