Erie Insurance: The Horan Review

April 25th, 2025

8 min read

[Full disclosure: Erie Insurance is one of our insurance carriers. As such, the Horan agency receives commissions for policies Erie underwrites for our clients. That relationship does not influence our opinions or evaluations of the carrier. What follows is an objective review of a company we chose to work with for many of the reasons you’ll read below.]

Insurance choices can seem overwhelming with complicated policy language and jargon that leave you uncertain about what coverage you actually have. When comparing options, you need clear information about a carrier's history, financial stability, and available coverage to make informed decisions based on your specific requirements.

The Horan insurance agency in Central New York works with numerous insurance carriers, including Erie Insurance, giving us insights many others lack. Our experience with different providers helps us evaluate carriers based on their performance and suitability for various situations.

In this article, we'll examine Erie Insurance's background, coverage offerings, financial standing, and how they might address different insurance situations in Central New York. We'll also look at who might benefit from their policies and who might want to consider alternatives.

How Erie Insurance Started

Erie was started by two insurance professionals—Henry Orth Hirt and Oliver Grover Crawford—who worked for a company called the Pennsylvania Indemnity Exchange between 1922 and 1924. Dissatisfied with their experience at the Exchange, Hirt and Crawford resigned from the company in December 1924 and set out to start their own firm.

The duo was so successful at their former employer that the Exchange hired six sales professionals to fill their void.

The Erie Insurance Exchange—Erie’s original name—launched in Erie, Pennsylvania, nearly four months later, on April 20, 1925. Hirt and Crawford—both Pennsylvania natives—drafted a business plan that led to 90 shareholders backing them with a combined $31,000 (or over $500,000 in today’s currency).

From accepting collect calls from customers in the early days, Erie slowly added policies and expanded its operations and coverage outside the state of Pennsylvania. Over the decades, Erie grew into a Fortune 500 company with more than 6,000 employees and 6 million active policies.

Insurance Policies Offered by Erie

Today, Erie offers a wide range of insurance products, both for personal and commercial purposes. Coverage extends to autos, boats, homes, businesses, and more. But let’s take a closer look at a few of their policy offerings.

Auto Coverage

Standard auto insurance comes with almost any insurer’s auto policy, but Erie’s “standard” includes six coverage types, which you can explore by reading our auto insurance overview.

Erie also offers additional options for those who choose to upgrade, including First Accident Forgiveness, which can waive surcharges for Erie policyholders following an at-fault accident that occurs after three years with no claims. New Yorkers with Rate Protect policies from Erie may not have to meet the three-year rule and could receive this option immediately.

Erie Auto Plus is another additional option, offering features like a Diminishing Deductible, which—as the name suggests—can reduce deductibles annually for Erie drivers who have had no claims for several successive years.

Erie Auto Plus is another additional option, offering features like a Diminishing Deductible, which—as the name suggests—can reduce deductibles annually for Erie drivers who have had no claims for several successive years.

For every claims-free year, deductibles may lower by $100, with a minimum of $100 for collision and $50 for comprehensive. That means if you’ve gone five consecutive years without a collision claim, your $500 deductible could potentially be reduced to $100.

Having Erie Auto Plus may increase a policyholder’s roadside assistance allowance, potentially changing your reimbursement from $75 to $125. A $10,000 death benefit may also be included for someone who dies in or because of an accident.

Erie offers ways to reduce costs for many young drivers under age 21 who are unmarried and still reside at home with their parents.

Another available feature is Pet Coverage, which can provide payments of up to $500 if your beloved furry passenger is injured in a motor vehicle accident.

And if your car is damaged in a hit-and-run while it’s legally parked and unoccupied, Erie may limit policyholders' deductibles to $100. Collectively, these make for numerous auto coverage offerings, and we haven’t touched on every feature.

There are many coverage options for licensed policyholders of all ages.

Homeowners Insurance

Erie’s base homeowners coverage, called Erie Secure, provides extensive coverage options. You get many standard coverages:

- Dwelling (also called hazard insurance) covers the main structure of the home

- Other Structures coverage is for outbuildings like sheds and barns

- Personal Property is for certain belongings inside the house

- Personal Liability Protection, in case a guest is injured on your property

- Loss of Use or additional living expenses kicks in when your home is rendered uninhabitable during repair or rebuilding efforts

But you also get other coverage options that come standard, like Theft and Misplacement/Loss, which covers the mysterious disappearance of your belongings.

While your primary possessions are covered by Theft and Misplacement up to the amount it would cost to replace them, certain items—like jewelry, watches, firearms, silverware, furs, and similar possessions—are also covered up to $3,000 per item.

Erie’s standard Theft and Misplacement offers extensive coverage compared to many other carriers. Erie also covers $500 worth of cash and precious metals.

If you want additional coverage for your valuables, you’ll have to schedule those precious items.

Explore the above policy features in our article detailing what homeowners insurance covers.

An additional feature of Erie’s personal liability protection allows homeowners to enjoy coverage for occasional gig work performed by their children. These temporary jobs include babysitting, newspaper delivery, caddying, lawn care, and the like. Most competing insurers require separate endorsements to offer equivalent coverage.

One of the notable features on homeowners insurance is the option for Guaranteed Replacement Cost, which promises—as Erie puts it—to:

“pay for the full cost of rebuilding your house back to its previous size and specifications—right down to the granite countertops, custom bookshelves, and gleaming hardwood floors that you so love.”

You can add Guaranteed Replacement Cost to an Erie Secure policy, which covers rebuilding expenses even if the final figures exceed the home’s replacement cost listed on the policy. If you choose the Erie Secure Home Plus Endorsement, it includes $5,000 in coverage for loss caused by Sewer or Drain Backup in New York. Underground Service Line Coverage is also covered up to $10,000.

Options increase with Erie’s Select tier, which offers $5,000 more in Identity Recovery and Fraud Reimbursement (max $30,000) than the Advantage and Plus tiers.

In recognition of our digital age, identity theft is a serious and costly problem. So the Identity Recovery and Fraud Reimbursement portions include Personal Cyber Insurance, which can provide reimbursement to policyholders who were extorted or suffered financial loss through a cyberattack.

Mold or fungi damage resulting from a covered peril may also be covered by Erie, up to $50,000 for Plus and Select tier policyholders.

Erie adjusts its property coverage for policyholders who own, let’s say, a condo and are subject to Homeowners Association (HOA) fees. An HOA usually has a master policy that protects the property. But there are times when damage from a fire or storm is so extensive that common areas like a clubhouse and pool can cost six figures to repair or replace.

In such cases, HOAs can levy an assessment to all condo owners for $2,000 or more on top of association dues. Erie’s Loss Assessment coverage addresses that, and similar bills up to $5,000. According to Erie’s approach, if a covered peril would have damaged your house, the common area damage falls within the scope of coverage for HOA members.

What is the Claims Process Like for Erie Insurance?

At the Horan agency, our experience has been that Erie Insurance responds to claims efficiently and with regular updates. Their claims service professionals have been helpful to work with. We've found Erie to be reasonable in considering coverage in a claimant's policy and their payment timeline.

Whether for your home, auto, or business, filing a claim with Erie can be done by contacting your agent—who will be familiar with the claims process—or through Erie’s website.

The first step will be notifying us, where an insurance professional will collect information about the claim, assign a claim number, and report it to the appropriate department. You’ll then hear from a claims manager or adjuster who will take it from there.

Erie’s Awards and Other Highlights

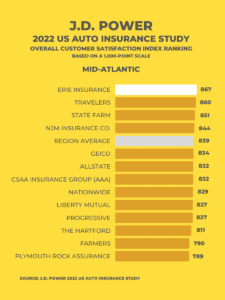

Erie Insurance ranked high in the JD Power 2023 US Homeowners and Renters Insurance Study. (And see their 2022 Auto Insurance ranking in the infographic.) The company actually topped the list for JD Power’s Overall Customer Satisfaction Ranking in the Mid-Atlantic with a score of 867 in 2022. Erie scored higher than competitors like State Farm, GEICO, Allstate, Nationwide, Liberty Mutual, and Farmers.

Erie Insurance ranked high in the JD Power 2023 US Homeowners and Renters Insurance Study. (And see their 2022 Auto Insurance ranking in the infographic.) The company actually topped the list for JD Power’s Overall Customer Satisfaction Ranking in the Mid-Atlantic with a score of 867 in 2022. Erie scored higher than competitors like State Farm, GEICO, Allstate, Nationwide, Liberty Mutual, and Farmers.

In August 2025, Erie Insurance ranked highest in overall customer satisfaction in the J.D. Power 2025 U.S. Small Commercial Insurance Study with a score of 723. The study examines customer satisfaction among small commercial insurance customers with 50 or fewer employees, measuring satisfaction across seven core dimensions including trust, price for coverage, product/coverage offerings, ease of doing business, people, problem resolution, and digital channels. The 2025 study was based on responses from 2,848 small commercial insurance customers and was fielded from March through May 2025.

Erie was also listed in the second annual survey of America’s Best Insurance Companies compiled by Forbes/Statista for 2025. Factors considered for the survey included Erie’s level of transparency, customer service, financial advice, digital services, performance/price, and how likely individuals were to recommend them to family and friends.

Erie earned an A+ (Superior) rating from the financial ratings company AM Best for financial strength, though AM Best has revised the outlooks to negative from stable. AM Best affirmed Erie's Long-Term Issuer Credit Ratings (Long-Term ICR) of "aa-" (Superior) for the property/casualty members of Erie Insurance Group.

According to Consumer Reports' 2025 auto insurance ratings published in their magazine and on CR.org, Erie Insurance Group received the highest overall satisfaction score of 72 among all auto insurers evaluated. The publication, which surveyed over 50,000 auto insurance policyholders about their experiences from February through April 2024, rated Erie particularly well in premiums, claims handling, coverage options, policy clarity, and timely payment. This consumer-driven recognition further validates Erie's commitment to exceptional service and value.

Charitable Efforts

Through its Giving Network, Erie donated to 975 charities in 2021 and nearly 900 charities in 2022. Many of Erie’s employees and agents also volunteer their time in local communities, building homes, tutoring young students, feeding families, and more.

All that said, given its awards and considering the many coverage options available from Erie, one still has to ask:

Is Erie Insurance Suitable for Me?

Good Fits

Erie offers affordable insurance and provides many coverage options for various policies. Those who qualify can even lock in auto insurance rates and receive discounts by bundling and paying premiums in total upfront.

Young drivers living at home with their parents or are considered good students also qualify for discounts.

If you have a small home business, you may be able to add it to your homeowners policy and extend coverage. Say you’re a music instructor, hair stylist, psychologist—or another kind of doctor—have an in-home photo studio or printshop, among other things, Erie might be a carrier to consider.

Whether you have personal or commercial insurance requirements, Erie has a wide range of policy offerings and options, but this is true for those who live or own items in one of the twelve states (and the District of Columbia) where the company is licensed.

Not-so-Good Fits

That leads us to the reason why a customer would not be able to obtain coverage. Anyone trying to insure items outside the states and district Erie serves cannot purchase insurance from the company.

Have you had more than one home claim in the last five years? Do you have a roof over twenty years old or a heating system over thirty years old? If so, Erie might not provide coverage for your situation. The same is true if your home has aluminum wiring.

Do you use your vehicle for rideshare purposes (think Uber and LYFT) or food delivery and other gig work in Central New York? Erie Insurance might not provide the coverage you're looking for because ridesharing is excluded from New York Erie auto insurance policies.

Have you had a DWI or more than two at-fault accidents in the last five years? Purchasing an auto policy through Erie might not be possible.

If you’re someone who wants to buy direct from an insurance carrier, Erie might not align with your preferences since it sells policies exclusively through its network of independent agents.

All in all, Erie Insurance has demonstrated financial durability—and has been in business for close to 100 years. While it maintains an A+ (Superior) rating from AM Best, the rating agency has revised Erie's outlook to negative from stable. When choosing an insurer, financial stability remains an important consideration, and Erie continues to operate with a strong foundation despite this outlook adjustment.

Selecting insurance involves finding a balance between coverage levels, cost, and carrier reliability. You need information about available options from someone familiar with local insurance considerations and carriers like Erie.

Our Central New York insurance agents can help you learn about Erie's offerings and how they might relate to your specific situation. With their focus on various insurance markets and financial stability, Erie offers coverage options worth considering for many property and vehicle owners in our region.

Click the Get a Quote button below to connect with our team about insurance solutions from carriers like Erie that can help address your insurance requirements and Central New York's unique insurance considerations.

If you’d like to read more Horan Reviews on carriers that serve the Central New York region, click the links below. We’ll add more review links as they become available.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: