What is a Surety Bond and Why is it Good for CNY Businesses?

January 10th, 2024

9 min read

If you’re a business owner in Central New York, you may have heard of surety bonds. But do you know what they are and how they can help you grow your business?

Surety bonds are contracts that guarantee you will do what you promise or pay for the damages if you don’t. They are often required by law, courts, or clients to get a license, a permit, or a contract.

But surety bonds are not just a legal obligation. They are also a smart business decision. They can protect your business, your customers, and your reputation from losses due to fraud, negligence, or misconduct. They can also help you gain trust and credibility with your customers and partners.

However, buying a surety bond can be confusing and overwhelming. There are thousands of different types of surety bonds for different purposes and industries. How do you know which one you need and how to get it?

That’s where we come in. We are Horan, an experienced insurance agency in Central New York. Since 2009, we have been helping businesses like yours find and buy the right surety bond to fit a given circumstance.

In this article, we will explain:

- What a surety bond is and how it works

- The most common types of surety bonds and their benefits

- How to find and buy the right surety bond for your situation

By the end of this article, you will have a clear understanding of surety bonds and how they can help you grow your business in Central New York.

The Three Parties Involved in a Surety Bond

Think of a surety bond as a three-way partnership that involves:

- The Principal: This is the party who needs the bond, like a contractor requiring performance and payment bonds for a construction project. They promise to fulfill specific obligations.

- The Obligee: This is the party demanding the bond, like the project owner in construction. They’re protected from financial losses if the principal fails to deliver.

- The Surety: Think of them as the guarantor, usually an insurance company. They back the principal’s promises and compensate the obligee if things go wrong. But unlike insurance, the surety can seek reimbursement from the principal later.

Imagine a surety bond as a bridge:

- The Principal wants to cross the river (complete a project, obtain a license) but needs a sturdy bridge (the bond).

- The Obligee owns the other side of the river (expects the project to be finished, the license to be valid).

- The Surety builds the bridge (issues the bond), guaranteeing safe passage (performance and payment). If the bridge collapses (the principal defaults), the surety repairs it (compensates the obligee), but they can also toll the bridge later (seek repayment from the principal).

Three Players, One Goal: Security and Assurance

- The Principal gets the green light (bond) to pursue their project or license.

- The Obligee gets protection (financial guarantee) if things go south.

- The Surety ensures the deal sticks (backs the promises) and gets their money back if needed.

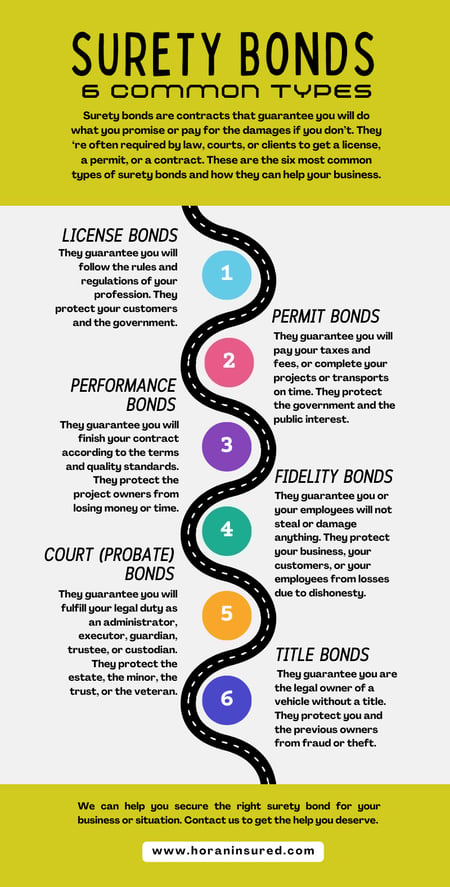

The 6 Most Common Surety Bonds and Their Uses

Some surety bonds are mandatory. You need them to operate legally or to comply with court orders. Other surety bonds are optional. You can choose them to protect your business or your customers. Each state has its own rules and requirements for surety bonds. Each business has its own situation and goals for using surety bonds. Let’s start with the basics: what is a surety bond?

The surety bonds we will cover are:

- License bonds

- Permit bonds

- Performance bonds

- Fidelity bonds

- Court (Probate) bonds

- Title bonds

How a Surety Bond Works and What You Pay for It

A surety bond is a contract that guarantees you will do what you promise or pay for the damages if you don’t. It is like an insurance policy, but it protects your customers or the government, not you.

You may need a surety bond to get a license, a permit, or a contract. The type and amount of the bond depend on the law, the court, or your choice. The bond amount is the maximum amount of money that the bond can pay out.

You don’t pay the full bond amount to buy a surety bond. You pay a small percentage of it. People with very good credit can usually get a surety bond for 0.5-5 percent of the total bond amount. Those with poor credit will pay more, from 5-20 percent of the bond amount. The better your credit, the lower the percentage you pay for the bond.

Suppose you need a license bond of $10,000 to operate your Herkimer-based business legally in New York State. The surety company charges you a 2 percent premium rate based on your credit score and industry risk.

The cost of your surety bond is 2 percent of $10,000, which is $200. You pay $200 to the surety company to buy your $10,000 license bond.

Besides your credit score, the exact cost depends on your industry and other factors. To learn more, read this informative Viking Bond Service post, Surety Bond Rates Explained.

Common Surety Bond 1: License Bonds

License bonds are contracts that guarantee you will follow the rules and regulations of your profession. They are required by government agencies at different levels to protect your customers and the public interest.

License bonds (also called commercial bonds) ensure you will:

- Comply with state licensing laws and regulations

- Conduct your business ethically and honestly

- Advertise your services truthfully and legally

- Pay your taxes and fees on time Some examples of license bonds are:

Some of the most common license bonds are for contractors, motor vehicle dealers, and freight brokers. These bonds protect their customers and the government from fraud, negligence, or misconduct. Let’s look at each of these bonds in more detail:

- Contractor license bonds: They guarantee you will complete your projects according to the contract and the building code and pay your subcontractors properly.

- Motor vehicle dealer license bonds: They guarantee you will sell vehicles legally and fairly and handle title transfers and sales taxes correctly.

- Freight license bonds: They guarantee you will transport goods safely and honestly and pay your carriers and shippers properly.

- Notary bonds: They guarantee you will perform your notarial duties faithfully and lawfully.

- Mortgage broker bonds: They guarantee you will arrange loans for your clients ethically and professionally.

- Public adjuster bonds: They guarantee you will represent your clients’ interests in insurance claims honestly and competently.

- Process server bonds: They guarantee you will deliver legal documents to the right parties and follow the court procedures.

Another type of license bond that you may need in Central New York is a liquor bond. A liquor bond guarantees you will pay the taxes and fees on the sale or distribution of alcohol. It is required by the New York State Liquor Authority for any business that sells or serves alcohol, such as

- bars,

- restaurants,

- liquor stores, or

- wineries.

The amount of the bond depends on the type and volume of alcohol you sell or serve. A liquor bond protects the state and the public from losses due to fraud, negligence, or misconduct by alcohol sellers or servers.

For example, if you own a bar in Syracuse and you fail to pay the sales tax on your alcohol sales, the state can claim your liquor bond to recover the unpaid taxes. A liquor bond can also help you avoid fines, penalties, or license suspension or revocation.

While all of this may seem daunting, fear not. We can help you find and buy the right license bond for your specific business or situation.

Common Surety Bond 2: Permit Bonds

Permit bonds are contracts that guarantee you will pay your taxes and fees or complete your projects or transports on time. They are not required for a license but for a specific job or activity.

Permit bonds are similar to license bonds, but they have different purposes and requirements. Some of the reasons you may need a permit bond are:

- You are working on a public road or property, such as road construction or utility installation

- You are driving a large or heavy vehicle through a city or state, such as a truck or a trailer

- You are collecting and paying taxes or fees to the government, such as fuel tax or sales tax

Some examples of permit bonds are:

- International Fuel Tax Agreement (IFTA) bonds: They guarantee you will pay the fuel tax for operating your vehicle across different states or countries

- Right of way bond: They guarantee you will restore the public property or road to its original condition after your work is done

- Oversize and overweight bonds: They guarantee you will follow the safety rules and regulations for driving a large or heavy vehicle

Permit bonds are required by different government agencies at the state, county, or city level. You will know if you need a permit bond because you will be asked to get one before you start your job or activity.

We can help you find and buy the right permit bond for your situation.

Common Surety Bond 3: Performance Bonds

Common Surety Bond 3: Performance Bonds

Performance bonds are contracts that guarantee you will finish your contract according to the terms and quality standards. They are not required by law but by the project owners. They protect the project owners from losing money or time if you fail to deliver.

Performance bonds are mostly used in the construction industry, but they can also apply to other industries, such as medical marijuana. Some of the laws and regulations that affect performance bonds are:

- The Miller Act: This is a federal law that requires a payment and performance bond for federal contracts over $100,000. It also requires some payment protection for contracts between $30,000 and $100,000. It protects the government, the taxpayers, and the subcontractors from fraud or default by the contractors.

- The Little Miller Acts: These are state laws that follow the Miller Act for state contracts. They vary by state, but they usually require a payment and performance bond for state contracts over a certain amount. In New York, the state law that follows the Miller Act is called the New York State Finance Law Section 137 or the New York Little Miller Act. It requires a payment and performance bond for state contracts over $100,000. It protects the state, the taxpayers, and the subcontractors from fraud or default by the contractors.

- The bid bond: This is a type of performance bond that guarantees you will accept and complete the contract if you win the bid. It protects the project owner from losing the bid money if you back out or change the terms.

- The payment bond: This is a type of performance bond that guarantees you will pay your subcontractors and suppliers on time. It protects the project owner from liens or lawsuits if you don’t pay them.

Performance bonds are based on the size and scope of the project. The cost of a performance bond depends on your credit score, your industry, and other factors. If you need a performance bond, we can help you secure one for your current situation.

If you’re in the construction industry, you may also need other types of bonds, such as:

- Maintenance bonds: They guarantee you will fix any defects or damages in your work for a certain period after the project is done.

- Supply bonds: They guarantee you will provide the materials and equipment needed for the project.

- Subdivision bonds: They guarantee you will complete the public improvements required for a subdivision project, such as roads, sidewalks, or utilities.

- Site improvement bonds: They guarantee you will complete the improvements required for a site project, such as landscaping, parking, or drainage.

Common Surety Bond 4: Fidelity Bonds

Fidelity bonds are contracts that guarantee you or your employees will not steal or damage anything. They are usually optional, except for ERISA bonds. They protect your business, your customers, or your employees from losses due to dishonesty.

Fidelity bonds have different types and purposes, such as:

- Business service bonds: They guarantee your employees will not steal or damage your customers’ property when they work on it, such as cleaning, repairing, or installing.

- Employee dishonesty bonds: They guarantee your employees will not steal or misuse your business’ money or property, such as cash, inventory, or equipment.

- Janitorial bonds: A janitorial bond is a type of business service bond that guarantees your employees will not steal or damage your customers’ property when they clean it. It protects your customers from losses due to theft or vandalism by your staff. It can also help you attract more clients and build a reputation for your cleaning business.

- Employee Retirement Income Security Act (ERISA) bonds: They guarantee you or your employees will not steal or mishandle the money in your employee retirement or health plans. They are required by the US Department of Labor for most plans.

Fidelity bonds are a good way to prevent and recover from theft or fraud in your business. They can also help you gain trust and credibility with your customers and employees.

If you want to buy a fidelity bond, we can help.

Common Surety Bond 5: Court (Probate) Bonds

Court (probate) bonds are contracts that guarantee you will fulfill your legal duty as an administrator, executor, guardian, trustee, or custodian. They are required by the court to protect the interests of the estate, the minor, the trust, or the veteran.

Court bonds are often required by probate courts, but they can also apply to civil cases, such as appeals. Some of the most common types of court bonds are:

- Administrator and executor bonds: They guarantee you will distribute the assets and estate of a deceased person to the beneficiaries according to the will or the court order.

- Guardianship bonds: They guarantee you will manage the financial assets of a minor in their best interest.

- Trustee bonds: They guarantee you will handle the trust assets according to the trust agreement and the law.

- Veterans Affairs custodian bonds: They guarantee you will take care of the funds of a veteran or their family according to the Veterans Affairs rules and regulations.

Court bonds are based on the value and complexity of the case. The cost of a court bond depends on your credit score, your personal and professional background, and other factors.

Common Surety Bond 6: Title Bonds

Title bonds are contracts that guarantee you are the legal owner of a vehicle without a title. They are required by the Department of Motor Vehicles (DMV) to register your vehicle and pay your taxes.

Title bonds are often needed when you buy a used car or when the title has errors. If you don’t have a title or can’t find the person on the title, you have to buy a title bond. The title bond acts as a temporary title until you get a new one.

Title bonds also protect the previous owners if the car was stolen or sold without their consent.

Title bonds usually last for three to five years. After that, the DMV will give you a new (clean) title.

There are many more surety bonds than the ones we mentioned. Buying a surety bond can be tricky if you don’t know what to do. That’s where expert help can make the difference. The Horan agency is here to walk you through the process.

Choosing the Right Surety Bond for Your Business

We’ve discussed what a surety bond is and how it can help your business in Central New York. We also covered the most common types of surety bonds and their benefits.

But how do you choose the right surety bond for your business? How do you find and buy the best surety bond for your situation?

The answer is simple: you work with us. We have the experience, the expertise, and the connections to help you get a surety bond fit for you.

We can guide you through the whole process and answer any questions you have along the way.

We know that buying a surety bond can be stressful and confusing. That’s why we make it easy and convenient for you. We want you to focus on growing your business and serving your customers, not worrying about your bond.

Don’t risk losing money, time, or reputation by buying the wrong bond or no bond at all. Don’t waste your time and energy by shopping around for the best bond or dealing with the paperwork. Let us handle it for you.

We’re here to help you succeed in your business.

To get started, click the Get a Quote button below. One of our knowledgeable and friendly surety bond experts will contact you to discuss the next steps.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: