Restaurant Insurance: How Much Does it Cost?

August 7th, 2023

4 min read

Opening a restaurant is an exciting and rewarding venture, but it also comes with many risks and challenges. One of the most important aspects of running a successful restaurant is having adequate insurance coverage to protect your business, your employees, and your customers.

But how much does restaurant insurance cost, and what factors affect the price? In this article, we’ll answer these questions and help you find the best insurance policy for your restaurant.

As a CNY insurance agency in the heart of a restaurant-friendly town, we understand the unique challenges and opportunities that restaurant owners face. We’ve been providing quality insurance solutions for CNY restaurants of all sizes and types for years.

With that, let’s dive in.

Factors That Affect Your Restaurant Insurance Premium and Coverage

Restaurant insurance is not a one-size-fits-all product. It’s a combination of different types of policies that cover different aspects of your business and can include coverage for

- property damage

- general liability

- business interruption

- food spoilage

- liquor liability

- and more

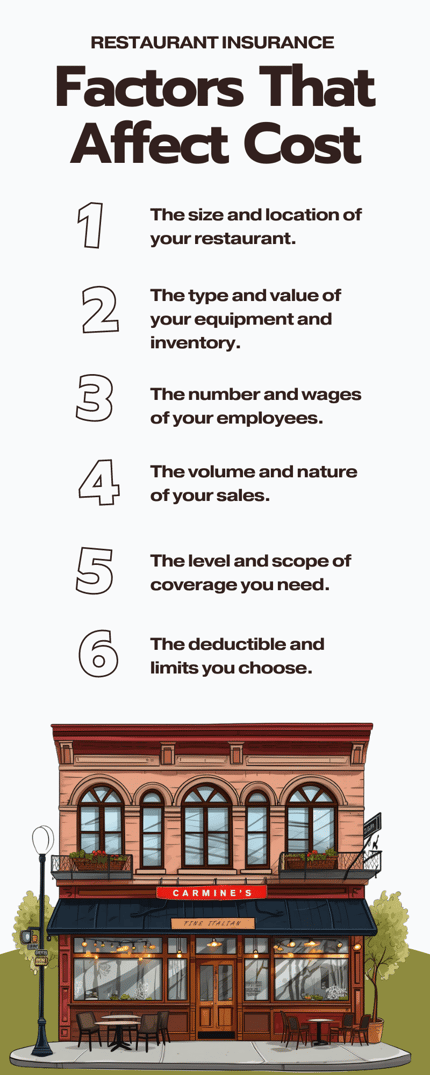

The cost of restaurant insurance depends on many factors, such as the size and location of your restaurant, the type and value of your equipment and inventory, the number and wages of your employees, the volume and nature of your sales, the level and scope of coverage you need, and the deductible and limits you choose.

A small cafe may pay less than $1,000 per year for basic coverage, while a large fine dining establishment may pay more than $10,000 per year for comprehensive coverage.

To get an accurate quote for your restaurant insurance, we need some information about your business. For example, we need to know:

- What kind of cuisine do you serve (Mexican, American, Asian, Mediterranean, Latin, etc.)?

- What is the style of your restaurant (fine dining, fast food, or family-friendly)

- Do you serve alcohol?

- How many employees do you have?

- How much is your equipment and other business property worth?

- What is the construction type of your building (frame or brick)?

- How big is your restaurant in square feet (this is a major factor for determining your rates)?

- Are there any apartments above your restaurant?

- Do you offer catering services?

These and other questions will help us calculate the best price for your restaurant insurance.

Enhance Your Restaurant Insurance Policy with Additional Coverage Types

Another aspect that affects the cost of your restaurant insurance is the level and type of coverage you choose. Different policies have different limits, deductibles, and exclusions that determine how much you’ll pay and how much you’ll receive in case of a claim.

Another aspect that affects the cost of your restaurant insurance is the level and type of coverage you choose. Different policies have different limits, deductibles, and exclusions that determine how much you’ll pay and how much you’ll receive in case of a claim.

Therefore, a higher limit means more protection but also a higher premium. A lower deductible means less out-of-pocket expenses but also a higher premium. An exclusion means a certain risk or event is not covered by your policy, which can lower your premium but also expose you to more liability.

In addition to the basic coverage types, such as general liability and property, you may also consider adding some optional endorsements or riders to your policy. These are additional features that enhance or customize your coverage for specific needs or situations. Some riders you may want to add inclue:

- Equipment breakdown coverage: This covers the cost of repairing or replacing equipment that is damaged by mechanical or electrical failure, such as refrigerators, ovens, or dishwashers.

- Business interruption coverage: This covers the loss of income and extra expenses that result from a temporary closure of your restaurant due to a covered cause, such as fire, flood, or vandalism.

- Liquor liability coverage: This covers the legal fees and damages that result from lawsuits related to alcohol service, such as drunk driving accidents or alcohol poisoning.

- Employment practices liability (EPL) coverage: This covers the defense costs and settlements that result from claims of wrongful employment practices, such as discrimination, harassment, or wrongful termination.

These are just some examples of the optional endorsements or riders that you can add to your restaurant insurance policy. Depending on your business needs and risks, you should consult with an insurance agent or broker to find out what other options are available for you.

Please note that this article is only about the restaurant’s business policy, which covers the general liability, property, and other risks related to your restaurant operations. It does not include other types of insurance that you may need or want for your restaurant business, such as:

- Workers’ compensation insurance: This covers the medical expenses and lost wages of your employees who are injured or ill due to their work.

- Business auto insurance: This covers the vehicles that you use for your restaurant business, such as delivery vans, catering trucks, or food trailers.

- Short-term disability/Paid Family Leave insurance: This covers a portion of your employees’ income if they are unable to work due to a non-work-related injury, illness, or pregnancy.

These types of insurance have different costs and requirements depending on your region, industry, and business size. If you’re interested in getting a quote for these types of insurance, please contact us for more information and price guidance. We can help you find the best coverage and rates for your restaurant business.

Find the Right Restaurant Insurance Coverage for Your Restaurant

Restaurant insurance is a complex and customized product that depends on many factors related to your business and your coverage needs. There is no simple answer to how much restaurant insurance costs, but there are ways to find the best policy and price for your restaurant.

The Horan agency has access to top-rated carriers, and we can compare multiple quotes for you with one application. Our carriers offer competitive rates and flexible coverage options. Whether you need a basic policy or a comprehensive package, we can help you find the right insurance policy for your restaurant.

And we can also help you with other types of insurance your restaurant business may require, such as workers compensation, business auto, or short-term disability/PFL.

To get a free quote for your restaurant insurance, click the Get a Quote button below or call 315-635-2095.

If liquor is served at your establishment, read our article explaining the benefits of obtaining liquor liability coverage for an extra layer of protection.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: