Travelers Insurance: The Horan Review

June 6th, 2025

7 min read

[Full disclosure: Travelers Insurance is one of our insurance carriers. As such, the Horan agency receives commissions for policies Travelers underwrites for our clients. That relationship does not influence our opinions or evaluations of the carrier. What follows is an objective review of a company we chose to work with for many of the reasons you’ll read below.]

Insurance policies often contain complex language that can leave you uncertain about what coverage you actually have. When you lack clarity about different policies, you might make uninformed insurance decisions that don't align with your specific requirements.

Your biggest concern likely isn't the risk to your home or belongings, but rather purchasing a policy that doesn't fit your situation. The complexity of policy details can make it difficult to determine if you've secured coverage that addresses your circumstances.

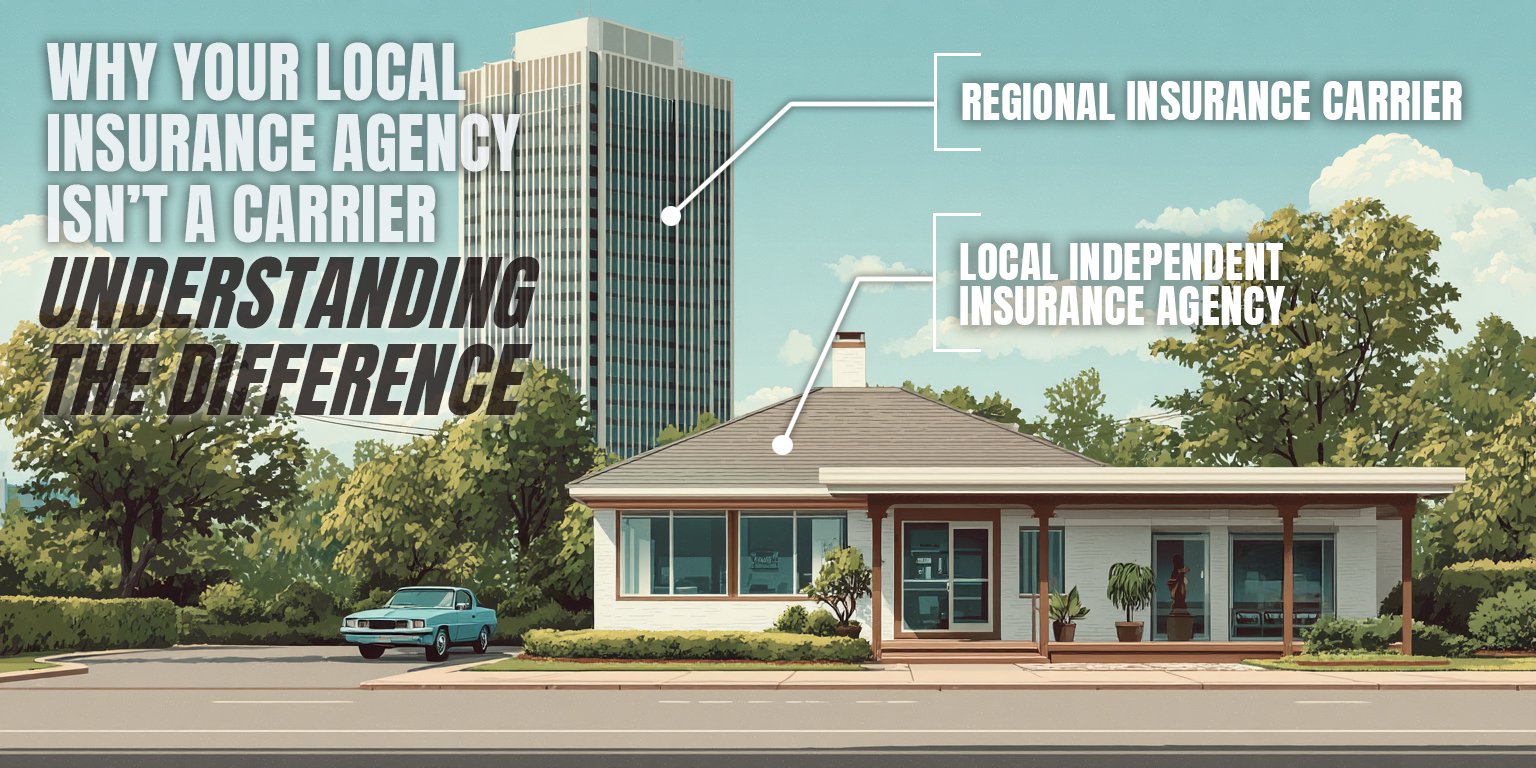

The Horan insurance agency in Central New York works with multiple insurance carriers, including Travelers Insurance. Our experience with diverse insurance providers gives us insight and perspective on how different carriers compare in various situations.

In this article, we'll explore Travelers Insurance's background, policy offerings, strengths, and potential limitations. We'll help you understand if their coverage options might be suitable for your specific situation in Central New York.

How Travelers Insurance Started

James G. Batterson, a stone contractor from Hartford, Connecticut, visited England in 1859. While traveling from the spa town Leamington to London, Batterson learned about a European form of accident insurance issued to travelers.

Batterson’s railway ticket included up to £1,000 in accidental death insurance coverage and other protections for injuries that didn’t lead to death. Intrigued, Batterson headed to insurance offices in London and Paris to investigate.

Having secured the information he needed, he returned to the United States to launch an accident insurance company to serve American travelers, for which he raised $500,000.

The Travelers Insurance Company was officially chartered in Connecticut on June 17, 1863. Around March 1, 1864, James E. Bolter—who became president of Hartford National Bank—ran into Batterson at the post office.

Bolter heard about Batterson’s plan to introduce accident insurance to Americans and jokingly asked what it would cost to insure his walk home from the post office against accidental death for up to $5,000.

After Batterson told him, “Two cents,” Bolter immediately paid the premium. Batterson preserved his original railway ticket, and the two cents Bolter paid him. They are treasured as souvenirs by Travelers Insurance to this day.

While that informal insurance agreement is fondly remembered, Travelers didn’t issue its first official policy until the next month, on April 5, 1864. Batterson served as president of the company from April 1, 1864, until 1901, the year he died.

Travelers Insurance has since become one of the largest insurers in the United States. It is the only property and casualty carrier listed on the Dow Jones Industrial Average, the notable stock index that tracks America’s 30 largest companies.

Travelers is an international insurer with field offices in all US states. It also operates in the United Kingdom, Ireland, and Canada. The company employs some 30,000 employees and has a network of 13,500 independent agents and brokers, which includes the Horan agency.

Insurance Policies Offered by Travelers Insurance

Travelers offers insurance products to help protect homes, cars, rentals, condos, landlords, boats and yachts, and valuables. While the Horan agency doesn’t write policies for their business portion, Travelers also offers commercial insurance if that product is a good fit for an independent agency.

The personal lines products Travelers Insurance delivers include a degree of customization. For instance, policyholders can add a generous amount of endorsements and additional coverages to a homeowners package. We’ll look at some of those features below.

Homeowners Insurance

Homeowners insurance from Travelers comes with standard coverages for the structure of your home, other structures on the property (sheds, outbuildings, etc.), your personal belongings, and more. You can read about those standard coverages in our homeowners insurance overview.

For most policyholders insured with Travelers, additional coverages will be necessary to provide added protections beyond the base level. But layering these coverages will come at a cost. For instance, the base home policy, called Travelers Protect, offers coverage most people have come to expect.

Upgrading to Travelers Protect Plus or Protect Premier levels enhances existing homeowners coverage. The Premier level takes jewelry theft coverage from a base of $1,500 under the standard homeowners package up to $5,000. Credit card, forgery, and counterfeit money coverage go from $1,000 to $10,000 for the same Premier endorsement.

Travelers also offers modern coverages for underground utility lines and water seepage, which delivers up to $10,000 of protection for instances like water seeping into your basement.

Because you have to layer policy protections through separate endorsements to arrive at robust coverage limits for items you want to insure, Travelers is often pricier than some of our other carriers. But Travelers Insurance is such a strong and familiar brand in the eyes of consumers that many don’t mind dealing with this aspect of the carrier.

Auto Coverage

Auto policies from Travelers include standard coverages like liability, which covers bodily injury and property damage. Uninsured and underinsured motorist, collision, comprehensive, and more are also included, all of which you can read about in our auto insurance overview.

For auto enhancements, policyholders can opt for the carrier’s Premier New Car Replacement coverage, which pays to replace your vehicle with a new one of the same make and model if it is totaled in the first five years.

To step up to Accident Forgiveness, which waives the first at-fault accident, policyholders must pay an additional fee.

If you frequently rent vehicles, drive a company car for business and personal use, or provide full-time care for someone whose car you drive, you can opt for Named Non-Owner coverage. This protection is great for people who don’t own a vehicle but make heavy use of borrowed or rented autos.

What is the Claims Process Like for Travelers Insurance?

Travelers Insurance has what we at Horan believe to be among the most unique claims services in the industry. Unlike many insurance companies, who will not offer advice when you attempt to report a claim, Travelers goes a step beyond.

Rather than just take your information and forward it to another person or department, a Travelers claims representative will offer pertinent advice regarding how a potential claim could affect your policy or premium in the future.

But concerning claims, some things are a no-brainer. If a grease fire burns up half your kitchen, call your agent to file a claim since they are familiar with both your policy and the claims process. If your agent is unavailable, Travelers is unique among carriers because it offers a high level of personal service to policyholders.

You can file a claim through the Travelers Insurance website, which provides ample instructions. We also find Travelers to be responsive regarding the claims process and fair with costs and losses to the consumer.

Travelers’ Awards and Other Highlights

Travelers Insurance landed on Newsweek’s 2022 list of America’s Most Responsible Companies, which will make sense when you read about their charitable efforts below. That same year, the NAIC (National Association of Insurance Commissioners) named Travelers the number one Workers’ Compensation Insurer in the US.

Travelers has been a Fortune 500 company continuously since 1995 through 2024.

The world’s largest credit rating agency, AM Best, also gave Travelers a stellar A++ (Superior) for Financial Strength and “aa+” (Superior) as a long-term credit issuer, which means the company is in good standing.

Charitable Efforts

Charitable Efforts

In 2021, Travelers donated $24 million to local communities, bringing its 10-year contribution total to $228 million for various causes.

And the company’s education program, Travelers EDGE, has aided underrepresented students in earning bachelor’s degrees to prepare for careers at Travelers and other insurance companies. According to Travelers, the EDGE program:

“provides a holistic approach to academic success and career preparation through partnerships with high schools, colleges, universities, and community-based programs.”

Considering the carrier’s Fortune 500 and Dow Jones status, high industry ratings, and charitable giving, one still has to weigh policy offerings from the company and ask:

Is Travelers Insurance Right for Me?

Good Fits

If you have a newer home with all the latest technology built-in—including monitoring stations, sensors, and alarms—you’re a good fit for Travelers.

If you want to add specific coverages for items without needing to add endorsements for policy protections you don’t need, Travelers may be a good fit.

If you’ve had no more than two claims in the past five years and no more than one in the past 12 months, you may be a good fit for Travelers.

Not-so-Good Fits

If you’re a driver under age 25, Travelers is not a good fit for your insurance requirements.

You can’t get car insurance from Travelers if you had medical care for an accident in the last 5 years.

You also can’t get car insurance from Travelers if you caused an accident that damaged your car or someone else’s property and had any other claim (even for towing or a cracked windshield) in the last 5 years.

If your home is insured for more than $500,000 and you plan on leaving for three months or more out of the year—you’re a snowbird with a hankering for Florida sun, let’s say—you may not be a good fit for Travelers.

If your house is over seven road miles from the first responding fire department, Travelers is not a good fit for your insurance requirements.

Travelers does not insure log homes.

Homes with roofs 25 years or older are not eligible for insurance from Travelers.

Gas furnaces that are 35 years or older make homes ineligible—this also applies to oil furnaces 25 years or older.

Homes with wood and pellet stoves must first pass inspection by a local fire department or building inspector.

If your home has knob-and-tube wiring, Travelers won’t be a good fit for you.

If you prefer a deductible lower than $1,000 for your homeowners policy, Travelers is not the carrier for you.

That said, if you want the option to purchase just about any type of modern insurance coverage available in the marketplace, Travelers is a suitable option.

The company has one of the best ratings in the industry, which is a hallmark of its financial strength and staying power. Each year, more and more consumers are becoming familiar with the Travelers brand, and that might include you.

But after reading this review, you can decide whether Travelers is a suitable insurer for your requirements beyond name recognition.

Making Informed Decisions About Travelers Insurance

We've covered Travelers Insurance's history, policy offerings, claims service, and eligibility considerations to help you make informed insurance decisions. You now have clearer insight into whether Travelers might be suitable for your specific situation in Central New York.

If your home has modern safety features, if you want customized coverage options, or if you have a clean claims history, Travelers could be worth considering. However, if you're a younger driver, own an older home, or need specialized coverage for unique properties, other carriers might better address your insurance requirements.

What matters most is securing coverage that addresses your specific circumstances. The strength of working with an independent agency is our ability to compare multiple carriers and find solutions that align with your situation.

Click the Get a Quote button below to connect with our team about Travelers Insurance or other carriers that might better suit your unique insurance requirements in Central New York.

If you’d like to read more Horan Reviews on carriers that serve the Central New York region, click the links below. We’ll add more review links as they become available.

- Dryden Mutual Insurance Review

- Erie Insurance Review

- Foremost Insurance Review

- Main Street America Insurance Review

- NYCM Insurance Review

- Oswego County Mutual Review

- Plymouth Rock Assurance Review

- Progressive Insurance Review

- Sterling Insurance Review

If you’re ready to see a quote from Travelers Insurance or other insurers in our network, click the Get a Quote button below, and one of our insurance specialists will reach out to you.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: