Sterling Insurance: The Horan Review

May 9th, 2025

7 min read

[Full disclosure: Sterling Insurance is one of our insurance carriers. As such, the Horan agency receives commissions for policies Sterling underwrites for our clients. That relationship does not influence our opinions or evaluations of the carrier. What follows is an objective review of a company we chose to work with for many of the reasons you’ll read below.]

Insurance policies often come with complex language that makes it difficult to understand what coverage you actually have. This complexity can lead to uncertainty when comparing options and evaluating which carrier might work for your specific requirements.

The Horan insurance agency in Central New York works with numerous insurance carriers, including Sterling Insurance, giving us insights into how they operate compared to others in the market. Our experience with diverse providers allows us to share information about Sterling's offerings and how they might fit different insurance situations in our region.

In this article, we'll examine Sterling Insurance's background, unique coverage options, and suitability for different insurance scenarios in Central New York.

How Sterling Insurance Started

A group of property owners from two New York counties in the Mohawk Valley convened a meeting at a Main Street hotel in Cobleskill, New York, on August 27, 1895. The residents sought a solution to the problem of unforeseen disasters possibly wiping out their rural livelihoods.

Among those gathered was retired Civil War colonel Alonzo Ferguson, founder of what became the Schoharie and Otsego Mutual Fire Insurance Company, which resulted from that meeting. The new insurer opened its doors in the village of Cobleskill five months later, in January 1896.

By 1910, business extended beyond the original two counties, necessitating a name change to Sterling Fire Insurance Company. As decades passed, Sterling Fire adopted other lines of insurance, moving into casualty. For that reason, the name was simplified to Sterling Insurance Company in 1959.

Nearly two decades later, in 1978, Sterling constructed a 30,000-square-foot facility on nine lush acres to serve as its Cobleskill headquarters. Today, Sterling Insurance provides coverage to New Yorkers using a growing network of independent agents.

Insurance Policies Offered by Sterling

Sterling Insurance specializes in property and casualty. As such, they offer policies for homeowners, dwelling fire, mobile homeowners, renters, equestrian estates, personal auto, personal umbrella, and packages for landlords and business owners.

Homeowners Insurance

Sterling offers the basics in its homeowners coverage, like most other carriers. You’ll get dwelling and other structures coverage, personal property insurance, and so on, which we explain in our homeowners insurance overview.

But Sterling also has a unique approach to their homeowners policies.

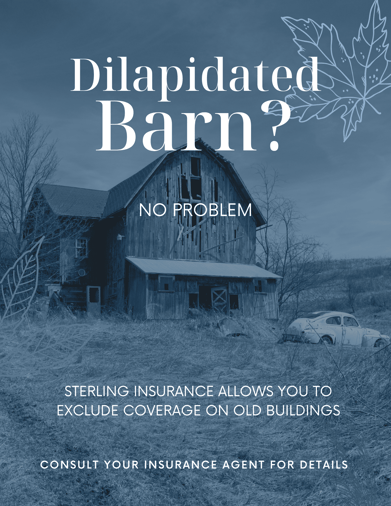

Say you own nine acres in a rural county. The main house has that charming country look and feel and can easily pass inspection, but then there’s an old barn looming in the distance. It’s been there well before you existed and is simply waiting for a stiff breeze to reduce it to a pile of planks.

When attempting to purchase a homeowners policy, most carriers require that every building on your property be above average repair, meaning that the derelict barn won’t fly. It won’t matter that your house passes muster while other buildings are in disrepair.

Sterling has a solution for this. It has the power to offer policyholders exclusions. You can choose Sterling for your homeowners policy and let them know you’d like to forego coverage on your old barn by signing an exclusion, which is simply damage or loss your insurance policy won’t cover.

Sterling has a solution for this. It has the power to offer policyholders exclusions. You can choose Sterling for your homeowners policy and let them know you’d like to forego coverage on your old barn by signing an exclusion, which is simply damage or loss your insurance policy won’t cover.

When the barn finally collapses, it will be on you to remove the debris at your expense. But you still get coverage on the structurally sound buildings.

Sterling also doesn’t use the prior claims factor to build out your premium cost. If you suffered a loss from a burst kitchen pipe and filed a water claim in the last five years, most carriers rate you based on that history, which affects your final premium amount.

While Sterling wants to know that information for internal purposes, they won’t rate you based on the claim, and it’s likely you won’t see your premium suddenly increase because of it.

Another Sterling Insurance perk is the $50 diminishing deductible. All homeowners policies automatically include this benefit for every year policyholders are claims-free. Most carriers offer diminishing deductibles on autos, but it’s rare to see insurers offering them for homes.

Sterling also extends unconventional discounts. While competing insurance companies will not reward you with a discount for insuring more than one home with them—because they view multiple homes as one product line—Sterling sees it quite differently. They consider multiple homes on a policy as bundling.

If you want to insure a second home with Sterling, a discount applies. Taking that concept even further, say you’re a landlord who has four separate homes you’re renting out. If you insure all of them with Sterling, you qualify for a discount for each new home policy added.

Personal injury is also included in the liability portion of your homeowners policy (Coverage L on your declarations page). Typical homeowners policies from competing insurers don’t include personal injury as standard coverage. You’re usually required to purchase personal injury separately, either by endorsing it (adding a rider) or buying a personal umbrella policy.

And as a final homeowners insurance perk, Sterling ups the coverage for grave markers. Grave markers and headstones are often cracked, damaged, or defaced by unruly citizens, so homeowners policies extend protection to them as personal valuables.

But typical coverage is $1,000. Say a loved one in your household passes away, and after the burial, you provide a grave maker for them. If that grave marker is vandalized or damaged in a covered event, Sterling’s reimbursement goes as high as $8,000. We at the Horan agency think that’s a notable coverage option.

Auto Coverage

While Sterling’s homeowners insurance is robust, the same cannot be said of their auto policies. Like many competing carriers, Sterling offers the usual: liability, collision and comprehensive, uninsured/underinsured motorist, and other coverages you can read about in detail in our auto insurance overview.

That said, Sterling’s auto insurance isn’t as competitive, price-wise, as some of our other carriers. That price discrepancy is even more glaring if you’ve had an auto claim, traffic violations, or tickets in the last three to five years.

What is the Claims Process Like for Sterling Insurance?

The Horan agency has worked with Sterling Insurance on several past claims, and we’ve found them to be reliable regarding response time and payouts.

If you need to file a claim, contact your independent agent, who will initiate the claim on your behalf. If your loss occurs on a weekend, call Sterling at the numbers available on their website and follow the after-hours instruction noted there.

Once the claim is initiated, a Sterling claims department representative will contact you and provide the next steps.

Sterling’s Awards and Other Highlights

Sterling Insurance remains below the radar on the awards front, but they’ve earned a stellar rating from AM Best, a respected US rating agency that started examining Sterling’s business in June 1925. AM Best rates Sterling A (Excellent) for Financial Strength.

It also views Sterling as a stable long-term issuer of credit, giving the company an a+ (Excellent) rating.

Charitable Efforts

In 2014, Sterling established the Sterling Foundation, which has donated to over 100 local charities since then. The foundation states that it primarily supports organizations that are aligned with its mission, which includes those that “care for shelter animals.”

In 2020 alone, Sterling Foundation supported organizations like Friends of Bassett Healthcare and others with 35 grants totaling $184,339.

Considering Sterling’s high industry ratings and charitable giving, one still has to weigh its policy offerings and ask:

Is Sterling Insurance Right for Me?

Good Fits

If you like price breaks when purchasing insurance, Sterling offers discounts on homeowners and landlord policies for things like newly purchased homes, homes under 30 years old, and recent renovations.

But for Central New Yorkers living in rustic homes with older roofs and furnaces, consider Sterling Insurance for your homeowners policy.

If you have a home with a roof that’s more than 20 or 30 years old (the cutoff for most carriers), Sterling doesn’t enforce such limits. If your roof still has life left, its age is less important. The same is true if you have an old furnace or other aging components in the house.

While most carriers require policyholders to bundle home and auto insurance before they’ll write an umbrella policy, Sterling does not. So Sterling may be a consideration if you want umbrella coverage without opting for the company’s auto insurance.

You’ll still have to insure a property with them, like your home, but the auto portion can be with another carrier, as long as the policy is purchased through the same agency that wrote the homeowners policy.

Not-so-Good Fits

No insurer will appeal to everyone, and neither will Sterling. For one thing, the company won’t insure anything outside New York State.

If you live in a high-value home, know that Sterling caps replacement costs at $1.25 million. Anything higher than that value won’t qualify for coverage.

On the other hand, if you have a home with a market value that is less than fifty percent of the replacement cost—say, for instance, you bought a dilapidated Queen Anne-style home in East Syracuse for $80,000—Sterling won’t consider insuring the property because rebuilding it after a fire might cost upwards of $400,000.

Your home’s market value has to be within fifty percent of what it would cost to rebuild following a total loss.

If you own a home that supports more than two families—think a three- or a four-family home—Sterling won’t issue a homeowners policy. A two-family home is as high as they’ll go for homeowners, and you have to live in one of the units.

For those who conduct business in their homes and will likely see customers on the premises—which requires specific underwriting approval—Sterling won’t be a good fit for your insurance needs.

Do you have a pit bull, rottweiler, Dobermann, chow, Akita, Presa Canario, Cane Corso, a wolf hybrid, or a dog mixed with any of those breeds? Sterling will cap your personal liability coverage at $100,000, restricting the purchase of a personal umbrella policy.

As to that, umbrella policies are also capped at $1,000,000. So if you desire a higher coverage limit, Sterling won’t be a good fit.

If you’re considering buying direct from Sterling, they won’t be a good fit because the carrier sells policies exclusively through its network of independent agents.

Connect With Licensed Agents About Sterling's Coverage Options

Selecting the right insurance involves weighing coverage options against cost and company reputation. Sterling Insurance stands out for its unique policy features, especially for homeowners with older or unusual properties in Central New York.

Their AM Best rating demonstrates financial stability, an important factor when choosing an insurance provider. This rating, along with their long history in New York State, indicates they'll likely remain a stable option for future coverage needs.

If you'd like to learn whether Sterling's homeowners policy options might work for your particular property, or if you have questions about insurance for older homes in Central New York, our licensed agents can help assess your requirements.

Click the Get a Quote button below to connect with our team about insurance solutions from carriers like Sterling that address your specific insurance requirements and Central New York's unique insurance considerations.

If you’d like to read more Horan Reviews on carriers that serve the Central New York region, click the links below. We’ll add more review links as they become available.

Daniel is an accomplished content creator. He has been working in publishing for almost two decades. Horan Companies hired Daniel as its content manager in November 2022. The agency entrusted its messaging to him. Since then, Daniel has written insurance articles, service pages, PDF guides, and more. All in an effort to educate CNY readers. He's helping them understand the world of insurance so they can make informed decisions.

Topics: